A Look At TTM Technologies (TTMI) Valuation After Recent Insider Share Sale By Director

Interest in TTM Technologies (TTMI) has picked up after Director Thomas Edman reported selling 16,800 shares on January 2, 2026, a move that fits into a broader pattern of insider selling over the past year.

See our latest analysis for TTM Technologies.

Edman’s sale comes as TTM Technologies trades at US$70.45, with a 90 day share price return of 20.37% and a very large 1 year total shareholder return of 183.05%, suggesting momentum has been building over time despite shorter term share price volatility.

If this kind of insider activity has caught your attention, it could be a good moment to widen your search and check out aerospace and defense stocks.

With TTM Technologies posting a 1 year total shareholder return above 180% and trading at US$70.45, the big question now is simple: is there still upside left here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 13% Undervalued

With TTM Technologies last closing at US$70.45 against a narrative fair value of US$80.75, the valuation hinges on how much future AI and defense demand can support earnings.

Large-scale data center buildouts announced by tech giants (e.g., Google, CoreWeave, Meta) and TTM's new Wisconsin facility position the company to capture outsized demand for advanced PCBs and interconnects required for AI and cloud infrastructure, directly supporting revenue growth and long-term customer relationships.

• Sustained increases in U.S. and NATO defense spending plans, alongside TTM's deep strategic alignment and $1.46 billion A&D backlog, provide long-term visibility and stability for high-margin revenue streams, improving predictability of forward earnings and supporting ongoing margin expansion.

Curious how a higher margin profile, rising earnings and a richer future P/E are all baked into that fair value? The narrative spells out the full earnings path, the revenue lift from AI and defense, and the profitability assumptions that need to hold up.

Result: Fair Value of $80.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh execution risks, such as slower progress at the Penang facility or higher cost U.S. capacity ending up underused.

Find out about the key risks to this TTM Technologies narrative.

Another View: Market Pricing Looks Full

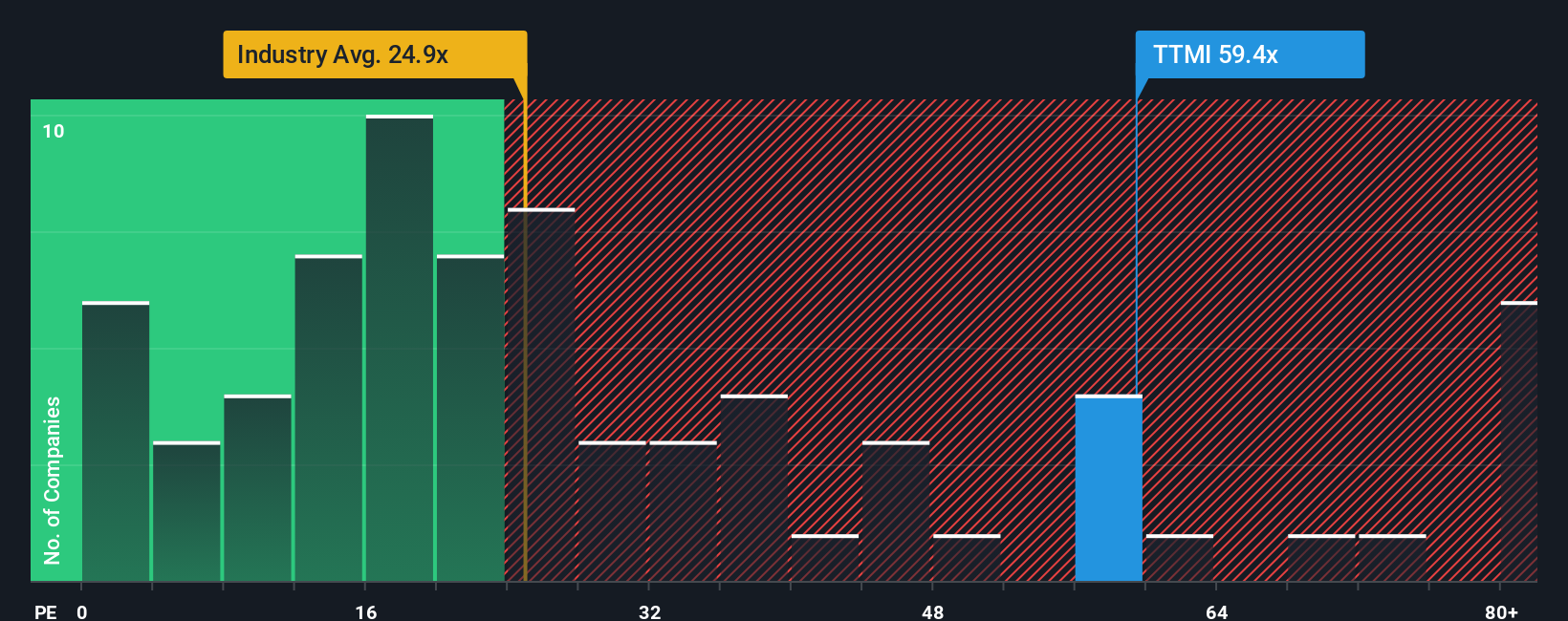

That 13% “undervalued” narrative sits awkwardly next to how the market is actually pricing TTM Technologies today. On a P/E of 55.2x, the shares sit well above the US Electronic industry average of 25.5x, the peer average of 33.4x, and even our fair ratio of 35x.

In plain terms, the current valuation builds in a lot of good news already. This raises the risk that any earnings wobble, delay at key facilities, or softer AI and defense demand could hit the share price harder. The real question for you is whether the growth story feels strong enough to justify staying this far ahead of those benchmarks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TTM Technologies Narrative

If you read this and think the assumptions miss something, or simply prefer to test the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your TTM Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If TTM Technologies is on your radar, now is the time to broaden your watchlist so you are not relying on a single story or sector.

- Spot potential value in smaller names by scanning these 3554 penny stocks with strong financials that pair low share prices with financial strength.

- Zero in on future-focused opportunities through these 25 AI penny stocks that link artificial intelligence themes with listed companies.

- Hunt for mispriced opportunities using these 877 undervalued stocks based on cash flows that flag stocks priced below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报