Uncovering 3 Undiscovered Gems in the US Market

As the U.S. stock market reaches new heights, with the Dow Jones Industrial Average and S&P 500 setting all-time records, investors are increasingly turning their attention to smaller companies that may have been overlooked in this rally. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, especially as economic indicators continue to shape the landscape for small-cap companies.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Security Federal | 20.04% | 5.77% | 1.59% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Esquire Financial Holdings (ESQ)

Simply Wall St Value Rating: ★★★★★★

Overview: Esquire Financial Holdings, Inc. is the bank holding company for Esquire Bank, National Association, offering commercial banking products and services to legal professionals, small businesses, and retail customers in the United States with a market cap of $842.61 million.

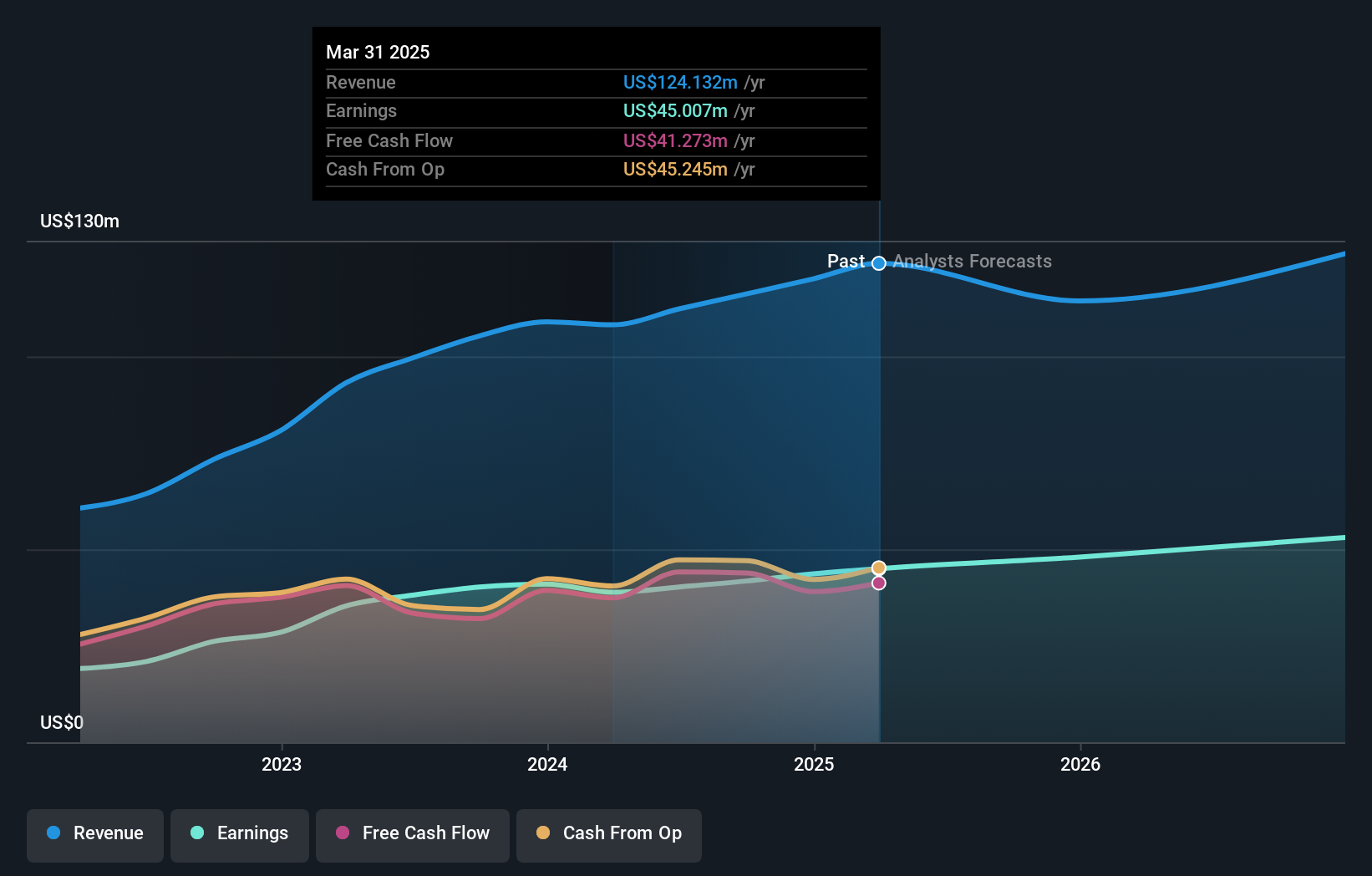

Operations: Esquire Financial Holdings generates revenue primarily from its community banking segment, totaling $131.74 million. The company's net profit margin shows an interesting trend at 31.2%.

Esquire Financial Holdings, with total assets of US$2.2 billion and equity of US$279.2 million, stands out for its robust financial health. It has a net interest margin of 6.1% and maintains an appropriate level of bad loans at 0.6%, supported by a sufficient allowance for bad loans at 244%. The company primarily relies on low-risk customer deposits, which account for 99% of its liabilities, enhancing stability. Trading at approximately 41% below fair value estimates suggests potential undervaluation in the market while earnings have grown impressively by about 26% annually over the past five years.

