3 Promising Penny Stocks With Market Caps Under $2B

As the Dow Jones and S&P 500 reach new all-time highs, investors are increasingly on the lookout for opportunities that can offer both stability and potential growth. Though often seen as a throwback to earlier trading days, penny stocks remain a relevant investment area, particularly when they involve smaller or newer companies with solid financial foundations. In this article, we will explore three penny stocks that not only demonstrate balance sheet strength but also hold promise for future gains.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.81 | $615.06M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.89 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8434 | $146.58M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.17 | $548.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.25 | $1.36B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.46 | $581.58M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.60 | $376.37M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.982 | $7.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.86 | $86.09M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 338 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

AbCellera Biologics (ABCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AbCellera Biologics Inc. focuses on discovering and developing antibody-based medicines for unmet medical needs in the United States, with a market cap of approximately $1.03 billion.

Operations: The company generates revenue primarily from its Discovery and Development of Antibodies segment, totaling $35.33 million.

Market Cap: $1.03B

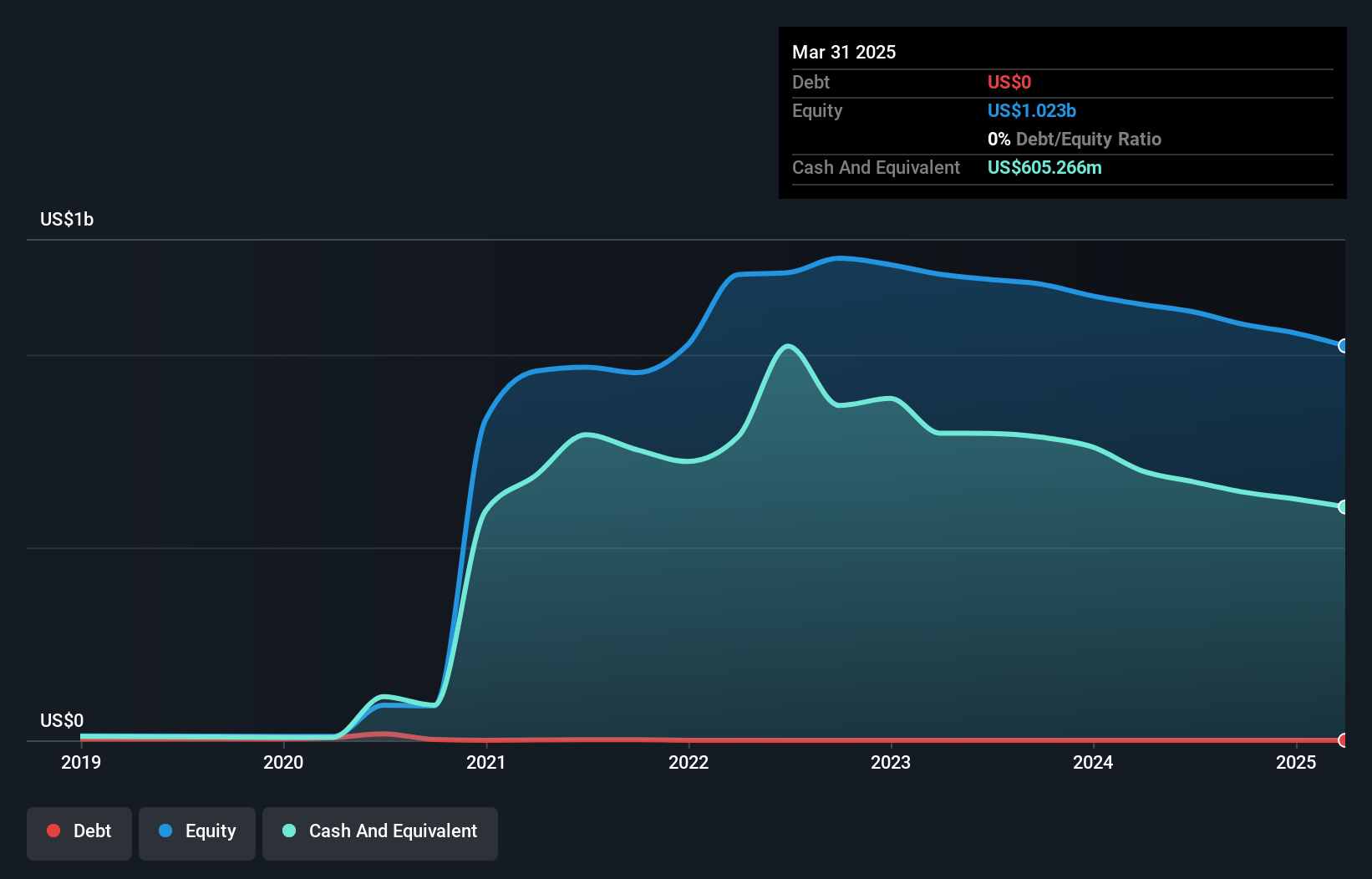

AbCellera Biologics, with a market cap of US$1.03 billion, is currently unprofitable and trading significantly below its estimated fair value. Despite its financial challenges, the company has no debt and substantial short-term assets exceeding liabilities. Recent developments include a settlement with Bruker Corporation that brings in US$36 million upfront and future royalties, indicating potential revenue growth. The addition of renowned scientist Stephen Quake to the board could bolster strategic direction. However, ongoing losses highlight risk factors for investors considering penny stock investments in AbCellera amidst its forecasted revenue growth trajectory.

- Take a closer look at AbCellera Biologics' potential here in our financial health report.

- Explore AbCellera Biologics' analyst forecasts in our growth report.

Vista Gold (VGZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vista Gold Corp., along with its subsidiaries, operates as a development-stage company in the gold mining industry in Australia with a market cap of $252.42 million.

