Does Wheaton Precious Metals' (TSX:WPM) New Hemlo Stream Clarify Its Capital-Light Cash Flow Playbook?

- Wheaton Precious Metals recently completed a US$300 million gold stream agreement with Hemlo Mining Corp tied to the Hemlo Mine acquired from Barrick Mining Corporation and issued 12,093 new shares through its dividend reinvestment plan and employee options, which have been admitted to trading on the London Stock Exchange.

- This latest stream adds another producing asset to Wheaton’s portfolio of 23 operating mines, reinforcing its capital-light model of converting long-term purchase rights into cash flow used for new streams and a progressive dividend policy.

- With this new Hemlo gold stream in place, we’ll now examine how it influences Wheaton’s investment narrative built around expanding streaming agreements.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Wheaton Precious Metals Investment Narrative Recap

To own Wheaton Precious Metals, you need to believe in the resilience of its streaming model and its ability to keep sourcing accretive deals, even as competition for high quality assets intensifies. The new US$300 million Hemlo gold stream fits neatly into this thesis by adding another producing mine, but it does not materially change the near term picture, where securing attractive future streams and managing tax and jurisdictional pressures remain the key catalyst and risk.

The admission of 12,093 new shares from the dividend reinvestment plan and employee options, bringing total voting rights to 454,033,830, ties directly back to Wheaton’s focus on using a capital light structure to fund new streams and a progressive dividend. For investors following the Hemlo transaction, this small issuance looks more like ongoing housekeeping in support of that model than a factor that shifts the catalyst profile around future deal flow.

Yet while new streams like Hemlo can support Wheaton’s business model, investors should be aware that intensifying competition for streaming deals could...

Read the full narrative on Wheaton Precious Metals (it's free!)

Wheaton Precious Metals' narrative projects $2.2 billion revenue and $1.1 billion earnings by 2028. This requires 9.2% yearly revenue growth and an earnings increase of about $0.3 billion from $789.0 million today.

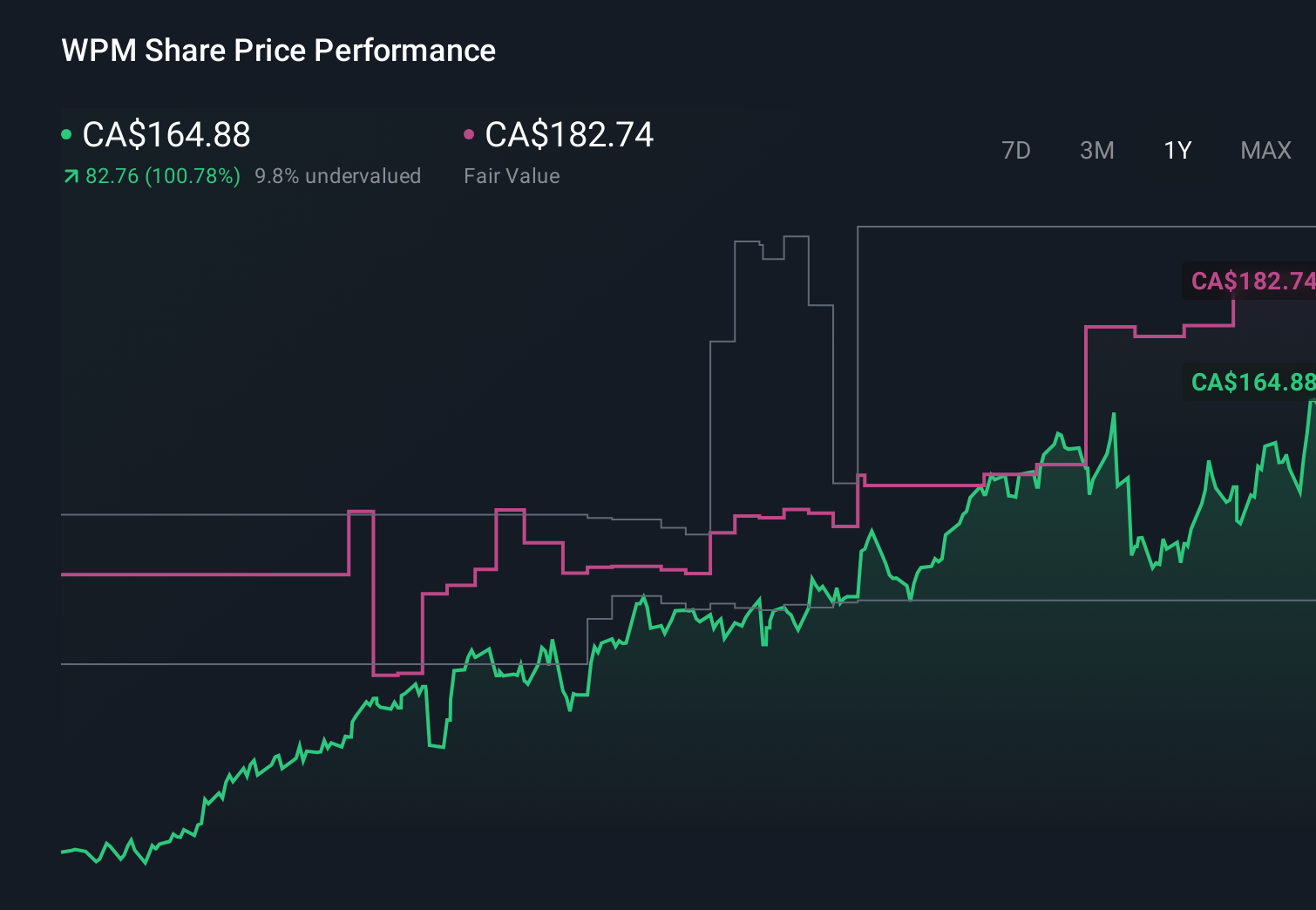

Uncover how Wheaton Precious Metals' forecasts yield a CA$190.41 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently estimate Wheaton’s fair value between US$111.58 and US$190.41, underscoring how far opinions can differ. Set this against the risk that global minimum tax changes could compress future free cash flow, and you can see why it pays to weigh several viewpoints before forming your own stance.

Explore 7 other fair value estimates on Wheaton Precious Metals - why the stock might be worth as much as 10% more than the current price!

Build Your Own Wheaton Precious Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wheaton Precious Metals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Wheaton Precious Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wheaton Precious Metals' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报