ASA Gold and Precious Metals (ASA)

Simply Wall St Value Rating: ★★★★★☆

Overview: ASA Gold and Precious Metals Limited is a publicly owned investment manager with a market cap of $1.15 billion.

Operations: ASA Gold and Precious Metals Limited generates revenue primarily from its financial services segment, specifically through closed-end funds, amounting to approximately $3.98 million. The company operates with a market capitalization of $1.15 billion.

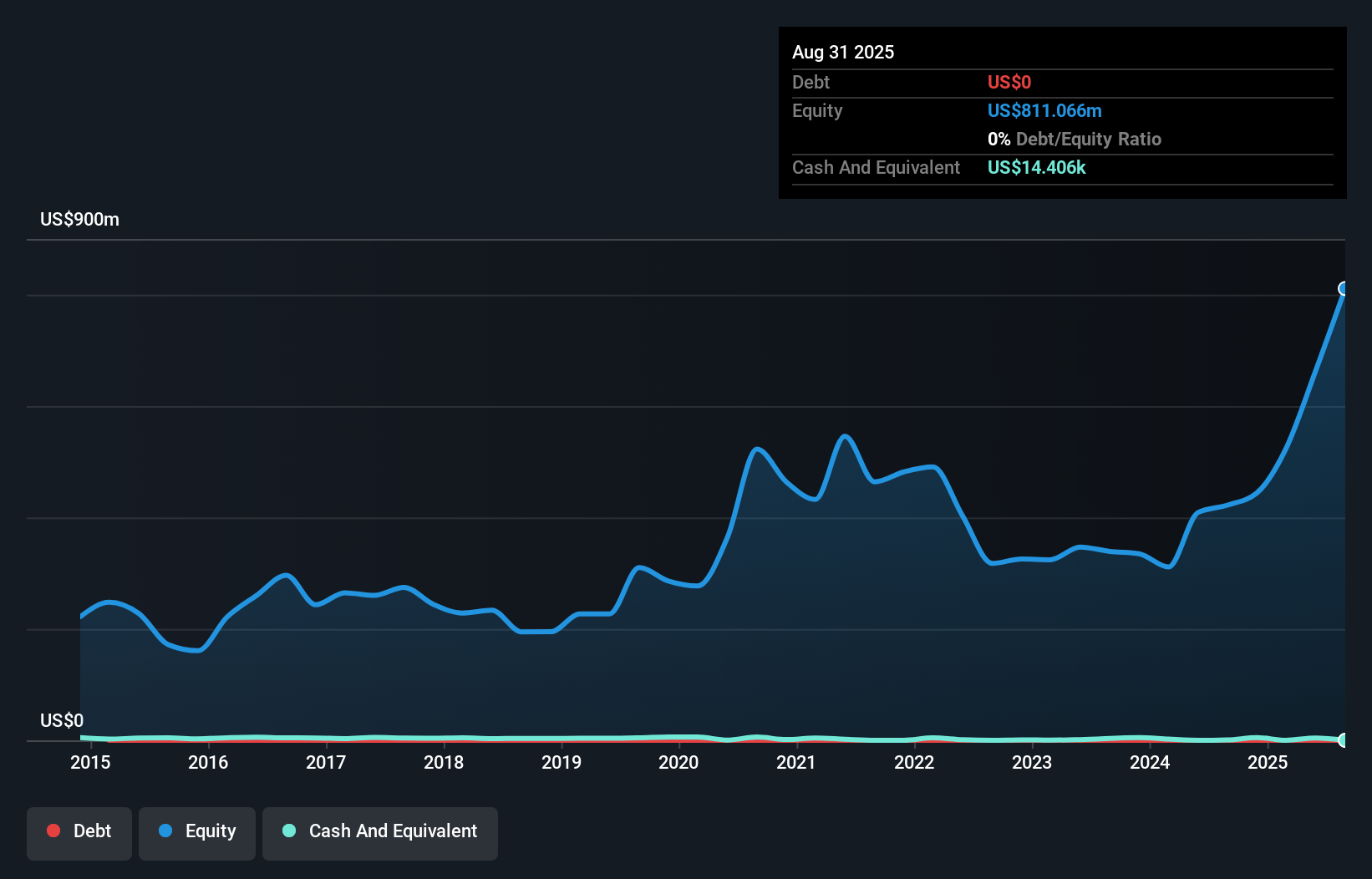

ASA Gold and Precious Metals, a small cap player in the precious metals sector, has seen its earnings soar by 330.7% over the past year, significantly outpacing the Capital Markets industry average of 16.5%. The company is debt-free, eliminating concerns about interest coverage. Despite a low price-to-earnings ratio of 3.1x compared to the US market's 19.1x, ASA's financial results are heavily influenced by a substantial one-off gain of US$377 million in the last year ending August 2025. However, with only US$4 million in revenue and limited data on cash runway sustainability, potential investors should consider these factors carefully.

