Alphabet (NasdaqGS:GOOGL) Valuation Check As AI Leadership And Gemini Momentum Drive Fresh Optimism

Alphabet (GOOGL) is back in the spotlight after a fresh wave of optimism around its AI leadership, rapid Gemini adoption, and expanding roles for Google Cloud, Waymo, and quantum computing partnerships.

See our latest analysis for Alphabet.

The recent batch of AI headlines, government contracts, and clean energy deals sits on top of a powerful run, with a 90 day share price return of 30.15% and a 1 year total shareholder return of 62.71%. This suggests momentum has been building, even if the latest 1 day move was slightly negative.

If Alphabet’s AI story has your attention, it could be a good moment to see what else is catching investors’ eyes across high growth tech and AI stocks via high growth tech and AI stocks.

After a 65% gain last year and with Alphabet now trading only about 6% below the average analyst target and near estimates of intrinsic value, is there still an opening for buyers, or is the market already pricing in the AI growth story?

Most Popular Narrative: 7.5% Undervalued

According to oscargarcia, the narrative pegs Alphabet’s fair value at US$340, a premium to the last close of US$314.34, and builds a case around cash generation, AI and long term compounding.

Google’s balance sheet is like a bunker built with gold bricks:

• Cash & Marketable Securities: Over $120B.

• Debt? Practically negligible.

• Operating Margin: ~25–30%.

• Free Cash Flow: $70–80B/year; it’s raining money.

And yes, they’ve started buying back shares aggressively, which is significant for long-term holders.

Want to see how this cash machine story turns into a higher future P/E and premium fair value? The narrative leans on strong margins, steady growth and a punchy profit multiple that many investors usually associate with market leaders. Curious which assumptions bridge the gap between US$314 and US$340? The full breakdown joins earnings, revenue mix and future profitability into one tight valuation case.

Result: Fair Value of $340 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish story still depends on Google defending its core ad and search positions while managing ongoing regulatory scrutiny that could pressure how it runs its platforms.

Find out about the key risks to this Alphabet narrative.

Another View: What Our DCF Suggests

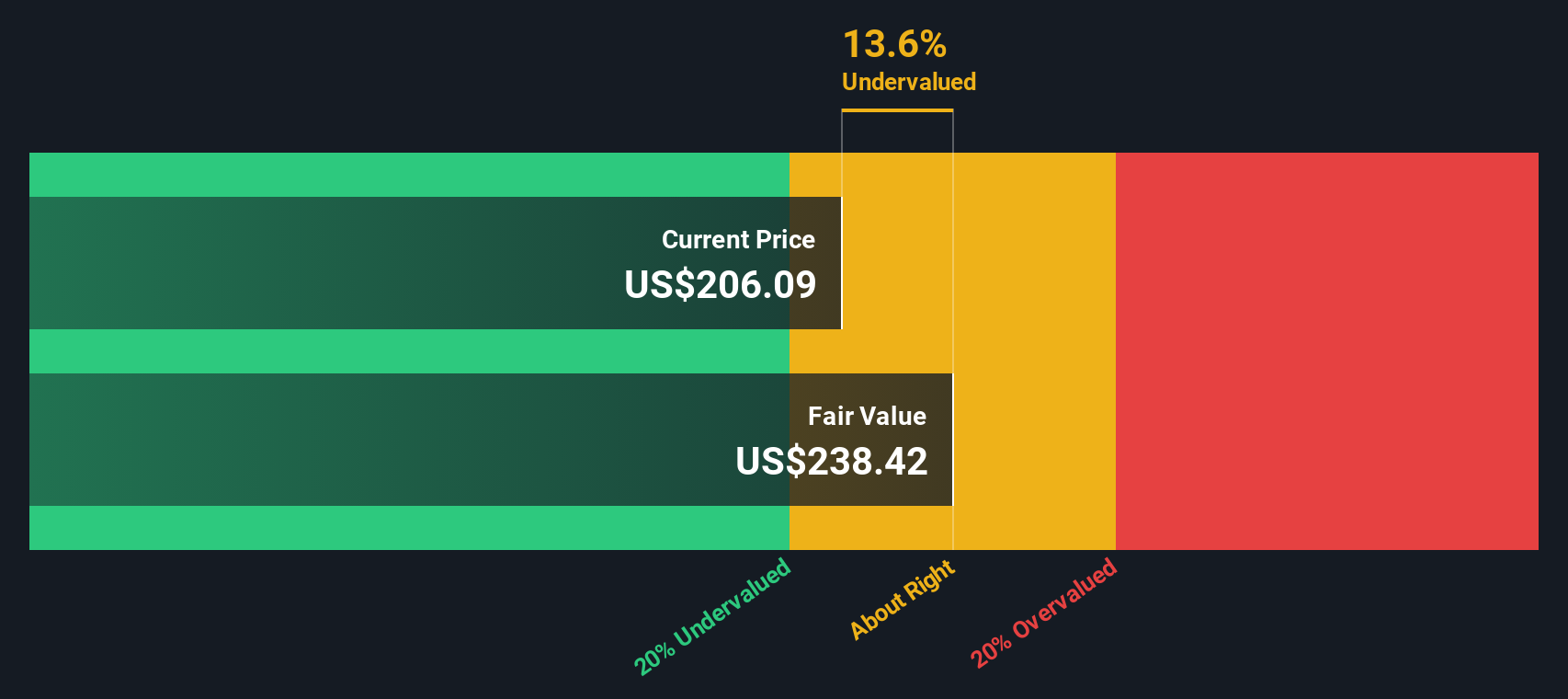

The user narrative sees Alphabet as 7.5% undervalued at US$340, but our DCF model lands much closer to the current price, with a fair value estimate near US$312.02 versus the US$314.34 share price. That points to a stock that looks closer to fairly valued than a clear bargain. Which story do you think fits better?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alphabet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alphabet Narrative

If you read the numbers differently or would rather test your own assumptions, you can pull the data together and build a custom view in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alphabet.

Looking for more investment ideas?

If Alphabet is already on your watchlist, this is a great time to widen your scope and line up a few more ideas for your next move.

- Target income now by checking out these 11 dividend stocks with yields > 3% that could help you build a steadier cash flow profile in your portfolio.

- Ride the AI momentum by scanning these 25 AI penny stocks that are catching attention for their exposure to artificial intelligence themes.

- Hunt for potential bargains with these 877 undervalued stocks based on cash flows and see which companies currently trade at prices that differ from their cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报