Undiscovered Gems in Europe to Watch This January 2026

As we enter January 2026, the European market is showing robust momentum, with the STOXX Europe 600 Index reaching new highs and closing out 2025 with an impressive annual price return. This positive economic backdrop provides a fertile ground for small-cap companies to thrive, making it an opportune moment to explore lesser-known stocks that could potentially benefit from these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Darwin | 3.03% | 50.55% | 46377.71% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

REVO Insurance (BIT:REVO)

Simply Wall St Value Rating: ★★★★☆☆

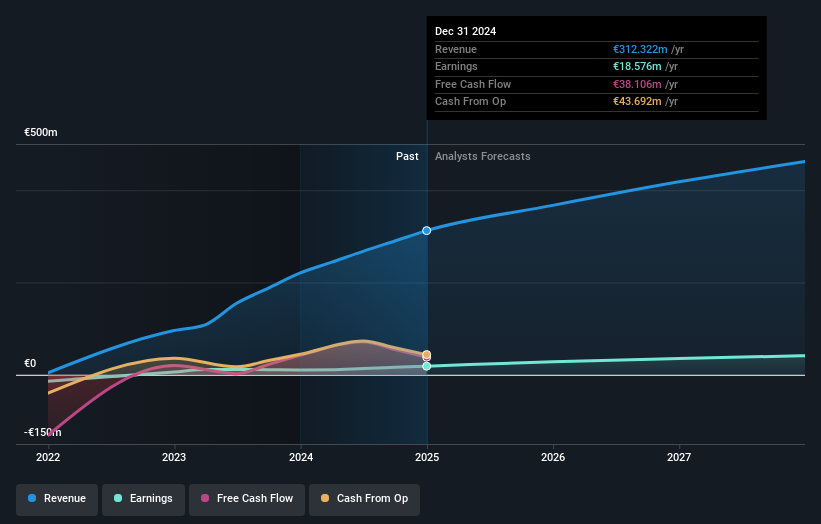

Overview: REVO Insurance S.p.A. operates as an insurance company in Italy with a market cap of €580.48 million.

Operations: REVO Insurance derives its revenue primarily from non-life operations, generating €373.32 million. The company's financial performance is influenced by the efficiency of its operations and management of expenses, impacting its profit margins.

REVO Insurance, a nimble player in the European market, has demonstrated impressive financial health with earnings growth of 50% over the past year, outpacing the insurance industry's 9.7%. The company remains debt-free, eliminating concerns over interest payments and showcasing robust financial management. Despite shareholder dilution last year, REVO's levered free cash flow turned positive at €42M by end-2023 and continued to grow to €71.73M mid-2024. With high-quality earnings and a forecasted annual growth of 21%, REVO seems poised for promising developments in its niche sector.

- Click to explore a detailed breakdown of our findings in REVO Insurance's health report.

Gain insights into REVO Insurance's past trends and performance with our Past report.

Bourse Direct (ENXTPA:BSD)

