3 Promising ASX Penny Stocks With At Least A$100M Market Cap

The Australian market has been experiencing fluctuations, with optimism from the U.S. influencing early gains, although these have often reversed by the close of trading. Amidst this backdrop, investors seeking opportunities beyond well-known stocks might consider penny stocks—smaller or newer companies that can still offer significant potential. While the term "penny stock" may seem outdated, it remains relevant for those looking to uncover hidden value in companies with strong financial foundations and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.425 | A$123.23M | ✅ 4 ⚠️ 4 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.85 | A$52.62M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.03 | A$453.39M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.07 | A$231.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.91M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.19 | A$3.66B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.27 | A$1.35B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.865 | A$136.74M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.33 | A$127.75M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.54 | A$666.55M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 413 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Caravel Minerals (ASX:CVV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Caravel Minerals Limited, with a market cap of A$176.01 million, explores for mineral tenements in Western Australia through its subsidiaries.

Operations: Caravel Minerals Limited does not report any specific revenue segments.

Market Cap: A$176.01M

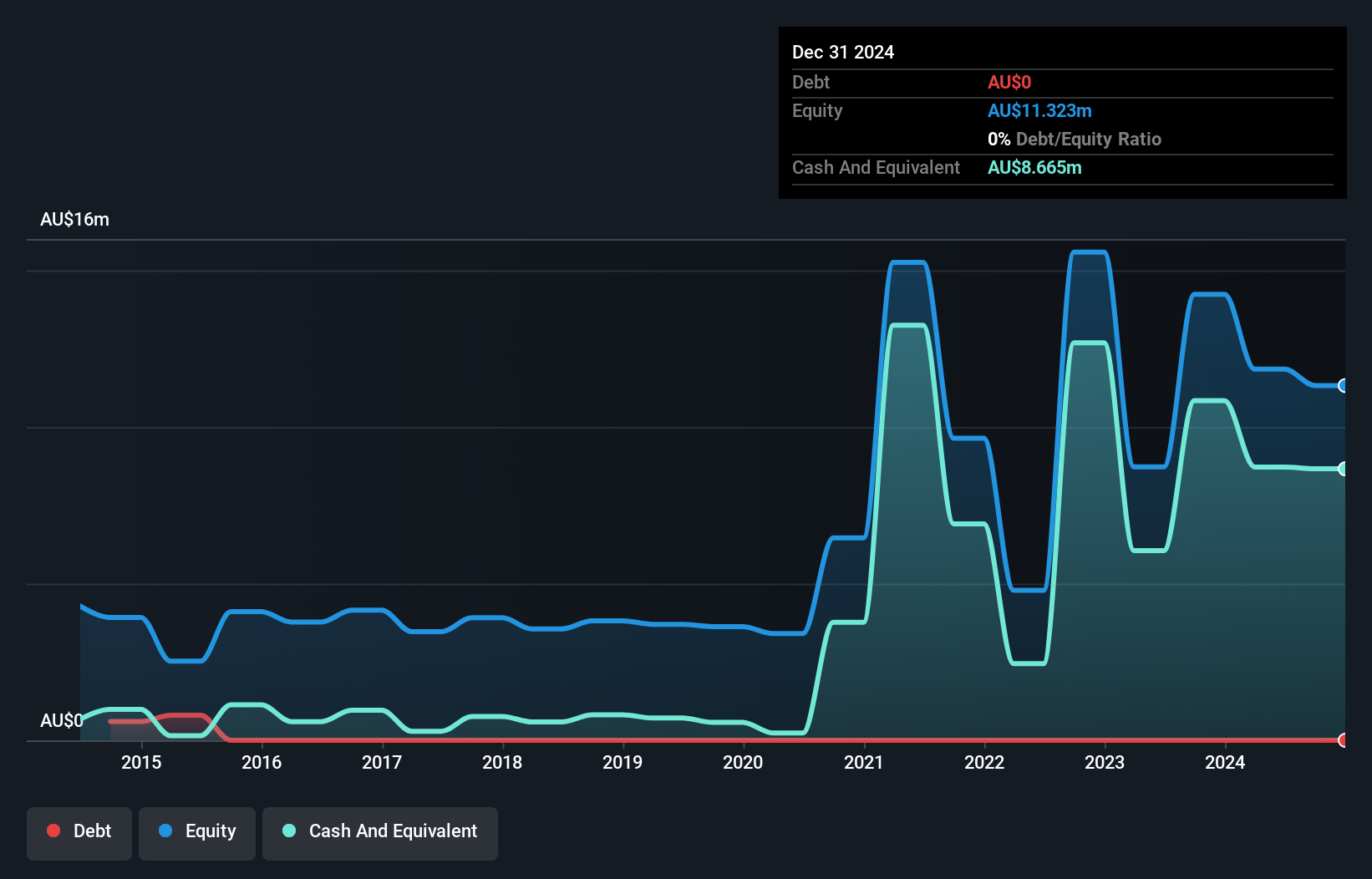

Caravel Minerals, with a market cap of A$176.01 million, is a pre-revenue company focused on mineral exploration in Western Australia. Despite being debt-free and having experienced management and board members, the company faces challenges such as high volatility in its share price and limited cash runway of less than a year. Its short-term assets exceed liabilities by A$5 million, but it remains unprofitable with no forecasted profitability over the next three years. Trading at 94.4% below its estimated fair value suggests potential for valuation upside if future developments align positively with investor expectations.

- Get an in-depth perspective on Caravel Minerals' performance by reading our balance sheet health report here.

- Examine Caravel Minerals' earnings growth report to understand how analysts expect it to perform.

Emmerson Resources (ASX:ERM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Emmerson Resources Limited, along with its subsidiaries, focuses on the exploration and evaluation of mineral properties and has a market capitalization of A$192.93 million.

Operations: The company generates its revenue primarily from mineral exploration, amounting to A$0.24 million.

