Snowflake (SNOW) Is Up 5.6% After Deepening Google Cloud AI Tie-Up - What's Changed

- Snowflake Inc. recently announced it has expanded its collaboration with Google Cloud, integrating Google’s Gemini 3 models directly into Snowflake Cortex AI so enterprises can build and run generative AI applications on governed data without moving it across platforms.

- The partnership also extends Snowflake’s availability on Google Cloud into new regions, enhances co-selling and marketplace routes, and introduces Gen2 Warehouses on Axion-based C4A machines, which management describes as bringing meaningful price-performance improvements for enterprise workloads.

- We’ll now examine how embedding Google’s Gemini models natively in Snowflake’s AI Data Cloud could influence the company’s long-term investment narrative.

We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Snowflake Investment Narrative Recap

To own Snowflake, you need to believe its AI Data Cloud can stay central to how enterprises store, analyze, and activate data, even as competition and technology shift quickly. The Google Cloud expansion reinforces Snowflake’s AI story and may support its near term growth catalyst around AI driven workloads, but it does not materially change the key risk that AI and hyperscaler offerings could still disrupt or compress its core data platform economics.

Among recent announcements, the multi year partnership with Anthropic to bring Claude models into Snowflake sits closest to this new Gemini integration. Together, these moves highlight Snowflake’s push to be an AI model neutral platform, which could help deepen usage of Cortex AI and related products if customers increasingly want choice across leading models while keeping governance, security, and analytics in one place.

Yet behind the AI partnerships, investors should be aware that growing competition and unproven monetization of new AI products could still...

Read the full narrative on Snowflake (it's free!)

Snowflake's narrative projects $7.8 billion revenue and $497.5 million earnings by 2028. This requires 23.8% yearly revenue growth and about a $1.9 billion earnings increase from -$1.4 billion today.

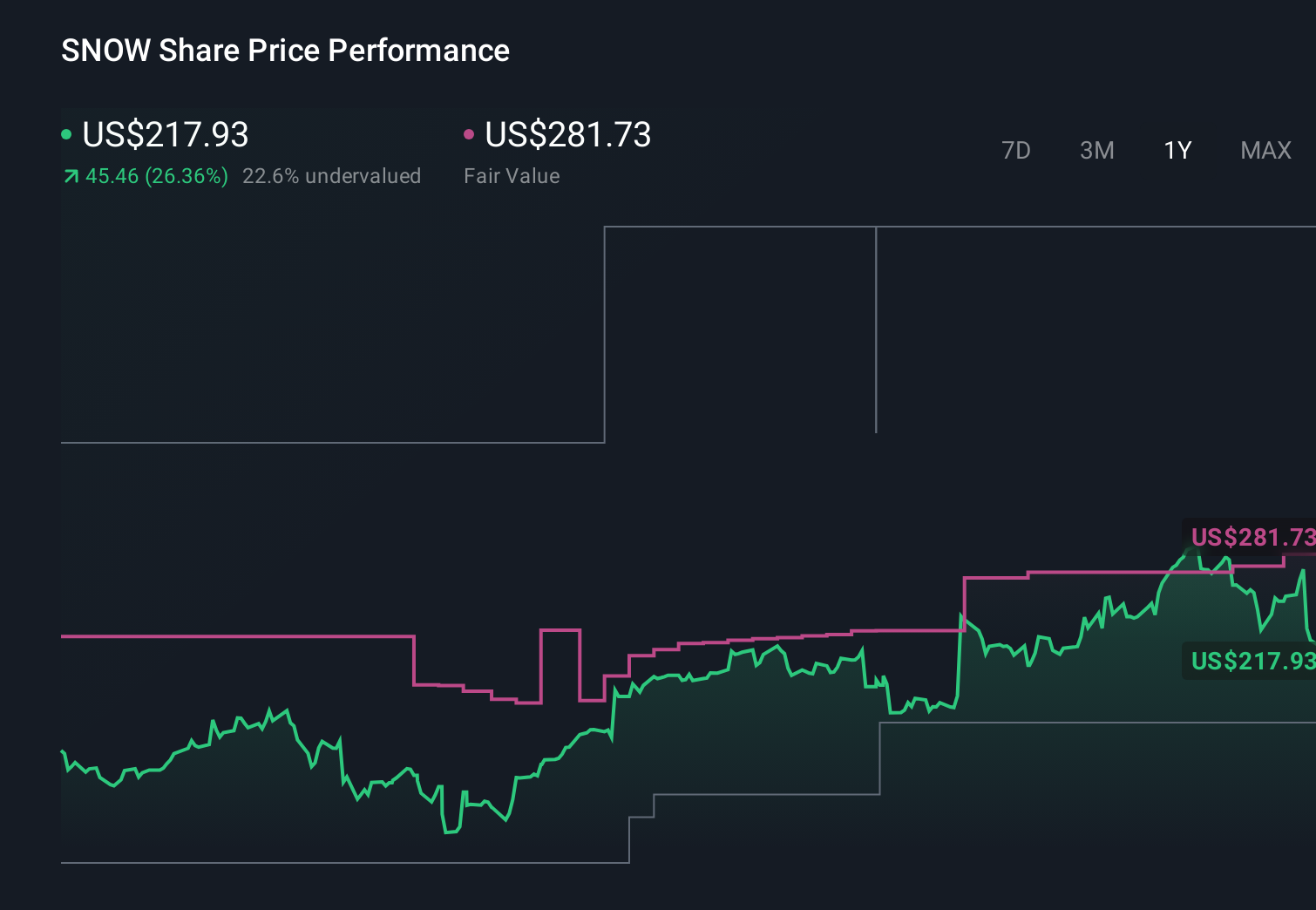

Uncover how Snowflake's forecasts yield a $281.73 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Thirteen members of the Simply Wall St Community value Snowflake between US$114.20 and US$281.73, underscoring how far opinions can stretch. As you weigh those views against Snowflake’s increasing AI focus and deepening hyperscaler competition, it is worth exploring several alternative scenarios for how its data and AI strategy might affect future performance.

Explore 13 other fair value estimates on Snowflake - why the stock might be worth less than half the current price!

Build Your Own Snowflake Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Snowflake research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Snowflake's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报