Assessing Vistra (VST) Valuation After Mixed Short Term Moves And Strong Multi Year Returns

Vistra (VST) has been drawing attention after recent share price moves, with the stock closing at $169.53. With mixed short term returns and strong multi year performance figures, investors may be reassessing the utility operator.

See our latest analysis for Vistra.

That latest move to $169.53 follows a mixed pattern, with a 4.05% 1 day share price return and a 17.92% 90 day share price decline. At the same time, a very large 5 year total shareholder return that is more than 7x the starting level suggests longer term momentum has been powerful even as shorter term sentiment cools.

If Vistra’s swings have caught your eye, it could be a good moment to broaden your watchlist and scan fast growing stocks with high insider ownership for other fast moving ideas with committed insiders.

With Vistra showing growth in revenue and net income, plus external estimates sitting above the current US$169.53 share price, the question is whether you are looking at an undervalued utility or a stock where the market already prices in future growth.

Most Popular Narrative Narrative: 27.3% Undervalued

Compared with Vistra’s last close at US$169.53, the most followed narrative points to a higher fair value anchored on rising power demand and profitability.

Structural increases in electricity demand driven by AI, data centers, and U.S. manufacturing are expected to significantly boost the utilization of Vistra's generation assets, supporting sustained revenue and potential margin expansion as higher fixed cost absorption improves profitability. Progress on large-scale, multi-decade contracts, such as potential colocation and long-term supply agreements with hyperscalers and data centers, provides a forward pipeline for stable, premium cash flows that are likely to support strong, visible earnings growth.

Curious what earnings power is being penciled in to justify that higher fair value, and how profit margins and future P/E assumptions tie together? The narrative breaks those expectations into a step by step earnings path, with specific revenue growth, margin expansion and valuation multiples that are usually reserved for faster growing sectors. Want to see which of those numbers you agree with and which feel stretched? The full narrative lays out every assumption behind that gap to fair value.

Result: Fair Value of $233.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story can be pressured if data center power demand or contract timing falls short of expectations, or if large projects and acquisitions run into costly delays.

Find out about the key risks to this Vistra narrative.

Another View: Price Tag Looks Full

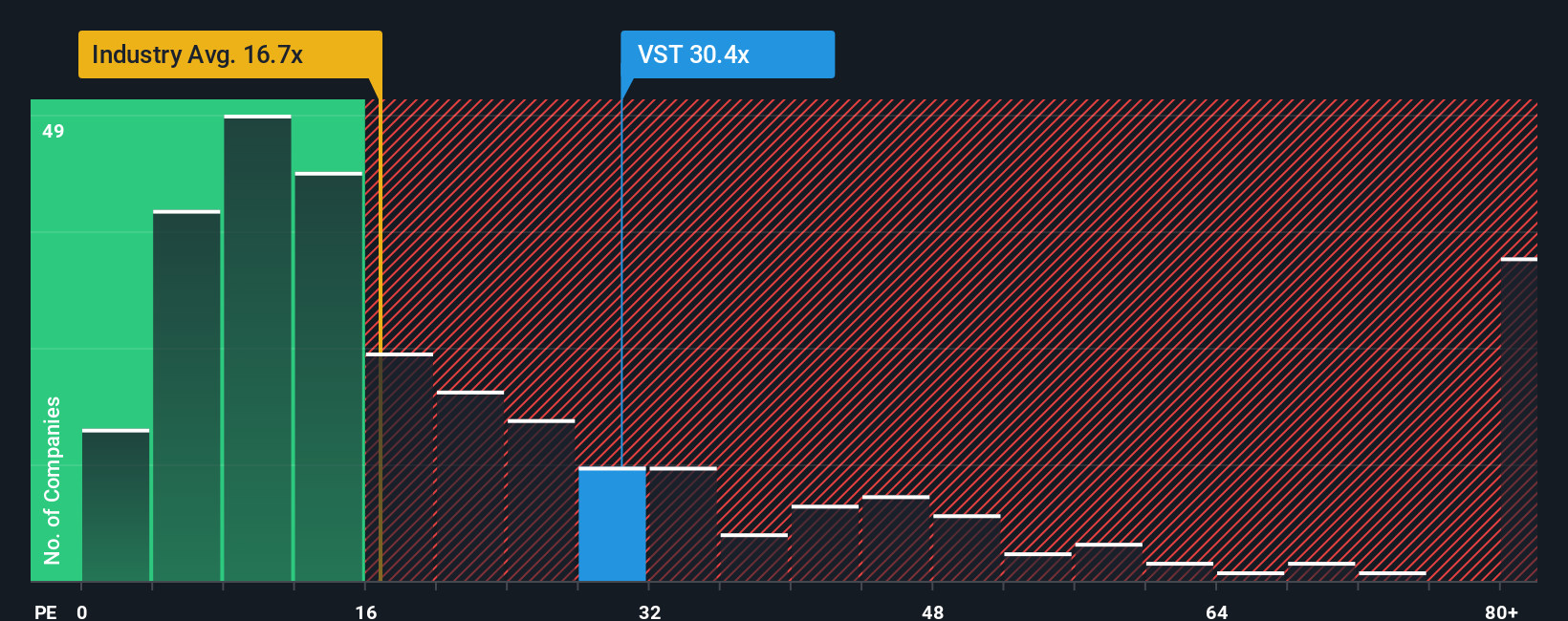

While the narrative points to Vistra trading below fair value on long term earnings power, the current 59.8x P/E is well above the peer average of 31.1x and a fair ratio of 42.2x. That gap points to meaningful valuation risk if expectations reset, so which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vistra Narrative

If you read these views and feel the story looks different to you, the data is available for you to test your own thesis in minutes. You can begin with Do it your way.

A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Vistra has sharpened your focus, do not stop here. Broaden your search now so you are not relying on a single story.

- Spot potential value early by scanning these 3552 penny stocks with strong financials where smaller companies can offer exposure that is very different to large utilities.

- Target the intersection of growth themes and technology by checking out these 25 AI penny stocks that link AI narratives with listed businesses.

- Hunt for price tags that may sit below intrinsic worth using these 874 undervalued stocks based on cash flows to surface ideas grounded in cash flow based metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报