Betolar Oyj And 2 Other European Penny Stocks Worth Watching

European markets have shown robust performance, with the pan-European STOXX Europe 600 Index reaching a new high and closing 2025 with its strongest annual return since 2021. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area. These stocks can offer surprising value when backed by strong financials, presenting opportunities for growth that larger firms might miss.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.418 | €1.53B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.79 | €85.06M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.31 | €226.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.20 | €67.88M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.14 | SEK191.03M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.65 | €410.99M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0726 | €7.89M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.796 | €26.66M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 287 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Betolar Oyj (HLSE:BETOLAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Betolar Oyj is a materials technology company that offers solutions for utilizing industrial sidestreams to create low-carbon, cement-free products for the mining, metals, and construction sectors across Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of €24.80 million.

Operations: The company's revenue is primarily derived from its Construction Materials segment, totaling €0.90 million.

Market Cap: €24.8M

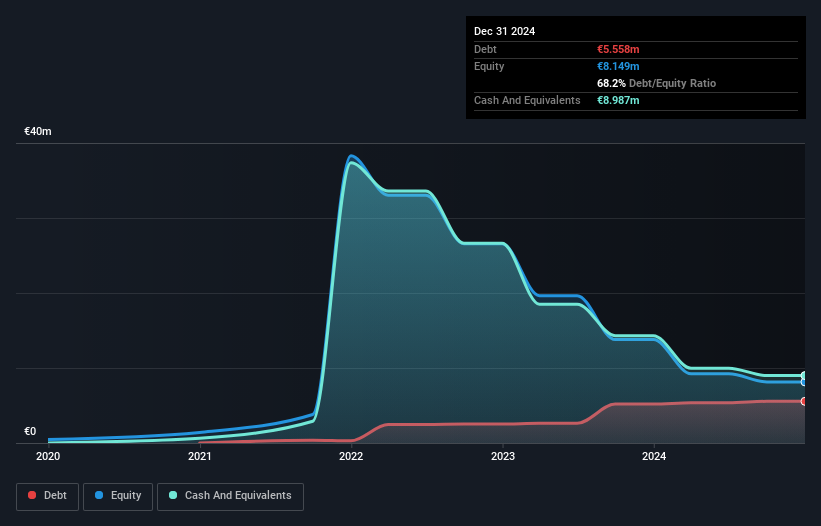

Betolar Oyj, a materials technology company, is currently pre-revenue with €0.90 million in sales from its Construction Materials segment. Despite reaffirming revenue growth guidance for 2025 and securing a €1.4 million order for an infrastructure project, Betolar remains unprofitable and is not expected to achieve profitability in the near term. The company's cash runway extends over one year, supported by short-term assets exceeding both short-term and long-term liabilities. Recent management changes include Amir Wafin's appointment as Executive Vice President of Circular Materials, reflecting strategic focus on low-carbon innovations amidst high share price volatility and increased debt levels.

- Jump into the full analysis health report here for a deeper understanding of Betolar Oyj.

- Gain insights into Betolar Oyj's future direction by reviewing our growth report.

Molecular Partners (SWX:MOLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Molecular Partners AG is a clinical-stage biotechnology company in Switzerland that designs and develops ankyrin repeat protein therapeutics for oncology treatment, with a market cap of CHF130.15 million.

Operations: There are no reported revenue segments for this clinical-stage biotechnology firm focused on developing ankyrin repeat protein therapeutics for oncology.

