Tourmaline Oil (TSX:TOU) Valuation Check As Recent Share Price Decline Contrasts With Underlying Business Strengths

A recent pullback in Tourmaline Oil (TSX:TOU) has caught investor attention, as the share price weakness contrasts with what many see as solid natural gas fundamentals and a continued focus on shareholder returns.

See our latest analysis for Tourmaline Oil.

At a recent share price of CA$59.15, Tourmaline Oil has had a 1 month share price return of 9.69% decline and a year to date share price return of 3.65% decline. However, the 5 year total shareholder return of over 3x suggests longer term holders have seen a very strong outcome, so recent weakness looks more like fading momentum than a break in the story.

If this pullback has you reassessing your energy exposure, it can help to widen the lens and compare ideas against other areas of the market using fast growing stocks with high insider ownership.

With solid revenue and net income figures, a value score of 4, and the current CA$59.15 price sitting below the CA$71.65 analyst target and modelled intrinsic value, is Tourmaline now mispriced, or is the market already baking in future growth?

Most Popular Narrative Narrative: 19% Undervalued

Compared with the last close at CA$59.15, the most followed narrative anchors on a fair value of about CA$73, implying meaningful upside in that framework.

The ramp-up of LNG Canada and expanding North American export infrastructure are set to relieve local bottlenecks, improve price realizations, and support higher sales volumes for Tourmaline over the next several years, positively impacting net margins and earnings.

Curious what underpins that higher value? The narrative leans on faster revenue growth, solid margin assumptions and a future earnings multiple above the wider oil and gas group.

Result: Fair Value of $73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on natural gas prices and export capacity actually materialising as expected, with project delays or persistently weak pricing both potential spoilers.

Find out about the key risks to this Tourmaline Oil narrative.

Another View Using Market Comparisons

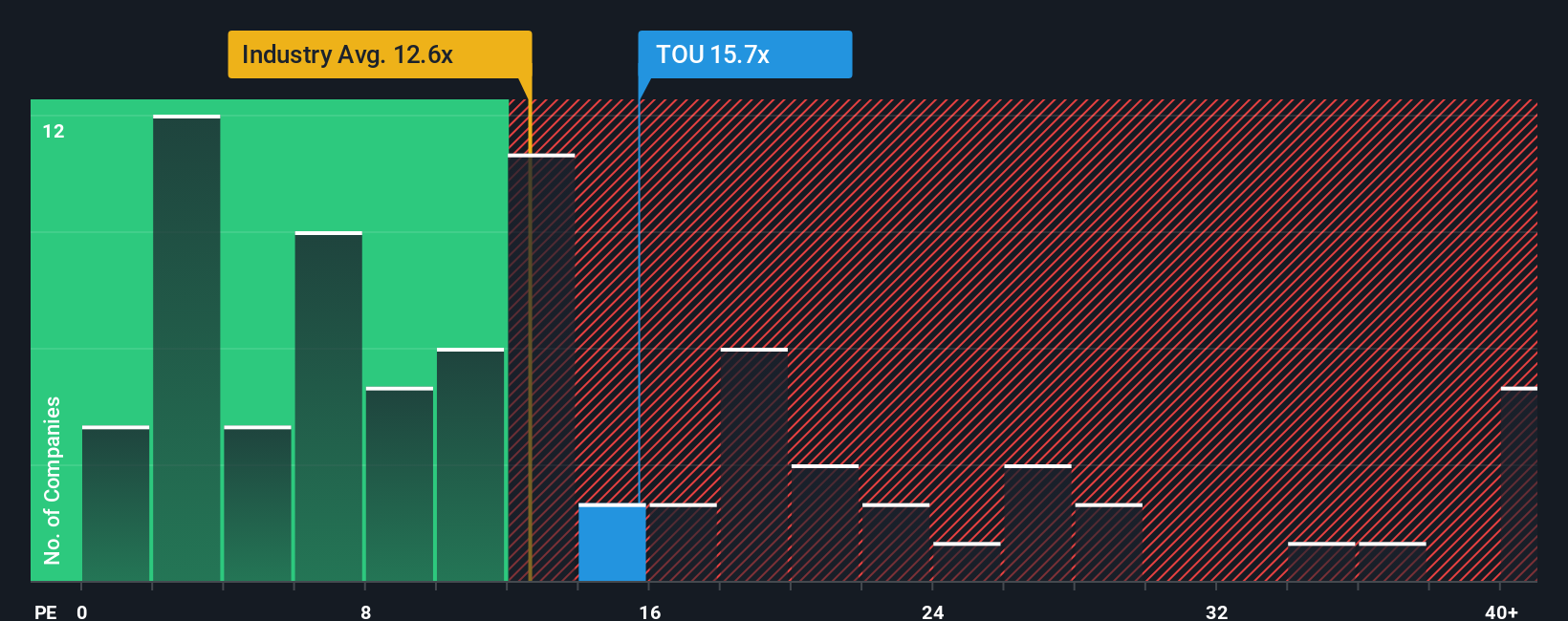

While the most popular narrative points to upside, the current P/E of 17.3x paints a more cautious picture. It sits above both the Canadian Oil and Gas industry at 14.5x and peers at 16x, although still below a fair ratio of 18.1x. This keeps the risk reward debate very much alive.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tourmaline Oil Narrative

If you see the numbers differently or want to stress test your own view, you can build a full Tourmaline story in just a few minutes: Do it your way.

A great starting point for your Tourmaline Oil research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Tourmaline is on your radar, do not stop there. Broaden your watchlist with fresh ideas that match the way you actually like to invest.

- Target income potential with these 11 dividend stocks with yields > 3% and quickly spot companies offering yields above 3% that might fit a cash flow focused portfolio.

- Back long term technology trends by scanning these 25 AI penny stocks for companies tied to artificial intelligence that could reshape how entire industries operate.

- Hunt for mispriced opportunities using these 877 undervalued stocks based on cash flows, filtering for businesses where current prices sit below cash flow based assessments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报