- Unlock comprehensive insights into our analysis of ASA Gold and Precious Metals stock in this health report.

Learn about ASA Gold and Precious Metals' historical performance.

HNI (HNI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: HNI Corporation, with a market cap of approximately $1.96 billion, operates in the manufacture, sale, and marketing of workplace furnishings and residential building products mainly in the United States and Canada.

Operations: HNI Corporation generates revenue primarily from two segments: Workplace Furnishings, contributing $1.94 billion, and Residential Building Products, adding $656.30 million.

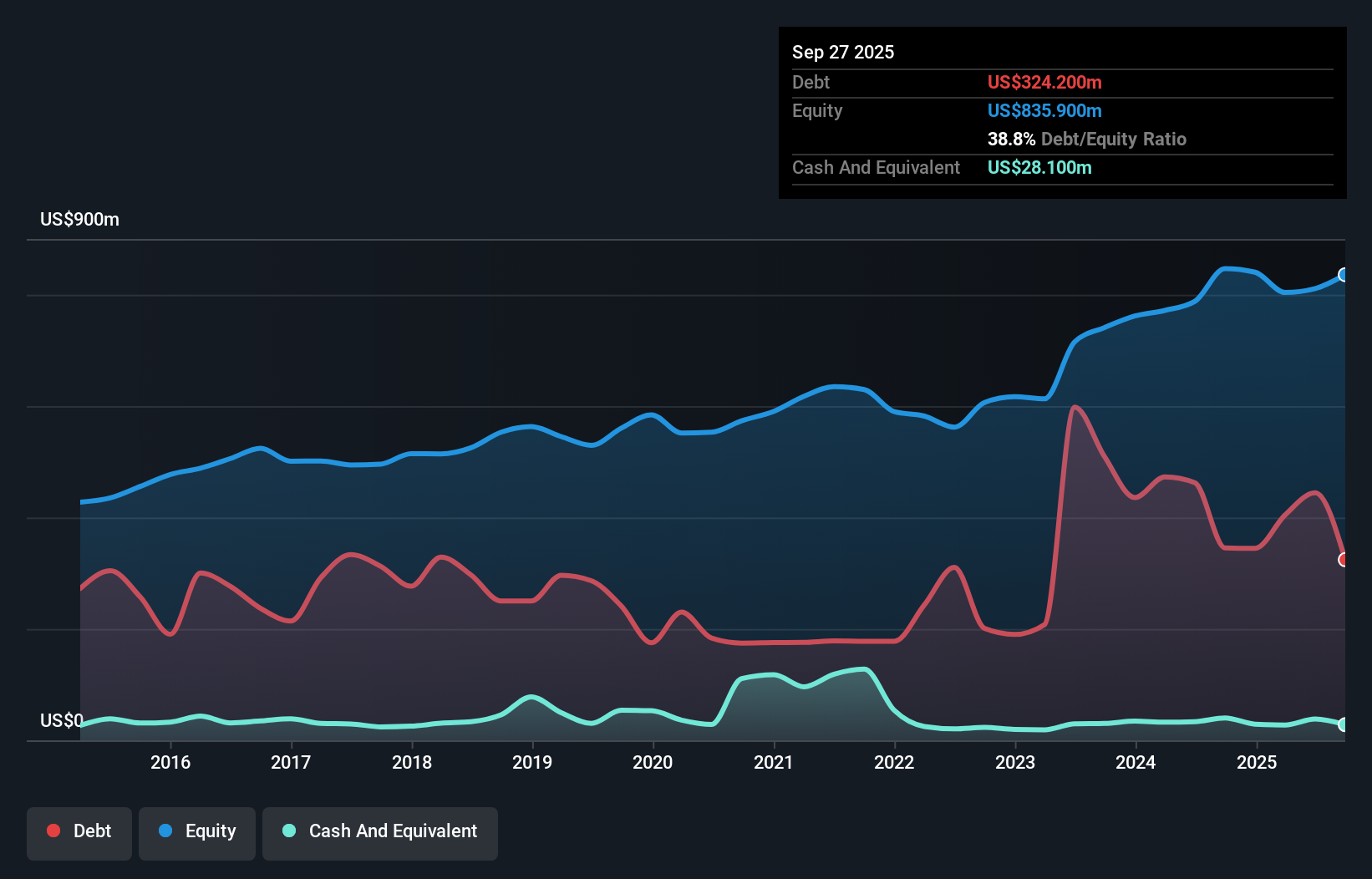

HNI, a smaller player in the commercial services sector, has shown robust growth with earnings climbing 14.5% over the past year, outpacing industry averages. The company recently completed a significant acquisition of Steelcase Inc., expanding its board to include new directors like Timothy C.E. Brown and Linda K. Williams, enhancing governance expertise. HNI's debt strategy includes a term loan B facility of $500 million to finance this merger while maintaining a satisfactory net debt to equity ratio of 35.4%. Trading at nearly 70% below estimated fair value suggests potential upside for investors eyeing undervalued opportunities in this space.

Next Steps

- Delve into our full catalog of 297 US Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报