A Look At RTX (RTX) Valuation After US$438 Million FAA Radar Modernization Contract

RTX (RTX) is back in the spotlight after its Collins Aerospace unit secured a US$438 million Federal Aviation Administration contract tied to a multi year U.S. airspace radar modernization effort.

See our latest analysis for RTX.

That FAA radar win comes on top of a strong run for RTX, with a 30 day share price return of 11.28% feeding into a 12.95% 90 day gain and a 68.95% total shareholder return over the past year. This suggests momentum has been building rather than fading.

If this kind of contract driven story has your attention, it could be a good moment to see what else is setting up in aerospace and defense through aerospace and defense stocks.

With RTX trading around US$190 and sitting only about 3.5% below one prominent analyst target, along with an intrinsic value estimate that is above the current price, it raises the question of whether there is still a buying window or if the market is already pricing in future growth.

Most Popular Narrative: 2.2% Undervalued

RTX closed at US$190.40 compared to a most followed narrative fair value of US$194.65, putting a small valuation gap under the spotlight.

Robust and growing backlog, highlighted by a 1.86 quarter book-to-bill ratio, $236 billion backlog (up 15% year-over-year), and major new international contracts (e.g., EU, MENA, Asia-Pacific) indicate RTX is well-positioned to benefit from sustained increases in global defense spending and heightened geopolitical tensions, setting up strong visibility for future revenue growth.

Curious what earnings path and profit margins sit behind that fair value and near term revenue visibility? The most followed narrative spells out those assumptions in detail.

Result: Fair Value of $194.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can change quickly if jet engine cost overruns at Pratt & Whitney or major cybersecurity incidents like the Collins software attack begin to weigh more heavily on earnings and confidence.

Find out about the key risks to this RTX narrative.

Another View: What The P/E Is Signalling

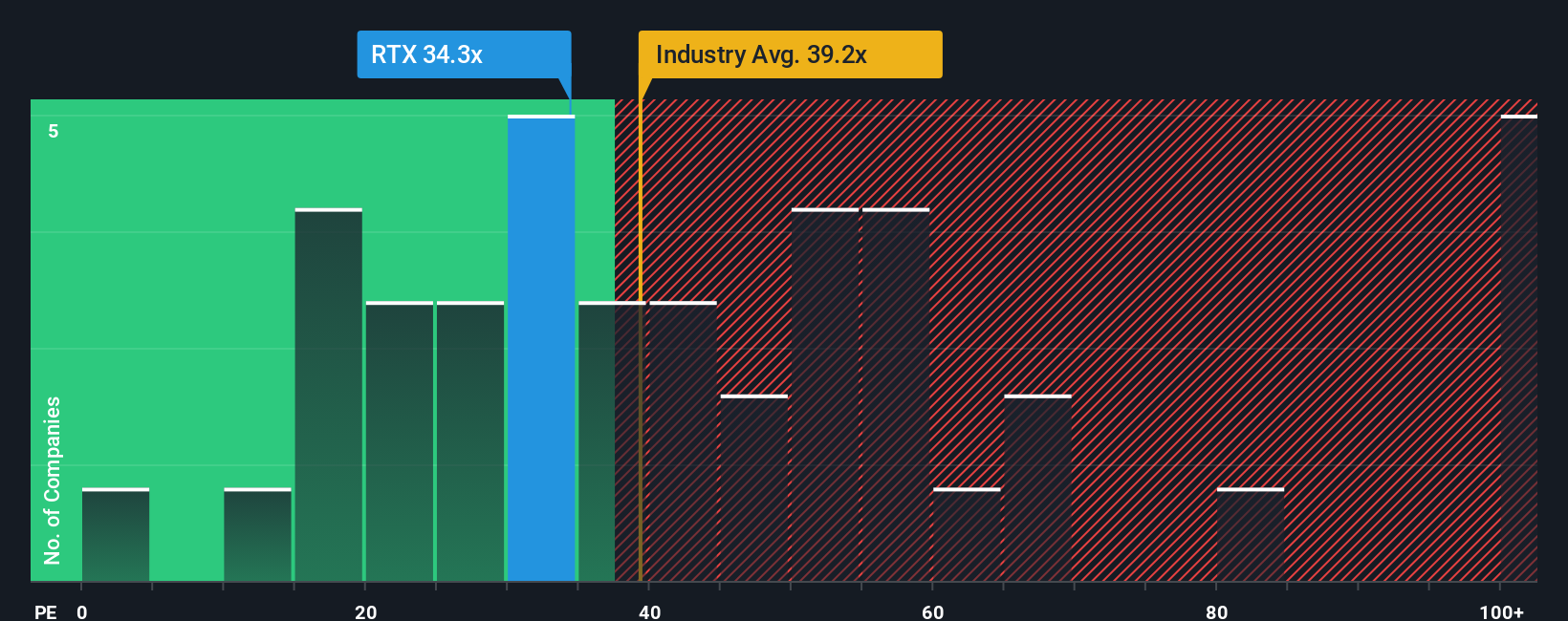

That 2.2% gap between RTX's US$190.40 share price and the US$194.65 fair value in the most followed narrative suggests a mild undervaluation. However, the current P/E of 38.7x tells a more cautious story when you compare it with other benchmarks.

RTX trades on a P/E of 38.7x, which is slightly below the US Aerospace & Defense industry at 40.4x, yet a touch above the peer average of 38.6x and above its own fair ratio of 35.6x. In practice, that means the market is already paying a premium to where the fair ratio suggests the P/E could settle, so any slip in execution or sentiment could put that premium under pressure. The question is whether you think RTX has done enough to keep investors comfortable paying up at these levels.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RTX Narrative

If you see the RTX story differently or simply want to stress test these assumptions against your own view, you can build a full narrative in just a few minutes with Do it your way.

A great starting point for your RTX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If RTX has sharpened your focus on quality ideas, do not stop here. The next move that really shifts your portfolio might be the one you explore next.

- Spot potential bargains early by scanning these 877 undervalued stocks based on cash flows that the market may not be fully appreciating yet.

- Ride the AI wave with these 25 AI penny stocks that are building tools, platforms, and services around artificial intelligence.

- Target income focused opportunities by checking out these 11 dividend stocks with yields > 3% that offer higher yields than the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报