Operations: Vista Gold Corp. does not report any specific revenue segments.

Market Cap: $252.42M

Vista Gold Corp., with a market cap of US$252.42 million, is pre-revenue and debt-free, offering a stable financial base amidst high volatility. The company has reduced losses by 20.5% annually over five years and maintains sufficient cash runway for over a year based on current free cash flow. Despite being unprofitable, Vista's experienced management and board provide strategic leadership. Recent earnings showed narrowed quarterly losses but significant nine-month net loss compared to the previous year's income, reflecting ongoing financial challenges in its development stage within the gold mining sector in Australia.

- Dive into the specifics of Vista Gold here with our thorough balance sheet health report.

- Assess Vista Gold's previous results with our detailed historical performance reports.

Fortitude Gold (FTCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fortitude Gold Corporation operates as a mining company focused on exploring gold and silver projects in the United States, with a market cap of $107.01 million.

Operations: The company generates revenue of $25.44 million from its Metals & Mining segment, specifically focusing on gold and other precious metals.

Market Cap: $107.01M

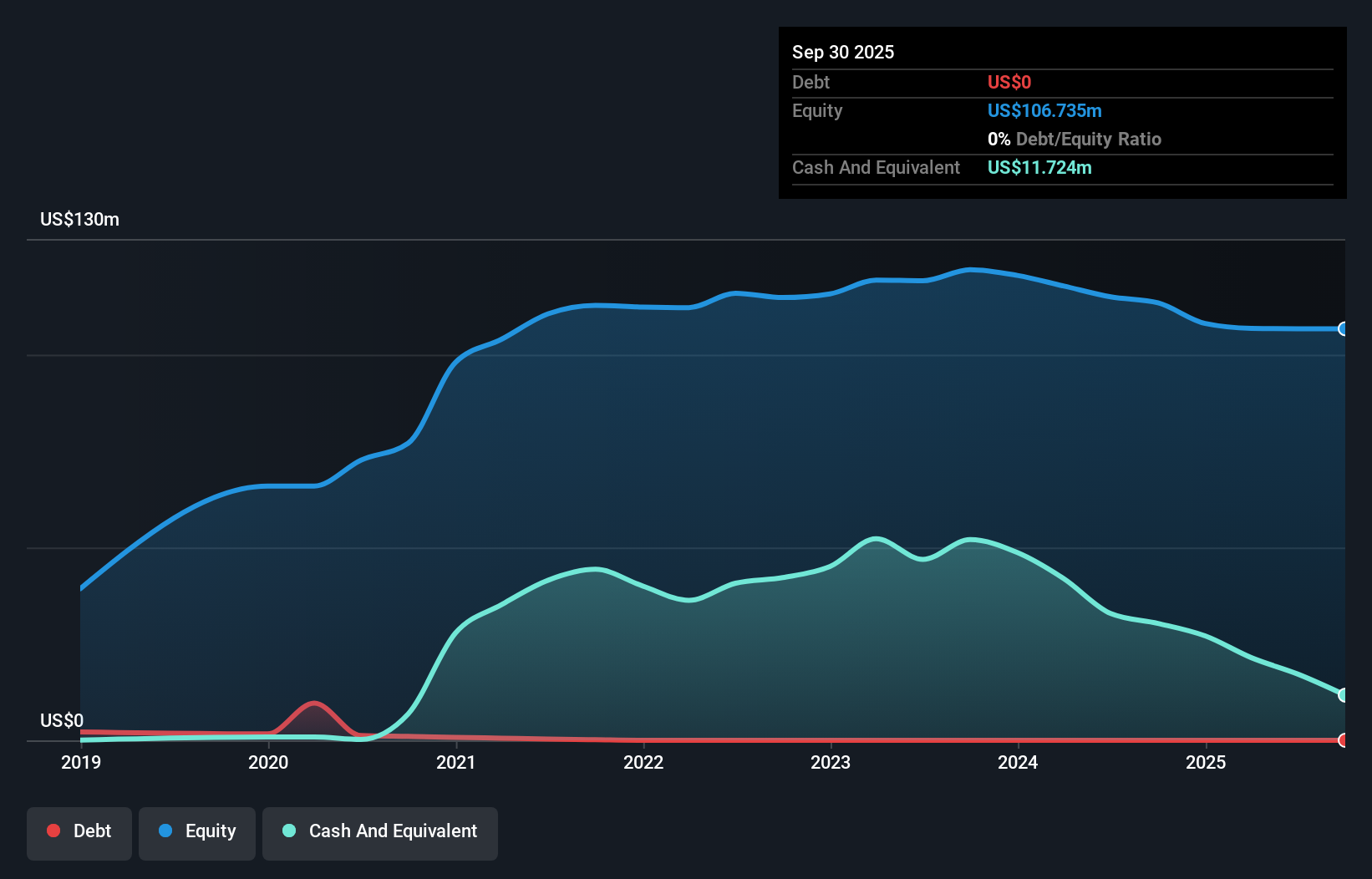

Fortitude Gold Corporation, with a market cap of US$107.01 million, operates without debt and maintains healthy short-term assets of US$36.3 million against liabilities. Despite being unprofitable, recent earnings indicate improved nine-month net income at US$2.33 million compared to the previous year, although quarterly sales have declined significantly to US$4.65 million from US$10.23 million a year ago. The company offers a dividend yield of 2.54%, though it's not well covered by earnings or free cash flow, reflecting challenges in sustaining payouts amidst declining revenue within its gold-focused operations in the United States.

- Get an in-depth perspective on Fortitude Gold's performance by reading our balance sheet health report here.

- Learn about Fortitude Gold's historical performance here.

Next Steps

- Reveal the 338 hidden gems among our US Penny Stocks screener with a single click here.

- Ready For A Different Approach? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报