Is Patterson-UTI (PTEN) Prioritizing Rig Scale Over Profitability To Redefine Its Investment Story?

- Patterson-UTI Energy recently reported that it operated an average of 93 drilling rigs in the United States during December 2025, while cautioning that rig counts alone may not mirror its financial performance.

- The company’s ability to keep a large, highly utilized rig fleet active, despite ongoing profitability pressures and net income losses, highlights an emphasis on operational scale and liquidity strength over near-term earnings.

- With Patterson-UTI’s high rig utilization underscoring operational resilience, we’ll now examine how this shapes the company’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Patterson-UTI Energy Investment Narrative Recap

To own Patterson-UTI Energy, you need to believe its large, highly utilized rig fleet and liquidity can eventually translate into healthier economics, despite ongoing net losses and sector volatility. The latest update, showing about 93 rigs running in December 2025 and management’s reminder that rig counts do not equal profits, does not materially change the near term picture: the key catalyst remains any stabilization in drilling activity, while the biggest risk is that elevated capital needs keep weighing on free cash flow.

The most relevant recent announcement here is the Q3 2025 earnings release, where Patterson-UTI reported US$1,175.95 million in sales and a US$36.4 million net loss, following nine month sales of US$3,675.81 million and an US$84.54 million net loss. Set against a still active rig fleet, these results highlight how moderating customer activity and higher capital intensity can pressure margins, which matters directly for investors focused on the company’s ability to fund its equipment upgrades and digital investments internally.

Yet behind the strong rig utilization, investors should be aware that high ongoing capital expenditure requirements could...

Read the full narrative on Patterson-UTI Energy (it's free!)

Patterson-UTI Energy's narrative projects $4.8 billion revenue and $337.4 million earnings by 2028. This implies revenues declining by 1.3% per year and an earnings increase of about $1.4 billion from -$1.1 billion today.

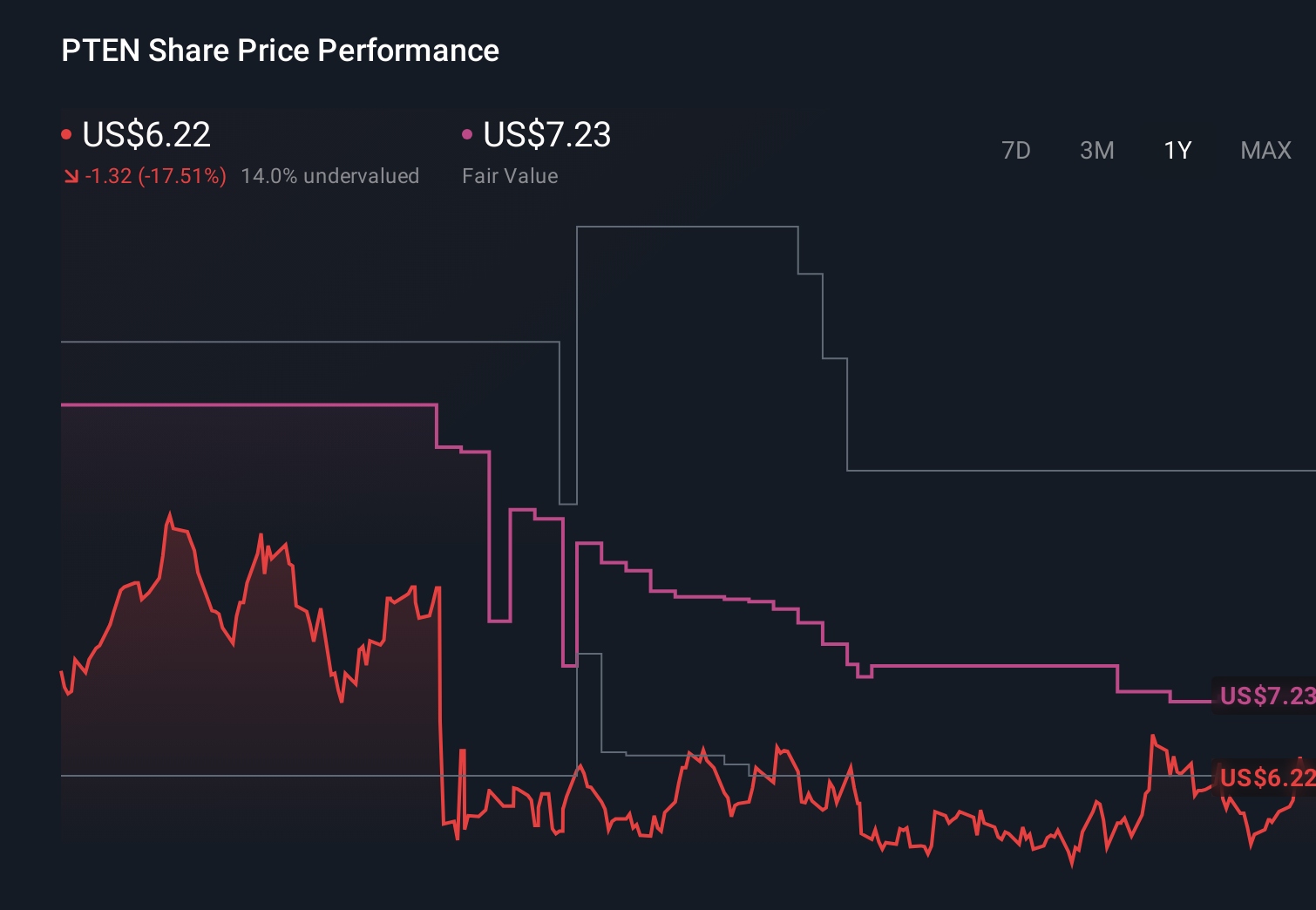

Uncover how Patterson-UTI Energy's forecasts yield a $7.23 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently estimate Patterson-UTI’s fair value between US$2 and about US$26.52, reflecting very different views on the company’s prospects. When you weigh those opinions against the risk that high capital expenditure could continue to suppress free cash flow, it becomes clear why exploring multiple perspectives on Patterson-UTI’s future performance really matters.

Explore 5 other fair value estimates on Patterson-UTI Energy - why the stock might be worth less than half the current price!

Build Your Own Patterson-UTI Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patterson-UTI Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Patterson-UTI Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patterson-UTI Energy's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报