Rheinmetall (XTRA:RHM) Is Up 11.5% After Trump’s Venezuela Move Spurs Geopolitical Risk Repricing

- In recent days, President Trump's intervention in Venezuela heightened concerns about global insecurity, drawing renewed attention to major defense contractors such as Rheinmetall. This reaction underscores how shifts in geopolitical risk can quickly influence investor focus on companies tied to military and security spending.

- Next, we will examine how rising geopolitical tensions linked to Venezuela might reshape Rheinmetall’s investment narrative and perceived growth drivers.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Rheinmetall Investment Narrative Recap

To own Rheinmetall, you need to believe that sustained demand for defense and security capabilities will support the company’s expanding order book and capital investment. Trump’s comments on Venezuela and the recent share price jump highlight how quickly geopolitical events can sharpen attention on defense stocks, but they do not fundamentally change Rheinmetall’s key short term catalyst, which remains execution on its large growth pipeline, nor its biggest risk around dependence on government budgets and approvals.

In that context, the recent €1.7 billion gross reconnaissance satellite contract with the German procurement authority is especially relevant, as it reinforces Rheinmetall’s role in European security infrastructure tied to NATO’s eastern flank. This multi year space project aligns with investor focus on new technology domains such as surveillance and intelligence, which could be important drivers for Rheinmetall if it can deliver on complex programs while managing the operational and regulatory risks that come with them.

However, investors should also weigh how any future shift in European defense budgets could...

Read the full narrative on Rheinmetall (it's free!)

Rheinmetall's narrative projects €26.4 billion revenue and €3.4 billion earnings by 2028.

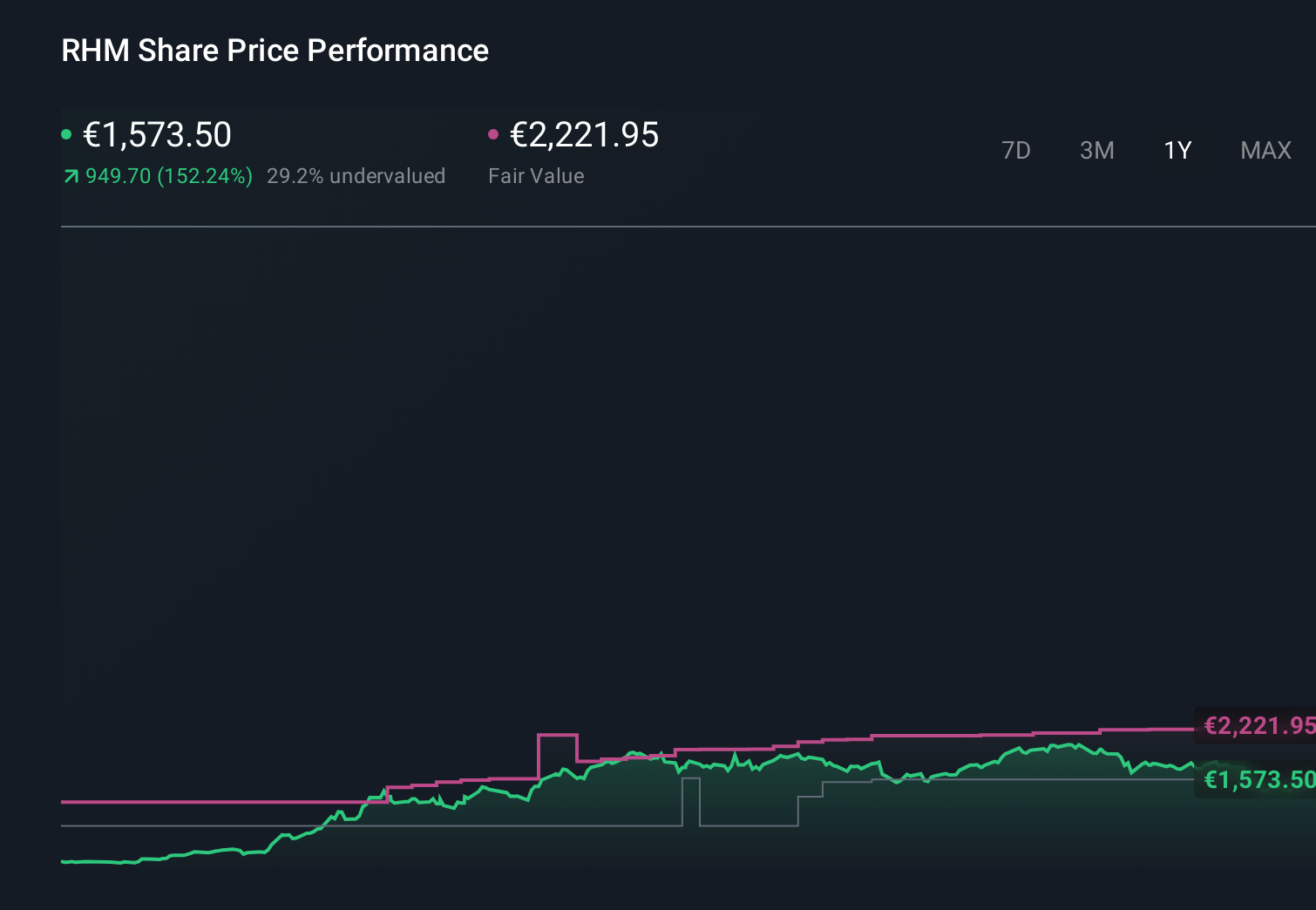

Uncover how Rheinmetall's forecasts yield a €2222 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Across 29 fair value estimates from the Simply Wall St Community, Rheinmetall’s perceived worth spans roughly €1,808 to €7,570, reflecting very different expectations. You can contrast those views with the execution and political approval risks discussed earlier, which could materially affect how the company converts today’s heightened geopolitical focus into future financial performance.

Explore 29 other fair value estimates on Rheinmetall - why the stock might be worth just €1809!

Build Your Own Rheinmetall Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rheinmetall research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Rheinmetall research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rheinmetall's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报