Assessing Novartis (SWX:NOVN) Valuation After Strong Multi‑Year Shareholder Returns

Novartis (SWX:NOVN) shares have quietly moved higher over the past month and past 3 months, putting recent performance and current valuation metrics in focus for investors watching this large Swiss pharmaceutical group.

See our latest analysis for Novartis.

Zooming out, the share price is at CHF 111.52 with a 1 year total shareholder return of 27.79% and a 5 year total shareholder return of 71.01%, suggesting momentum has been building rather than fading over time.

If Novartis has you looking more closely at large healthcare names, it could be a good time to review other healthcare stocks that may suit your portfolio.

With a CHF 111.52 share price, a value score of 5 and an intrinsic value model suggesting a 57% discount, the key question is whether Novartis is still mispriced or if the market is already factoring in future growth.

Most Popular Narrative Narrative: 4.6% Overvalued

The most followed narrative puts Novartis’ fair value at about CHF 106.64 per share, a touch below the current CHF 111.52 level. It ties that gap to a detailed view on future earnings, margins and capital returns.

Novartis' pipeline and regulatory progress in advanced therapies (including biologics, gene, and cell therapies) positions the company to benefit from emerging healthcare technologies, potentially affecting future earnings and margin trends as new high-value products launch.

Expansion in emerging markets, particularly China (with Leqvio's out-of-pocket uptake and ex-U.S. growth in priority brands), increases Novartis' overall addressable market and may help mitigate saturation in developed geographies, influencing future sales and cash flow.

Curious how top line growth, profit margins and shrinking share count are combined with a relatively modest P/E in this story? The full narrative lays out the revenue path, earnings changes and discount rate that need to line up for today’s price and that fair value to make sense.

Result: Fair Value of $106.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can quickly change if loss of exclusivity on key drugs bites harder than expected or if global pricing pressure squeezes margins more than analysts currently factor in.

Find out about the key risks to this Novartis narrative.

Another View: Valuation Gap On Earnings

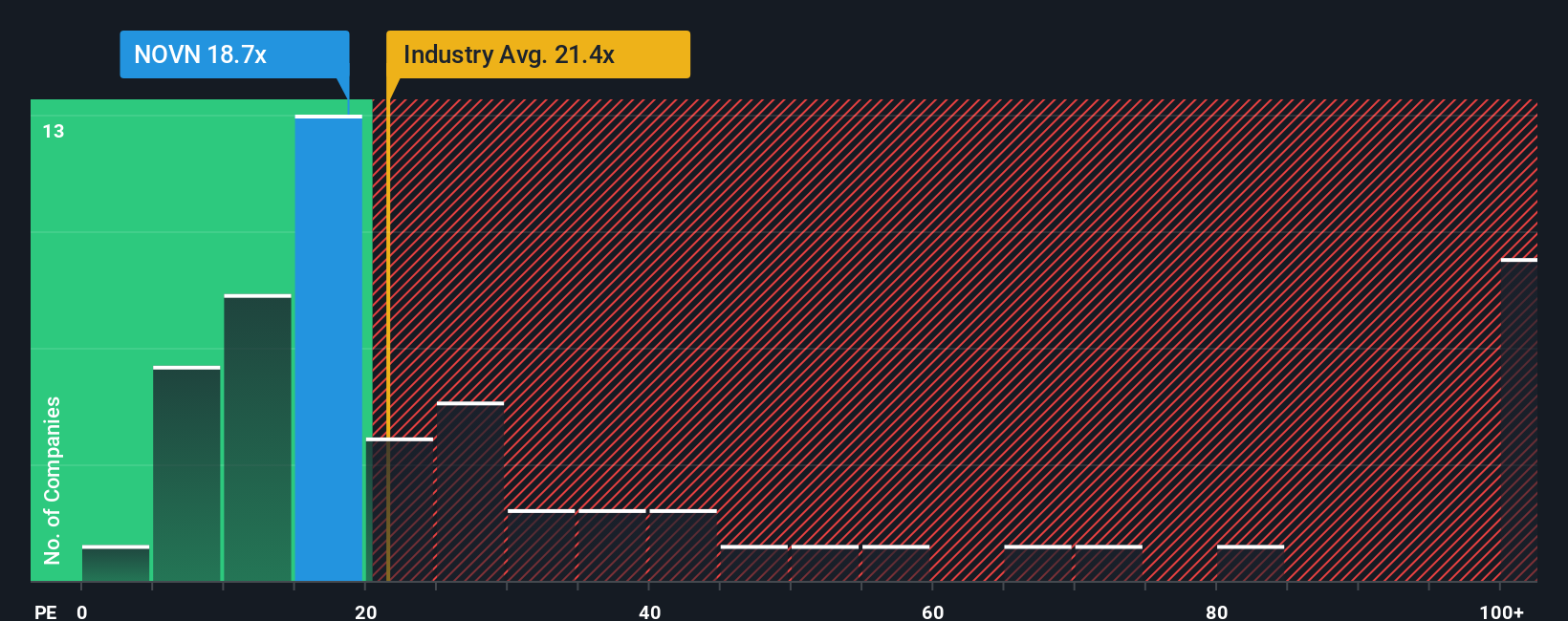

The narrative fair value suggests Novartis is about 4.6% overvalued at CHF 106.64 versus the CHF 111.52 share price. Yet on earnings, the picture is very different. Novartis trades on a P/E of 18.7x, compared with a fair ratio of 36.7x and a peer average of 85.7x.

That gap is wide. If the market moved closer to the fair ratio, or to the peer average, today’s valuation would look conservative rather than stretched. The question for you is whether earnings quality, growth and risk justify that discount, or whether it is a margin of safety you are comfortable with.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Novartis Narrative

If you see the numbers differently, or just prefer to weigh the data yourself, you can build your own view in a few minutes: Do it your way.

A great starting point for your Novartis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop with one stock. Use focused screeners to quickly surface ideas that match what you care about most.

- Target reliable income by scanning these 11 dividend stocks with yields > 3% that put cash returns at the center of your watchlist.

- Spot potential mispricings fast by filtering for these 877 undervalued stocks based on cash flows that might sit below their intrinsic worth based on cash flows.

- Get ahead of major shifts in computing by tracking these 29 quantum computing stocks that could reshape entire industries over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报