A Look At Procter & Gamble (PG) Valuation As First Earnings Under New CEO Approach

Procter & Gamble (PG) is heading into its January 22 earnings report under new CEO Shailesh Jejurikar, and the stock’s recent pullback has many investors reassessing expectations for demand, pricing power, and costs.

See our latest analysis for Procter & Gamble.

The recent 90 day share price return decline of 7.15% and 1 year total shareholder return decline of 10.97% suggest momentum has been fading, as investors weigh higher rates, legal headlines, and the upcoming earnings update under new leadership.

If this has you reassessing your consumer staples exposure, it could also be a good moment to look across other healthcare stocks for different defensively tilted ideas.

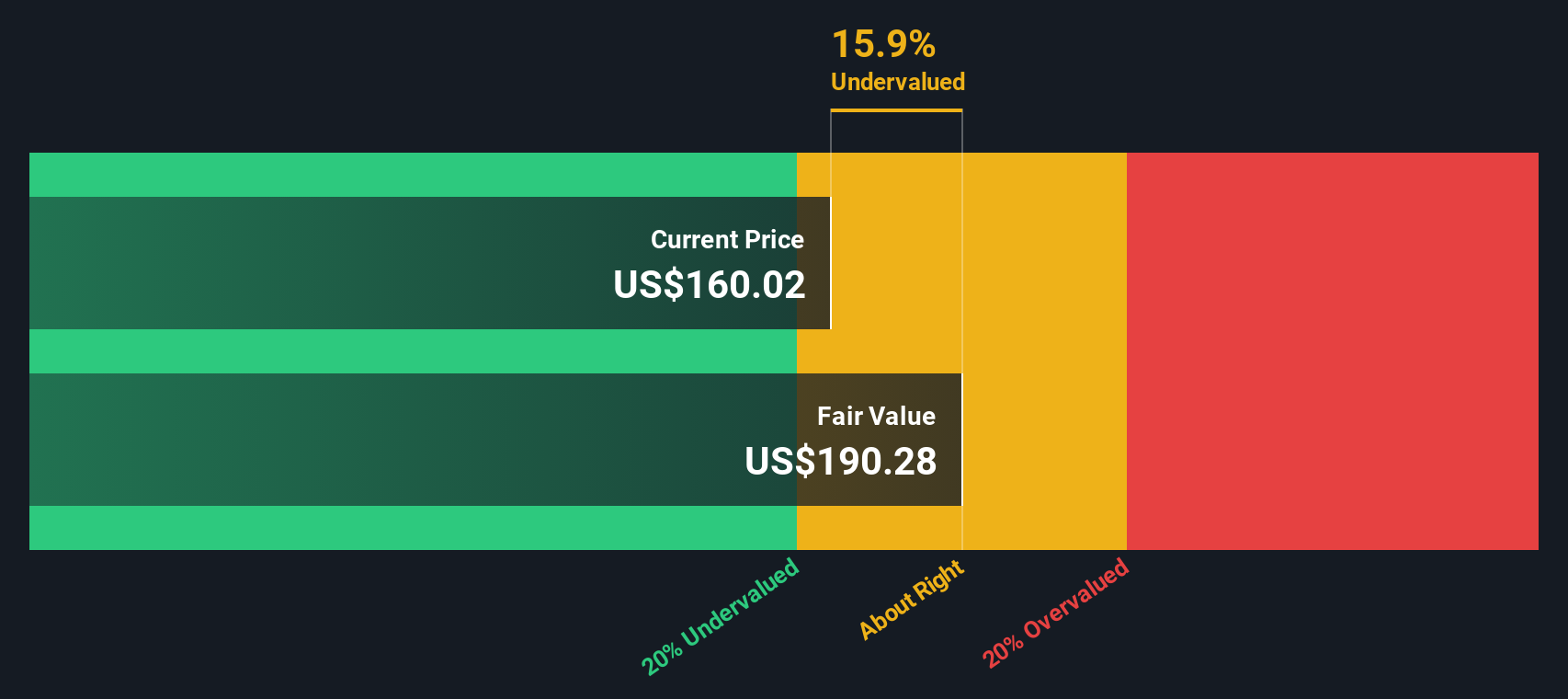

With PG trading at $139.91 and flagged as having an intrinsic discount of about 28%, the key question is whether that gap reflects excessive caution or a fair reset. Is this a chance to buy, or is future growth already priced in?

Most Popular Narrative: 17% Overvalued

According to andre_santos, the narrative fair value of Procter & Gamble at $119.81 sits well below the last close at $139.91, which sets up a clear valuation gap for investors to consider.

To assess P&G’s intrinsic value, four valuation methods are used, with different weightings to reflect relevance and reliability:

• Discounted Cash Flow (DCF). Intrinsic value is estimated by projecting Procter & Gamble''s free cash flows over the next 10 years and discounting them to present value.

Curious how steady revenue growth, firm margins and long term dividend assumptions combine into that $119.81 figure? The key is how the narrative blends four different models under an 8.42% discount rate and slow growth outlook. The full breakdown spells out which cash flow path, payout profile and terminal expectations really drive that gap to today’s price.

Result: Fair Value of $119.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could be challenged if PG’s 10.97% 1 year total return slide signals deeper brand or pricing pressure, or if input costs further squeeze its 17% profit margin.

Find out about the key risks to this Procter & Gamble narrative.

Another View: SWS DCF Flags Undervaluation

Andre_santos’ work points to a fair value of $119.81 and an overvaluation call, but our DCF model lands in a very different place, with fair value at $194.19 and PG trading about 28% below that mark. Two serious valuation frameworks, two very different conclusions. Which side of that gap do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Procter & Gamble for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Procter & Gamble Narrative

If you are not fully convinced by either side of this valuation debate, you can test the numbers yourself and shape a version that fits your view, then Do it your way in under three minutes.

A great starting point for your Procter & Gamble research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If PG has you thinking harder about price versus potential, do not stop here. Broaden your watchlist with a few focused stock ideas ready to research.

- Target dependable income by scanning these 11 dividend stocks with yields > 3% that offer yields above 3% and may suit a more defensive, cash flow focused approach.

- Chase growth potential by reviewing these 25 AI penny stocks tied to artificial intelligence themes that could reshape how companies operate and compete.

- Hunt for value by checking these 875 undervalued stocks based on cash flows where prices sit below estimates based on cash flows and might appeal if you prefer fundamentals to headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报