Market Cap: A$192.93M

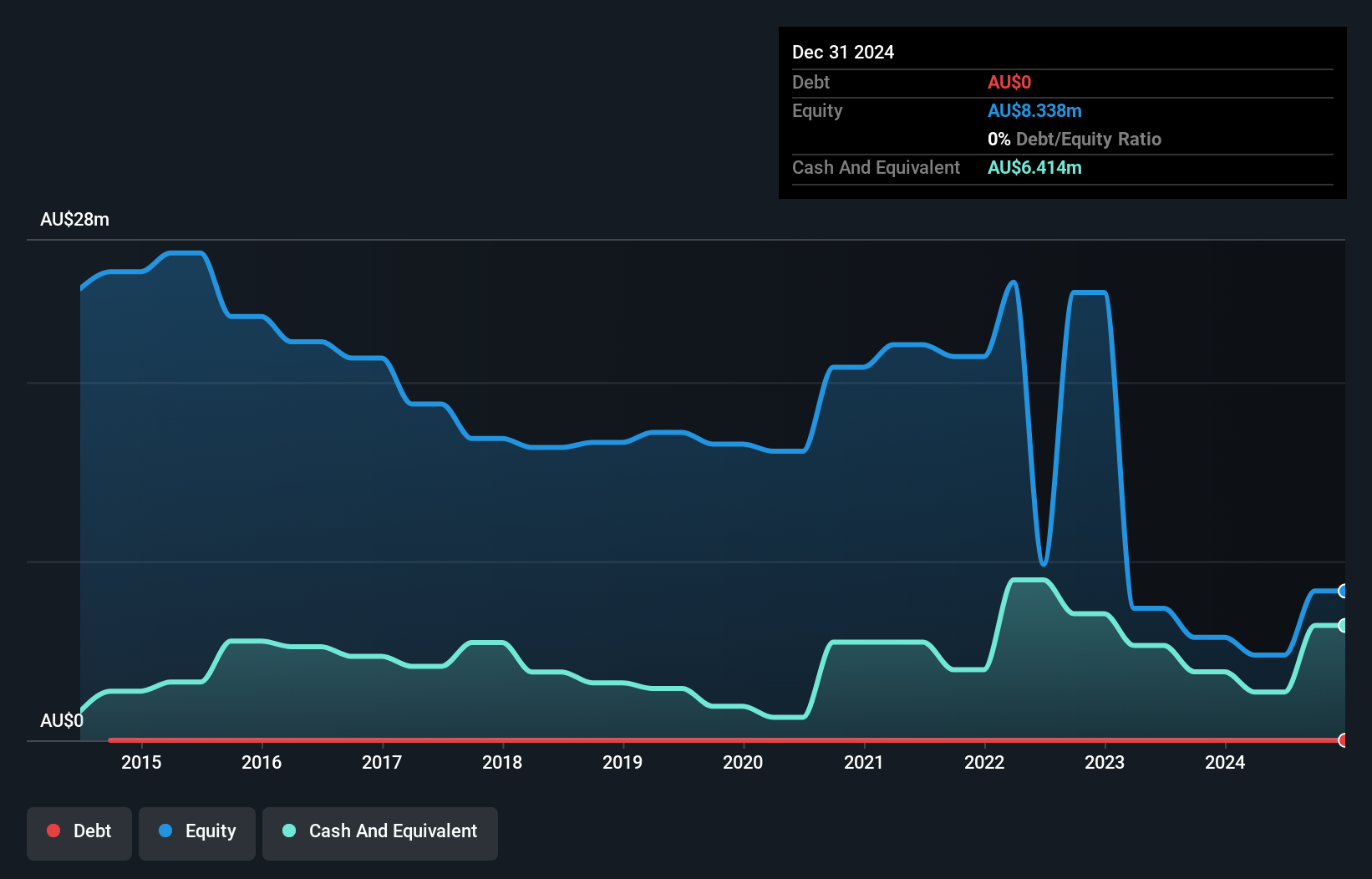

Emmerson Resources, with a market cap of A$192.93 million, is a pre-revenue company focused on mineral exploration. It remains debt-free and has an experienced management team with an average tenure of three years. The company has a stable weekly volatility and sufficient cash runway for over three years if free cash flow continues to grow at historical rates. While unprofitable, Emmerson's short-term assets significantly exceed its liabilities, providing some financial stability. Investors should note the upcoming Q1 2026 earnings release expected on December 24, 2025, which may offer further insights into its financial trajectory.

- Click here to discover the nuances of Emmerson Resources with our detailed analytical financial health report.

- Understand Emmerson Resources' track record by examining our performance history report.

Renascor Resources (ASX:RNU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Renascor Resources Limited is involved in the exploration, development, and evaluation of mineral properties in Australia, with a market cap of A$218.79 million.

Operations: The company's revenue segment is focused on the exploration of graphite, copper, gold, uranium, and other minerals, generating A$0.075 million.

