Assessing Sterling Infrastructure (STRL) Valuation After Data Center Surge And CEC Acquisition

Sterling Infrastructure (STRL) is back in focus after its E-Infrastructure Solutions segment reported 125% year-over-year data center revenue growth in Q3 2025 and closed the CEC acquisition, which expanded its electrical capabilities.

See our latest analysis for Sterling Infrastructure.

Those data center gains and the CEC deal come as the share price has eased in the short term, with a 90 day share price return showing a 13.51% decline, while the 1 year total shareholder return of 89.40% and very large 5 year total shareholder return point to strong longer term momentum.

If Sterling’s recent moves in data centers have caught your eye, it could be a good moment to widen the lens and check out aerospace and defense stocks as another source of ideas.

With the share price cooling in recent months but 1 year and 5 year total returns still very strong, the key question for investors is whether Sterling is now undervalued or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 30% Undervalued

The most followed narrative puts Sterling Infrastructure’s fair value at about US$453 per share versus the last close of US$317.41, framing a sizeable gap for investors to weigh.

Record-high and growing backlog, particularly in E-Infrastructure Solutions (up 44% year-over-year to $1.2 billion), coupled with a robust pipeline of future phase work approaching $2 billion, provides strong multi-year revenue visibility and stability, mitigating downside risk to revenues and supporting sustained earnings growth.

Curious what kind of revenue glide path and profit profile could back that valuation gap? The narrative leans on steadier earnings, resilient margins, and a richer future earnings multiple. The full story is in how those moving parts fit together.

Result: Fair Value of $453.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change if mega data center and manufacturing projects slow, or if cost inflation and project complexity begin to squeeze margins.

Find out about the key risks to this Sterling Infrastructure narrative.

Another Angle on Value

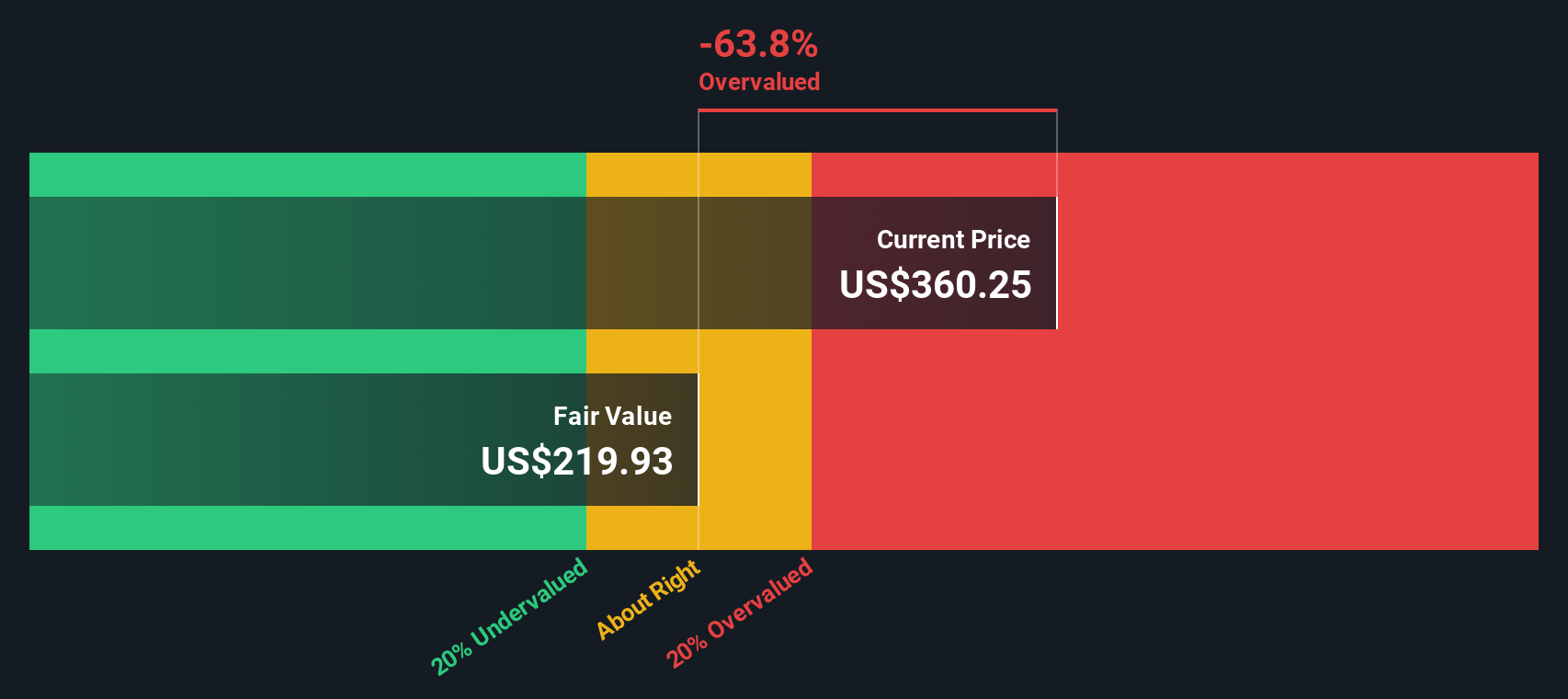

Our SWS DCF model points to a fair value of about US$312.21 per share, compared with the current price of US$317.41. That suggests the shares are slightly overvalued on this basis, even though the narrative-based fair value points to around US$453. Which lens do you trust more when expectations are this different?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sterling Infrastructure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sterling Infrastructure Narrative

If you see the numbers differently or prefer to stress test your own assumptions, you can build a complete view in just a few minutes, starting with Do it your way

A great starting point for your Sterling Infrastructure research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Sterling has sharpened your thinking, do not stop here. The next move that fits your style could be sitting in another corner of the market.

- Spot potential turnaround names early by scanning these 3554 penny stocks with strong financials where smaller companies can offer outsized upside and risk in equal measure.

- Ride powerful tech trends by checking these 25 AI penny stocks that sit at the crossroads of artificial intelligence and rapid business adoption.

- Hunt for mispriced opportunities using these 877 undervalued stocks based on cash flows to focus on companies where current prices sit well below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报