Assessing Hasbro (HAS) Valuation After Strong 1 Year Returns And Digital Growth Narrative

Hasbro (HAS) has drawn fresh attention after recent share price moves, with the stock up 7.6% over the past month and 15.4% in the past 3 months. This has prompted investors to reassess its profile.

See our latest analysis for Hasbro.

Beyond the recent gains, Hasbro’s share price return over the past year has been supported by a 58.9% 1-year total shareholder return, which also reflects dividends and reinvestment effects. Overall, short term share price momentum appears to be building on stronger long term total shareholder returns.

If you are reassessing Hasbro after its recent move, it can also be useful to see how other consumer names are shaping up, starting with fast growing stocks with high insider ownership.

So with Hasbro trading at $87.24, a 41.6% discount to one estimate of intrinsic value and only a 6% discount to the average analyst target, should you see an undervalued opportunity here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 5.6% Undervalued

With Hasbro trading at US$87.24 against a narrative fair value of US$92.46, the current price sits slightly below that framework’s estimate.

Rapidly growing cross-platform digital gaming and licensing revenue, exemplified by Wizards of the Coast (notably Magic: The Gathering's 23%+ YoY growth and MONOPOLY GO!), is expanding Hasbro's addressable market and recurring high-margin earnings streams, positioning the company to capitalize on the global rise of digital entertainment, which should drive outsized revenue and operating profit growth.

Want to see what is baked into that value gap? The narrative leans heavily on future earnings, richer margins, and a punchy profit multiple. Curious which assumptions really move the needle here?

Result: Fair Value of $92.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on key risks, including any wobble in core franchises like Magic: The Gathering or setbacks in the digital pivot that challenge those margin and earnings assumptions.

Find out about the key risks to this Hasbro narrative.

Another View: Sales Multiple Flags a Richer Price

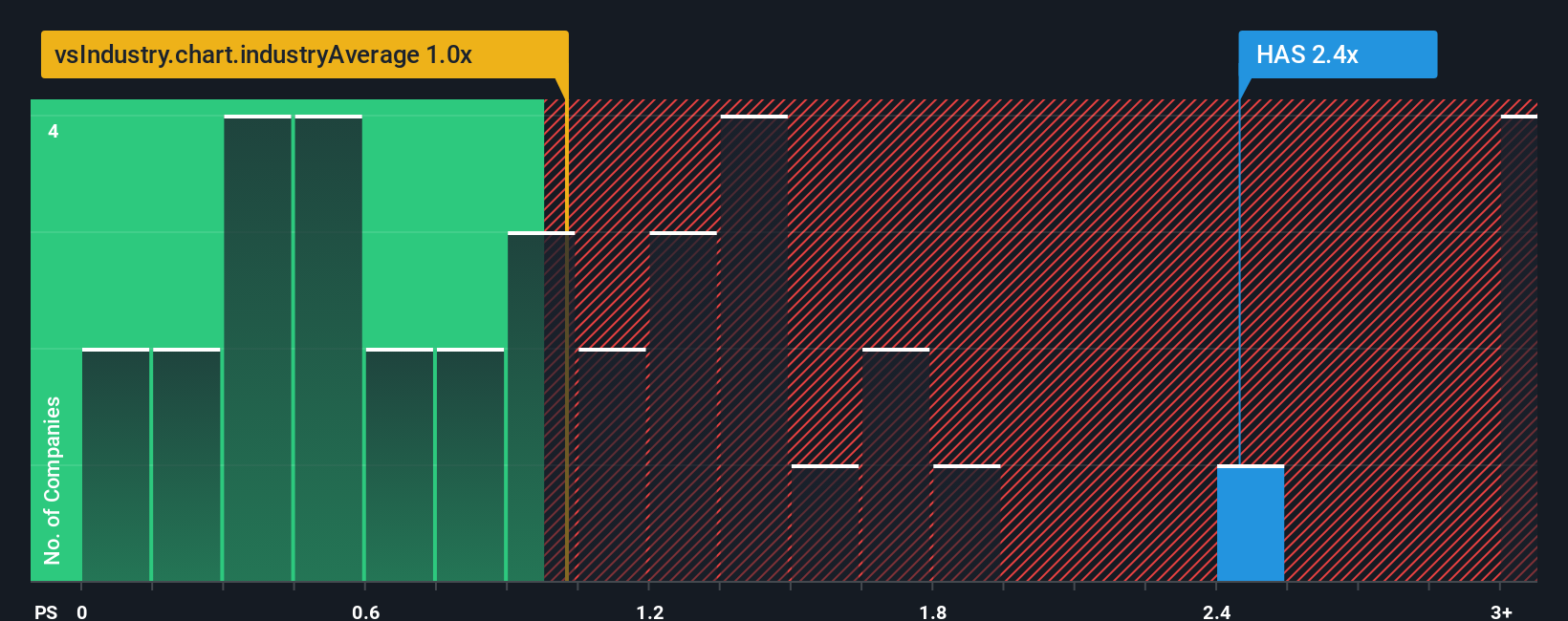

The narrative fair value points to Hasbro as modestly undervalued, but its sales based valuation tells a different story. At a P/S of 2.8x, the shares trade well above the US Leisure industry at 1x, the peer group at 1.2x, and the fair ratio of 2.2x that the market could move toward.

This gap suggests investors today are already paying a premium for each dollar of sales, which could limit upside if sentiment cools or growth assumptions are questioned. The key question is whether you think Hasbro’s future earnings path truly justifies that richer pricing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hasbro Narrative

If you see the numbers differently, or just prefer to test your own assumptions against the data, you can build a tailored Hasbro story in minutes with Do it your way.

A great starting point for your Hasbro research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss opportunities that fit your style even better, so give yourself options and see what else stands out.

- Spot potential value candidates early by scanning these 877 undervalued stocks based on cash flows that might line up with your return and risk expectations.

- Zero in on income ideas by reviewing these 11 dividend stocks with yields > 3% that could complement a portfolio focused on regular cash flows.

- Tap into high growth themes by checking out these 25 AI penny stocks that connect new technology trends with listed companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报