Market Cap: A$218.79M

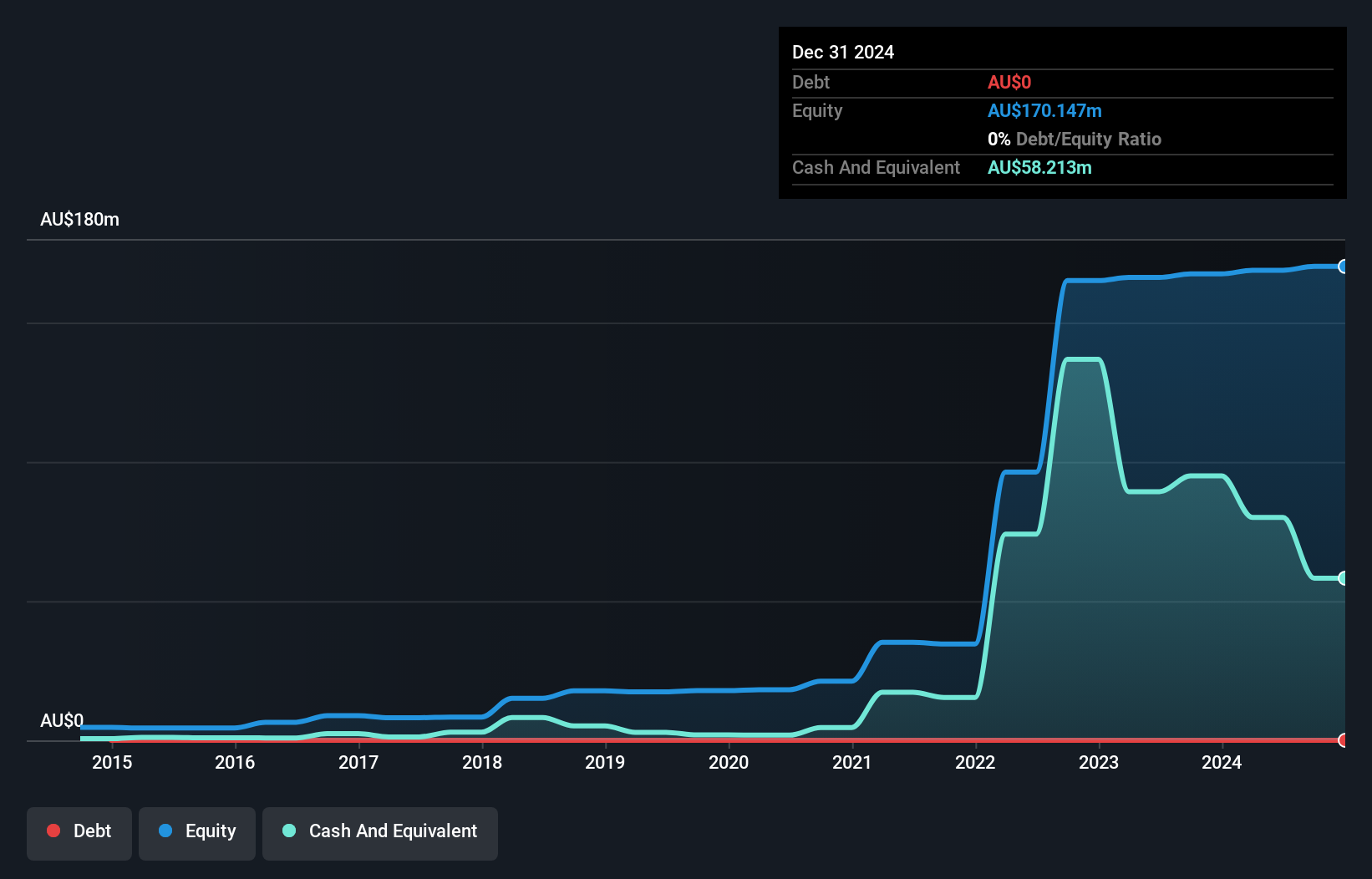

Renascor Resources, with a market cap of A$218.79 million, remains pre-revenue, generating only A$75K. The company is debt-free and benefits from a seasoned board with an average tenure of 15.3 years. Although earnings have grown impressively by 60.5% annually over five years, recent growth has slowed to 7.1%, underperforming the industry average of 10.1%. Short-term assets are robust at A$106.9 million, covering both short- and long-term liabilities comfortably. Recent events include updates on their Battery Anode Material project and participation in international conferences, indicating active engagement in strategic initiatives despite its low return on equity at 1.1%.

- Dive into the specifics of Renascor Resources here with our thorough balance sheet health report.

- Assess Renascor Resources' previous results with our detailed historical performance reports.

Key Takeaways

- Click here to access our complete index of 413 ASX Penny Stocks.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报