Assessing Aritzia (TSX:ATZ) Valuation After Analyst Upgrades And Strong Third Quarter Outlook

Recent analyst calls around Aritzia (TSX:ATZ) have zeroed in on expected third quarter strength, with higher earnings forecasts tied to revenue growth, e-commerce, new stores, and what is described as better inventory positioning.

See our latest analysis for Aritzia.

Those upbeat third quarter expectations are landing after a powerful run in the shares, with the CA$121.40 share price reflecting a 48.39% 90 day share price return and a very large 5 year total shareholder return of 389.71%. This suggests momentum has been building as investors reassess Aritzia’s growth prospects and risks.

If Aritzia’s recent strength has you thinking about where else growth stories might emerge, this could be a good moment to scan fast growing stocks with high insider ownership for other ideas on your radar.

With Aritzia trading near CA$121 and sitting only slightly below the average analyst target of about CA$126, the key question is whether recent optimism leaves meaningful upside or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 13.5% Overvalued

With Aritzia last closing at CA$121.40 versus a narrative fair value of CA$107, the most followed view leans cautious on how much is already priced in.

Aritzia's geographic expansion strategy, particularly in the United States, has shown strong performance and presents significant growth potential through ongoing boutique openings. This is likely to drive revenue growth.

Curious what earnings power that kind of footprint could support, and what profit margins need to hold for the math to work? The narrative leans on faster earnings growth, higher profitability and a richer future P/E than the wider retail group to land at its fair value.

Result: Fair Value of $107 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still the risk that heavy reliance on U.S. expansion and higher marketing spend will not translate into the revenue and margin gains that analysts are modelling.

Find out about the key risks to this Aritzia narrative.

Another View: Earnings Multiple Sends A Caution Flag

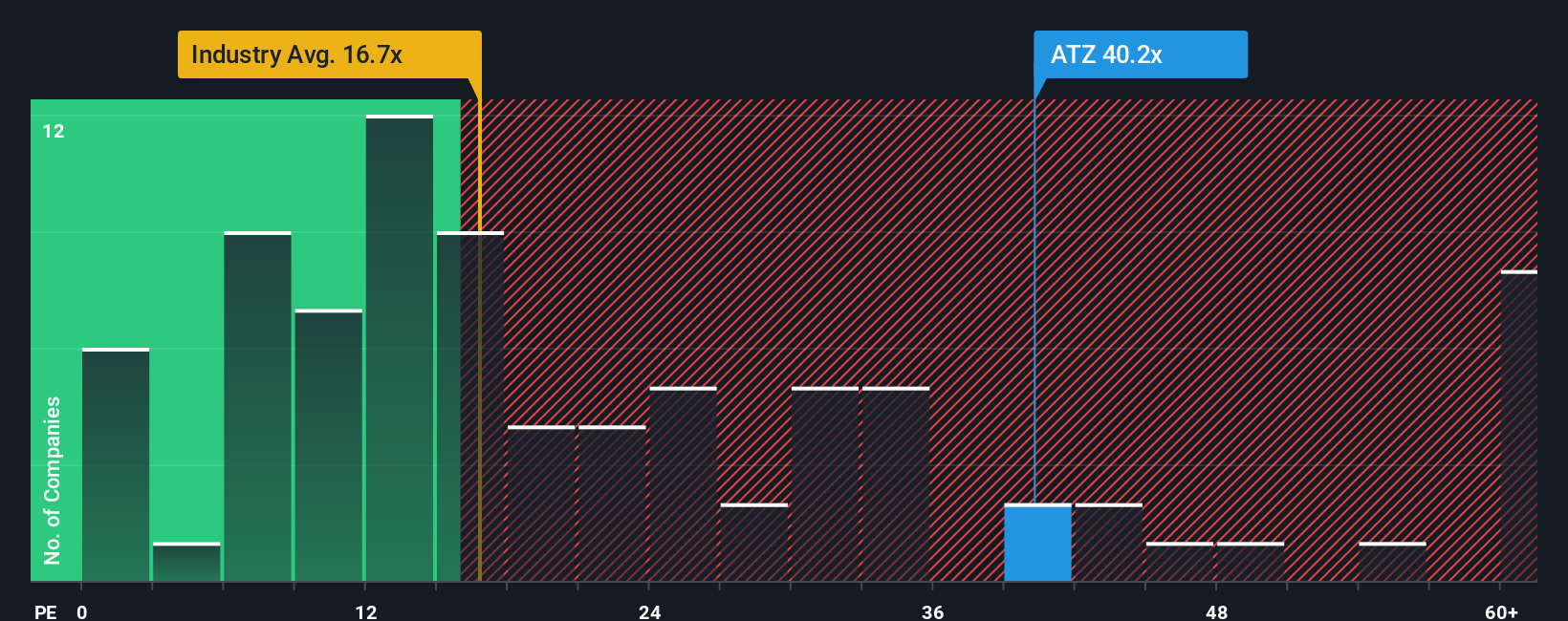

While the most followed narrative pegs fair value at CA$107 and calls Aritzia overvalued, the current P/E of 49.6x tells a similar story in a different way. That multiple sits well above the North American specialty retail average of 20.7x and the peer average of 21.2x.

Even against the estimated fair ratio of 39.7x, the 49.6x P/E looks punchy. This suggests the share price is already baking in a lot of good news. If growth or margins end up closer to the pack, how much room is there for disappointment to be priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aritzia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aritzia Narrative

If you see the numbers differently or prefer to test your own assumptions against the data, you can build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Aritzia.

Ready to hunt for your next idea?

If Aritzia is on your radar, do not stop there. Widen your search now so you do not miss opportunities that fit your style.

- Target potential value upside by scanning these 876 undervalued stocks based on cash flows that currently trade below what their cash flows suggest they might be worth.

- Spot emerging themes in automation and machine learning by reviewing these 25 AI penny stocks that are tied to real business models, not just hype.

- Tap into higher income potential by screening these 11 dividend stocks with yields > 3% that offer yields above 3% while still passing basic quality checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报