Did GM's (GM) 2025 Sales Gain Amid Slower EV Push Just Shift Its Investment Narrative?

- General Motors recently reported that it retained its position as the top U.S. automaker in 2025, growing full-year sales to 2.85 million vehicles and increasing market share, even as it slowed EV production, managed large recalls and warranty costs, and temporarily laid off workers at plants like Factory Zero and Flint Assembly.

- These developments highlight a company leaning on strong demand for core models such as Silverado, Cadillac and Corvette while recalibrating its EV rollout, quality controls and global leadership structure to align operations with changing consumer demand and regulatory conditions.

- We’ll now examine how GM’s ability to grow U.S. sales while trimming near-term EV output shapes and stresses its existing investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

General Motors Investment Narrative Recap

To own GM today, you need to believe the company can use its U.S. sales leadership and stronger core truck and SUV demand to fund a measured transition toward EVs and software, without letting quality issues or capital needs erode returns. The latest recalls and higher warranty charges directly reinforce that quality and cost control are the key near term risk, while GM’s ability to keep volumes and pricing resilient in its core models remains the central catalyst. Overall, these developments are material for how investors think about GM’s margin profile, but less so for its basic competitive position in the U.S. market right now.

Among the recent announcements, the sharp rise in 2025 warranty costs, including the roughly US$1.1 billion second quarter impact tied to recalls, lines up most clearly with the existing risk that higher warranty expenses could pressure margins and weaken customer loyalty. While GM is also investing in EV platforms, new software features and ongoing buybacks, the recall trend cuts directly across the bullish narrative that improved quality and digital diagnostics will steadily bring warranty costs down over time.

Yet beneath GM’s strong sales and product momentum, warranty related quality risks remain a key issue investors should be aware of as...

Read the full narrative on General Motors (it's free!)

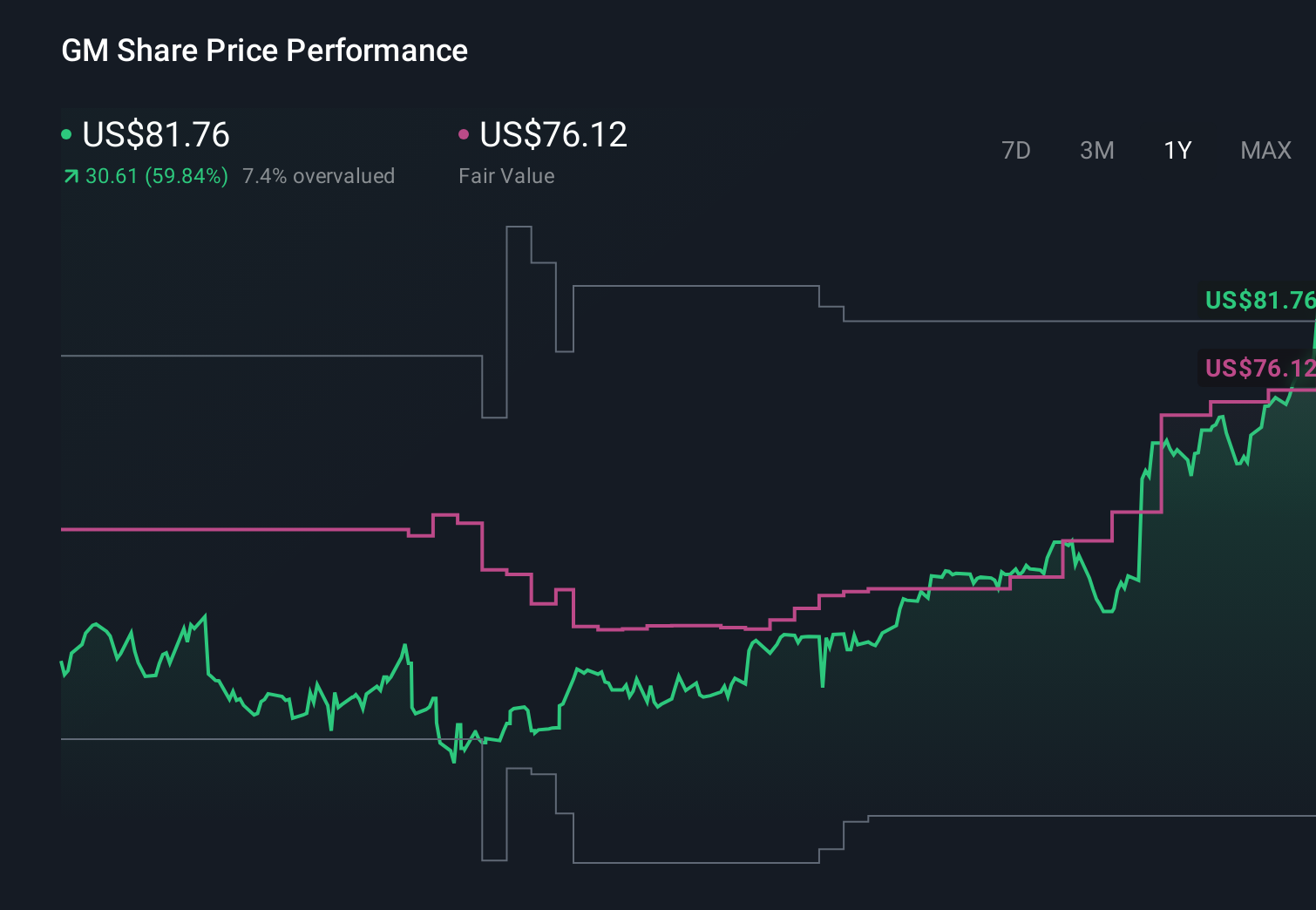

General Motors' narrative projects $185.3 billion revenue and $8.0 billion earnings by 2028. This implies a 0.4% yearly revenue decline and about a $1.5 billion earnings increase from $6.5 billion today.

Uncover how General Motors' forecasts yield a $79.46 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently see GM’s fair value anywhere between about US$41.79 and US$100, reflecting a very wide span of expectations. Set against this, ongoing recall driven warranty costs highlight how execution on quality could be a swing factor for GM’s future profitability, so it is worth weighing several of these alternative views before forming your own.

Explore 9 other fair value estimates on General Motors - why the stock might be worth as much as 22% more than the current price!

Build Your Own General Motors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General Motors research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free General Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General Motors' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报