A Look At Seagate Technology Holdings (STX) Valuation As AI And HAMR Growth Drives Investor Interest

Recent commentary around Seagate Technology Holdings (STX) has focused on booming AI data center and social media video demand, as well as progress with HAMR technology that supports higher drive capacities and potential margin benefits.

See our latest analysis for Seagate Technology Holdings.

Those AI and video storage themes have coincided with a sharp move in the shares, with the 90 day share price return of 47.28% and a very large 1 year total shareholder return suggesting strong momentum rather than a short term spike.

If Seagate’s AI storage story has caught your attention, it could be a good moment to see what else is shaping data infrastructure, starting with high growth tech and AI stocks.

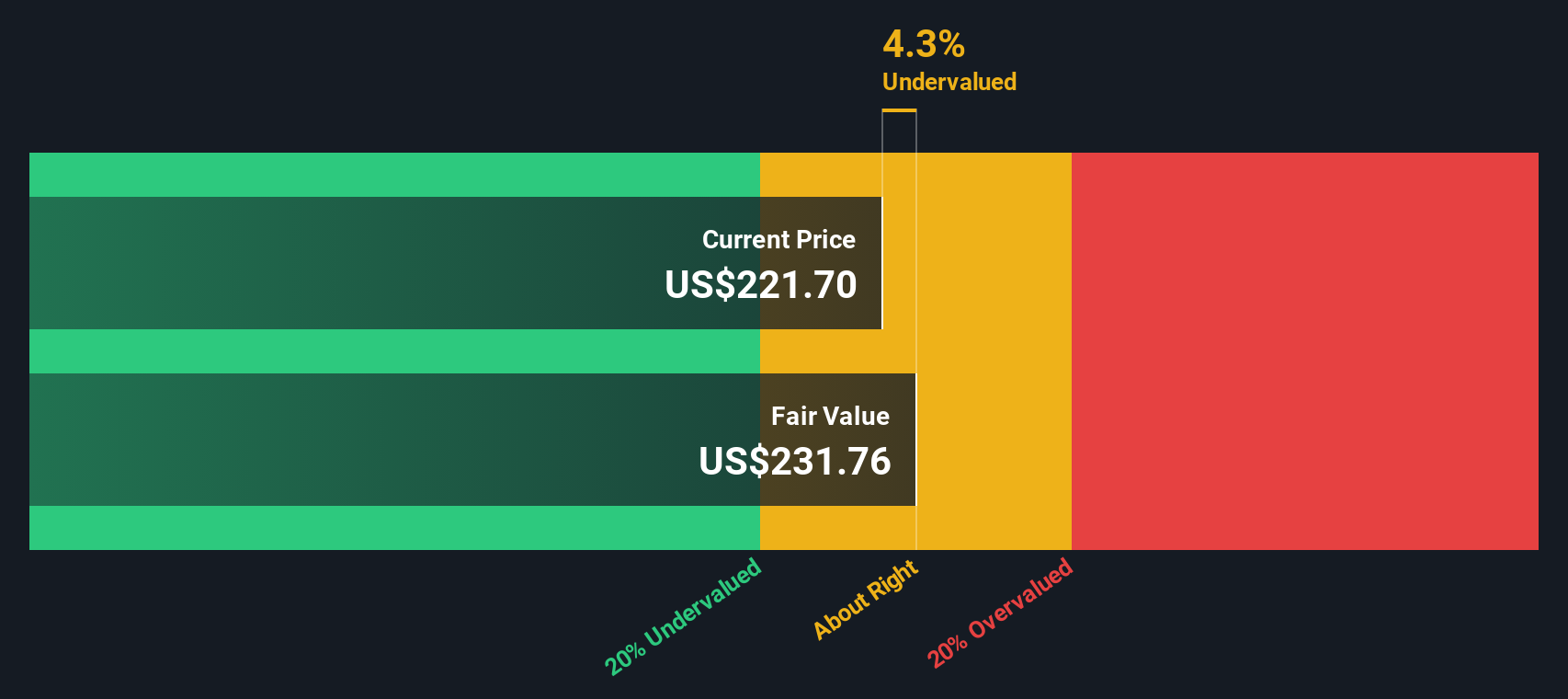

With Seagate trading at $330.42 against an analyst price target of $297.09 and an intrinsic value estimate that implies roughly an 8% discount, you have to ask whether there is still a buying opportunity here or whether the market is already pricing in potential future growth.

Most Popular Narrative Narrative: 11.2% Overvalued

The most followed narrative puts Seagate’s fair value at about $297 per share, which is below the last close of $330.42 and highlights the current premium.

The Fair Value Estimate has risen slightly to approximately $297 per share from about $289. This reflects modestly stronger long term growth and earnings assumptions.

The Future P/E has risen moderately to roughly 23.4x from about 22.7x. This indicates a somewhat higher valuation multiple applied to forward earnings expectations.

Curious what earnings path and margin profile could support paying up for those future multiples, and how fast revenue needs to climb to get there?

Result: Fair Value of $297.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh trade policy shifts or a tougher HDD and SSD competitive environment, either of which could pressure both revenue and margins.

Find out about the key risks to this Seagate Technology Holdings narrative.

Another View: DCF Points the Other Way

While the narrative fair value of about $297 per share frames Seagate as 11.2% overvalued, the Simply Wall St DCF model currently puts fair value closer to $359.92. At $330.42, that implies roughly an 8.2% discount. Which set of assumptions do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Seagate Technology Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Seagate Technology Holdings Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a complete Seagate view in just a few minutes with Do it your way.

A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Seagate has sharpened your focus on where your money works hardest, do not stop here. The next opportunity might already be on your radar.

- Spot early stage potential by checking out these 3554 penny stocks with strong financials that combine smaller market caps with stronger financial footing than many peers.

- Ride the AI wave more intentionally by scanning these 25 AI penny stocks for companies directly tied to data, compute, and automation themes.

- Target pricing that looks more favorable by reviewing these 876 undervalued stocks based on cash flows and seeing which businesses currently screen as cheaper based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报