A Look At iRhythm Technologies (IRTC) Valuation After The Recent Evercore ISI Upgrade

Evercore ISI Group recently upgraded iRhythm Technologies (IRTC) to an Outperform rating, a shift that has drawn fresh attention to the stock and its potential role in cardiac monitoring exposure.

See our latest analysis for iRhythm Technologies.

The Evercore ISI upgrade comes after a period where iRhythm’s share price has been relatively steady in the shorter term, with a 30 day share price return of 3.71%, while the 1 year total shareholder return of 104.24% points to strong momentum that contrasts with the weaker 5 year total shareholder return of a 20.63% decline.

If this kind of renewed interest in cardiac monitoring names has your attention, it could be a good moment to look across other healthcare opportunities using healthcare stocks.

With iRhythm posting 1 year total returns above 100%, double digit annual revenue growth and recent analyst optimism, the real question is whether the current price still underestimates its cardiac monitoring potential or already reflects future growth.

Most Popular Narrative Narrative: 15.4% Undervalued

Compared with the last close of US$184.98, the most followed narrative anchors on a higher fair value of about US$219, built from long term cash flow assumptions.

Investment in the Zio ecosystem including next-generation patches, enhanced form factors, and AI-powered analytics (such as the Lucem Health partnership) is improving product differentiation, diagnostic yield, and workflow efficiency, likely leading to higher gross margins and operating leverage as software and data become a larger component of the business.

Curious how a loss making business still lands on a premium future earnings multiple? Revenue compounding, margin shifts and a rich terminal P/E are doing the heavy lifting. Want to see exactly how those assumptions interact to reach that fair value mark? Read on and test whether those expectations line up with your own view of iRhythm’s growth path.

Result: Fair Value of $219 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the bullish setup could be knocked off course if regulatory issues drag on or if new cardiac monitoring competitors pressure pricing and expectations for future growth.

Find out about the key risks to this iRhythm Technologies narrative.

Another View: Market Pricing Looks Rich

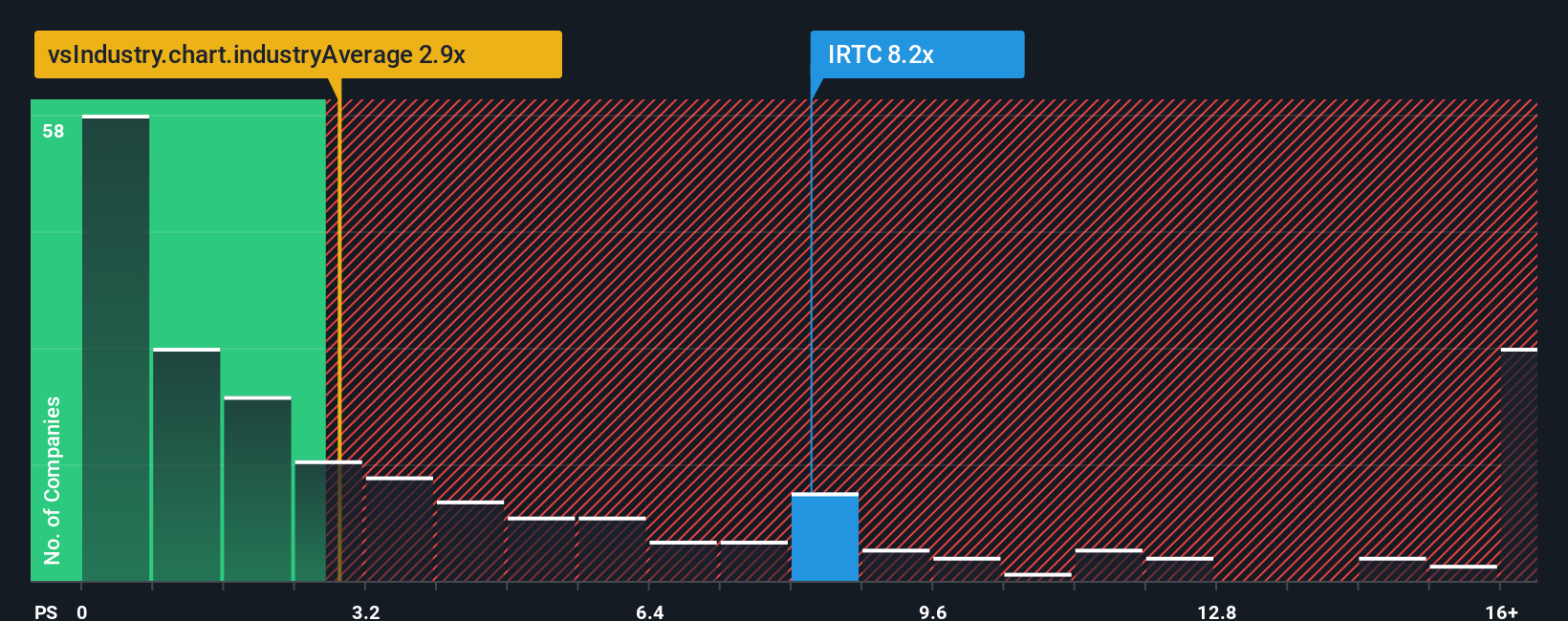

That 15.4% “undervalued” narrative sits awkwardly next to how the market is actually pricing iRhythm today. On a P/S of 8.5x versus 5.4x for peers and 3.1x for the broader US Medical Equipment group, the stock trades on a much higher revenue multiple than both its closest comparison set and the wider industry. The fair ratio of 4.6x is also well below the current level. This suggests that if sentiment cools or growth expectations reset, the multiple could drift toward that fair ratio instead of stretching further. The open question is whether you think the growth story is strong enough to keep that gap in place, or even widen it.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own iRhythm Technologies Narrative

If you see the story playing out differently, or prefer to crunch the numbers yourself, you can build a custom view in minutes. Start with Do it your way.

A great starting point for your iRhythm Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If iRhythm is just one piece of your watchlist, this is the moment to widen your lens and line up a few more angles on potential opportunities.

- Target regular income potential by scanning these 11 dividend stocks with yields > 3% that might help anchor your portfolio with cash returns.

- Spot growth stories early by reviewing these 25 AI penny stocks that are tied to real business models rather than just hype.

- Hunt for mispriced names by checking these 877 undervalued stocks based on cash flows that could be trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报