Assessing Pegasystems (PEGA) Valuation After Rate‑Sensitive Pullback And Planned Insider Share Sale

Market move and what triggered it

Pegasystems (PEGA) opened 2026 on a softer footing after a 6.1% drop to $56.06, as investors reacted to pressure on rate sensitive software names and a filing showing an officer may sell up to 4,000 shares.

See our latest analysis for Pegasystems.

That early 2026 wobble comes after a mixed stretch, with a 7.12% year to date share price return and a 28.09% total shareholder return over 1 year. The 3 year total shareholder return of about 3.6x hints at shifting sentiment around growth potential and risk.

If you are weighing how PEGA fits into your portfolio, this can be a good moment to scan other software names and compare them with high growth tech and AI stocks as potential ideas on your radar.

With Pegasystems trading at $60.05 and flagged as having an intrinsic discount of about 31% plus a discount of roughly 23% to analyst targets, you have to ask: is this a genuine opening, or is future growth already in the price?

Most Popular Narrative: 18.8% Undervalued

With Pegasystems last closing at $60.05 against a narrative fair value near $73.91, valuation hinges on cloud momentum, AI workflow adoption and earnings quality.

The analysts have a consensus price target of $62.682 for Pegasystems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $78.0, and the most bearish reporting a price target of just $40.19.

Curious what kind of steady revenue build, margin profile and future earnings multiple are baked into that fair value? The assumptions behind it are anything but modest.

Result: Fair Value of $73.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it is worth remembering that currency swings and any slowdown in cloud migration or Blueprint adoption could quickly challenge the current, growth-heavy narrative.

Find out about the key risks to this Pegasystems narrative.

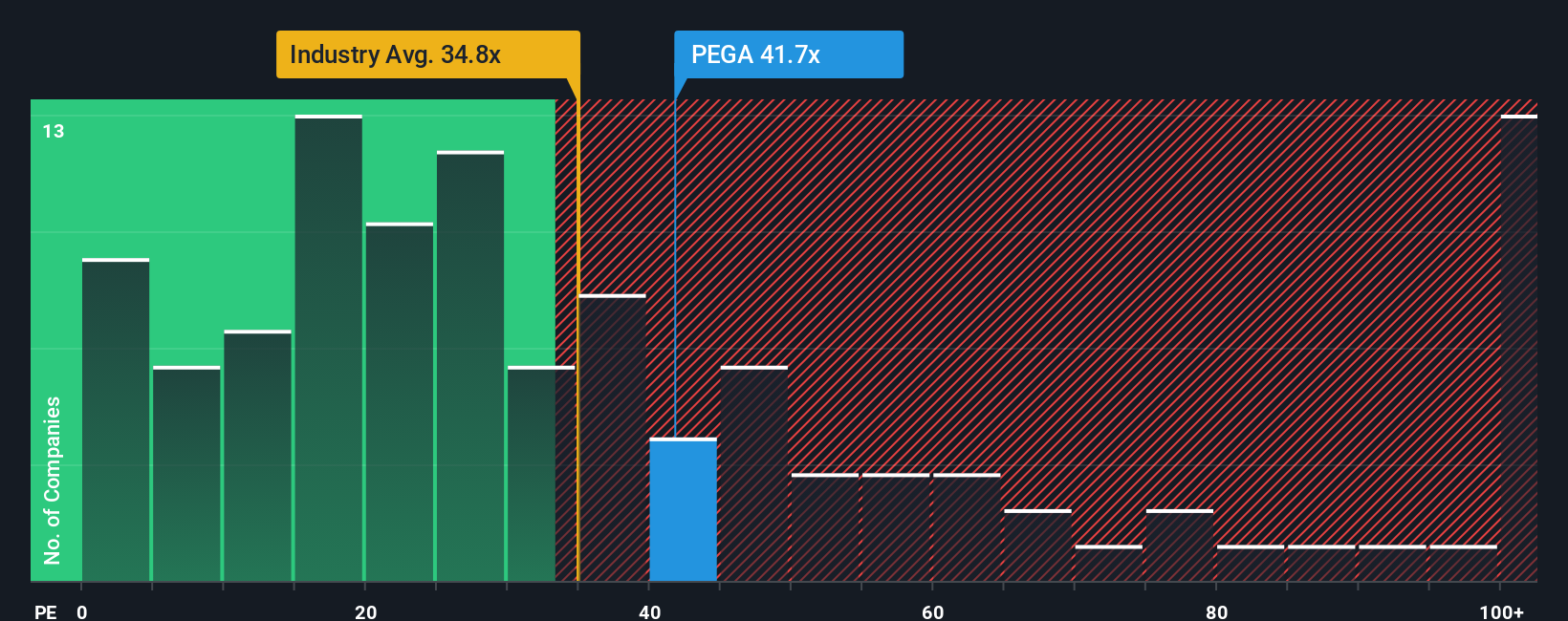

Another View: What The Market Multiple Is Saying

Our DCF work points to Pegasystems trading about 31% below an estimated fair value of $87.05, which lines up with the 18.8% discount to the narrative fair value of $73.91. Yet the current P/E of 36.7x sits above the US Software average of 32.3x and the fair ratio of 29.3x, so you are paying a richer price today than what that fair ratio suggests the market could move toward, even if it still looks reasonable against peers at 38.1x. Is that a risk you are comfortable with, or does it simply reflect how much the market already pays for Pega’s quality and growth profile?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pegasystems Narrative

If you see the data differently or want to stress test these assumptions yourself, you can create your own Pegasystems narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Pegasystems.

Looking for more investment ideas?

If Pegasystems has caught your eye, do not stop there, some of the most interesting opportunities often sit in places you have not checked yet.

- Scan for potential high-upside names by checking out these 3553 penny stocks with strong financials that pair tiny share prices with solid financial underpinnings.

- Target the next wave of automation by reviewing these 25 AI penny stocks that are plugged into key themes in artificial intelligence.

- Zero in on value by sorting through these 877 undervalued stocks based on cash flows that currently trade below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报