PBF Energy (PBF) Valuation After Martinez Rebuild Extension And Venezuelan Crude Supply Uncertainty

PBF Energy (PBF) is back in focus after extending the rebuild timeline for its fire damaged Martinez refinery into February 2026, while fresh turmoil in Venezuela raises questions around crude supply and PBF’s import exposure.

See our latest analysis for PBF Energy.

The Martinez rebuild delay and Venezuelan supply uncertainty come against a choppy backdrop for PBF’s stock, with a 30 day share price return of 18.47% and a 90 day share price return of 8.56% pointing to fading short term momentum, even as the 1 year total shareholder return of 5.91% contrasts with a very large 5 year total shareholder return multiple of roughly 3x.

If refinery headlines have you rethinking where the next opportunities might be, it could be a good time to scan aerospace and defense stocks for ideas beyond the energy sector.

With PBF Energy shares recently around US$27.23 and trading at a discount to average analyst targets, yet carrying a loss of US$526.3 million, investors may be asking whether this represents a reset entry point or whether the market is already factoring in any potential recovery.

Most Popular Narrative Narrative: 11% Undervalued

With the most followed narrative putting fair value for PBF Energy at about US$30.58 against a last close of US$27.23, the gap hinges on a specific earnings and margin recovery story.

Company wide cost reduction and business improvement initiatives (RBI) are on track to deliver $230 million of annualized savings by end 2025 and $350 million by end 2026, mainly through lower OpEx and CapEx. These are expected to sustainably improve net margins and free cash flow over the next several years.

Want to see what kind of revenue path and margin rebuild need to line up for that fair value to hold? The narrative leans on a sharp earnings swing, rising profitability, and a future earnings multiple very different from today. Curious how those moving parts fit together and what assumptions drive the model’s cash flow path?

Result: Fair Value of $30.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the Martinez restart timing and the company’s loss of US$526.3 million are key pressure points that could disrupt that recovery path.

Find out about the key risks to this PBF Energy narrative.

Another View: What The DCF Model Says

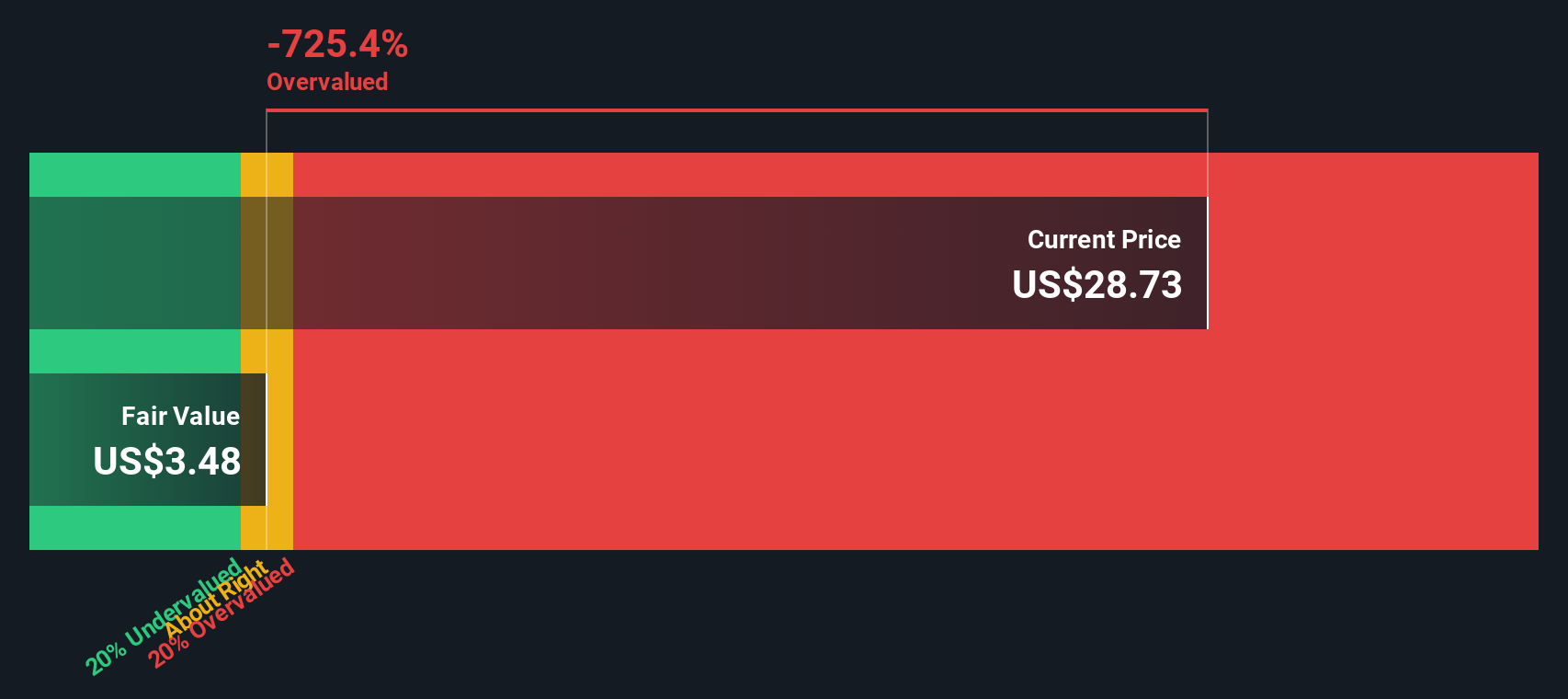

While the popular narrative points to an 11% gap to fair value at about US$30.58, the Simply Wall St DCF model points the other way, with an estimated fair value of roughly US$2.51 and PBF shares at US$27.23. That is a sharp mismatch. Which story do you trust more: the cash flows or the multiple driven narrative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PBF Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PBF Energy Narrative

If you look at these numbers and reach a different conclusion, or simply want to test your own assumptions, you can build a personalized PBF Energy view in just a few minutes and Do it your way

A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If you stop with just one stock, you risk missing other opportunities that may suit your goals better, so widen your search with a few focused screens.

- Spot potential value candidates early by scanning these 877 undervalued stocks based on cash flows that may offer prices below what their cash flows suggest.

- Tap into the intersection of medicine and algorithms by checking out these 29 healthcare AI stocks shaping the future of patient care and diagnostics.

- Lean into high income potential by reviewing these 11 dividend stocks with yields > 3% that offer yields above 3% and could help strengthen your portfolio’s cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报