Market Cap: CHF130.15M

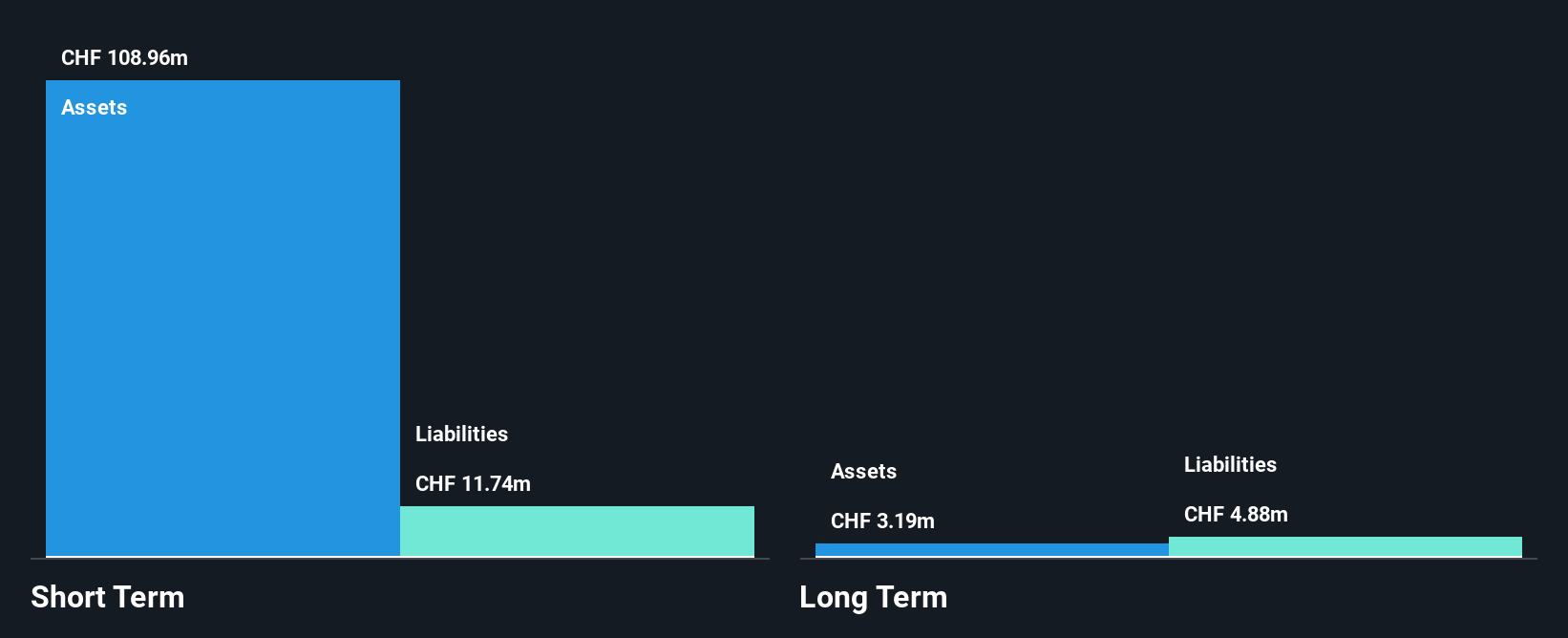

Molecular Partners AG, a clinical-stage biotech firm in Switzerland, remains pre-revenue but shows potential through its innovative ankyrin repeat protein therapeutics for oncology. Despite unprofitability and high share price volatility, the company maintains a strong financial position with no debt and sufficient cash runway to support operations for over two years. Recent developments include promising data from ongoing trials such as MP0533 for acute myeloid leukemia and MP0712 targeting DLL3 in small cell lung cancer. The formation of a Scientific Advisory Board with experts like Prof. Ken Herrmann aims to enhance strategic guidance on clinical advancements and platform expansion.

- Dive into the specifics of Molecular Partners here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Molecular Partners' future.

Mister Spex (XTRA:MRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mister Spex SE is a retailer of optical products operating in Germany and internationally, with a market cap of €45.63 million.

Operations: The company generates revenue primarily through its Online Retailers segment, which accounted for €186.22 million.

Market Cap: €45.63M

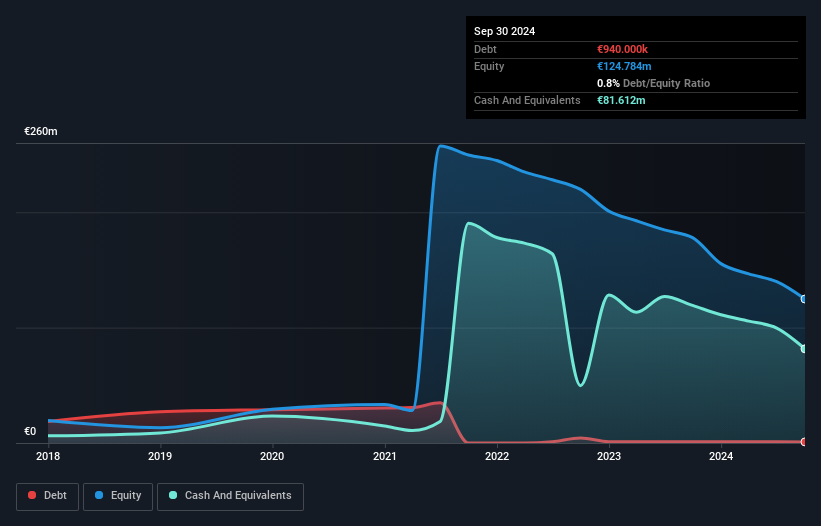

Mister Spex SE, a retailer of optical products, faces challenges with declining revenues and ongoing unprofitability. Recent financial results show a decrease in sales to €47.53 million for Q3 2025 from €58.41 million the previous year, alongside a reduced net loss of €4.97 million compared to €15.27 million last year. Despite these hurdles, the company benefits from strong short-term asset coverage over liabilities and has more cash than total debt, providing some financial stability. The recent appointment of Benjamin v. Schenck as CFO brings experienced leadership that could help navigate its strategic direction amidst market volatility.

- Get an in-depth perspective on Mister Spex's performance by reading our balance sheet health report here.

- Evaluate Mister Spex's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Jump into our full catalog of 287 European Penny Stocks here.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报