Simply Wall St Value Rating: ★★★★☆☆

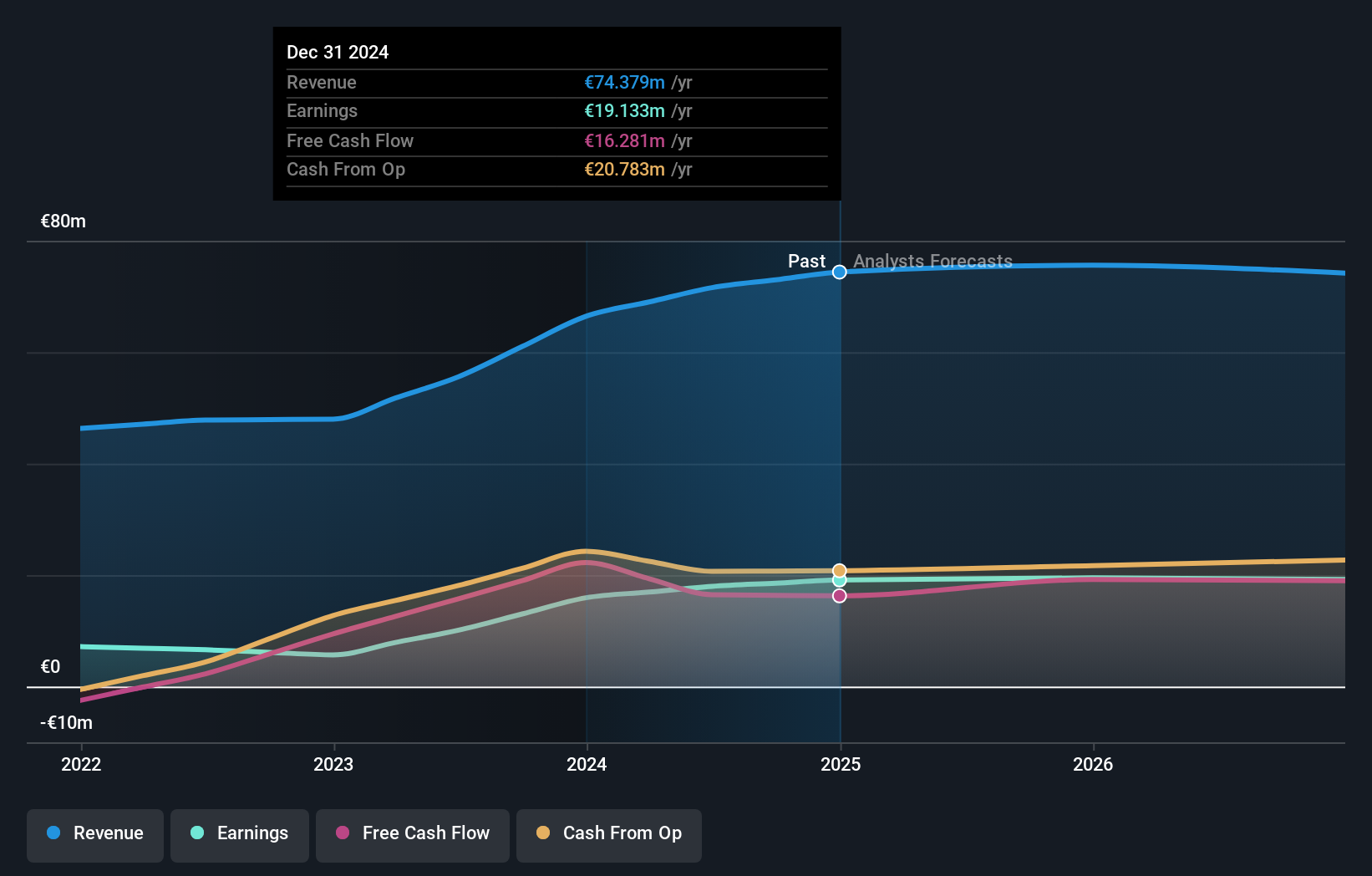

Overview: Bourse Direct SA is a French company specializing in Internet stock brokerage services with a market capitalization of €272.50 million.

Operations: Bourse Direct generates revenue primarily from its Stock Exchange Online services, contributing €61.19 million, and Financial Intermediation, adding €7.52 million.

Bourse Direct, a compact player in the financial sector, showcases a compelling profile with its price-to-earnings ratio at 14.9x, which is lower than the French market's 16.4x. Over the past five years, its earnings have impressively surged by 30% annually. The company's net debt to equity ratio stands at a satisfactory 27%, reflecting prudent financial management as it has decreased from 181% to 65% in recent years. Although its earnings growth of 1.9% last year lagged behind the industry average of 8.7%, Bourse Direct remains profitable with positive free cash flow and promising future growth projections of around 2%.

- Dive into the specifics of Bourse Direct here with our thorough health report.

Examine Bourse Direct's past performance report to understand how it has performed in the past.

Steyr Motors (XTRA:4X0)

Simply Wall St Value Rating: ★★★★★☆

Overview: Steyr Motors AG specializes in the manufacturing and sale of diesel engines for commercial and military vehicles globally, with a market capitalization of €228.28 million.

Operations: The company's revenue is primarily derived from two segments: Civil (€17.96 million) and Defense (€27.08 million).

Steyr Motors, a niche player in maritime propulsion systems, has recently expanded its international footprint with new distribution agreements worth €5 million. Despite being dropped from the S&P Global BMI Index, it achieved profitability last year and is trading at 32.6% below its estimated fair value. The company's net debt to equity ratio stands at a satisfactory 2.6%, while interest coverage by EBIT is robust at 20.1 times. With earnings forecasted to grow significantly by 66% annually, Steyr Motors seems poised for future growth amidst rising demand in defense sectors and strategic partnerships in Greece and the UK.

- Navigate through the intricacies of Steyr Motors with our comprehensive health report here.

Review our historical performance report to gain insights into Steyr Motors''s past performance.

Summing It All Up

- Click here to access our complete index of 299 European Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报