Bloom Energy (BE) Valuation Check After New Credit Facility And US$502 Million Quanta Microgrid Order

Bloom Energy (BE) is in focus after securing a US$600 million revolving credit facility led by Wells Fargo and a roughly US$502 million fuel cell microgrid order from Quanta’s U.S. unit.

See our latest analysis for Bloom Energy.

At a share price of US$103.05, Bloom Energy has seen sharp swings recently, with a 7 day share price return of 18.1%, a 30 day share price return of 13.53%, and a 1 year total shareholder return of just over 3x, reflecting how the new credit facility and large Quanta order are feeding into changing views on its growth potential and risk profile around AI and data center power demand.

If the AI power story around Bloom Energy has caught your eye, this could be a moment to scan other high growth tech and AI names using high growth tech and AI stocks.

With Bloom Energy now trading around US$103 after sharp swings and a 1 year total return of just over 3x, the key question is whether the current valuation still leaves upside or if the AI power boom is already fully priced in.

Most Popular Narrative: 8.4% Undervalued

Against Bloom Energy's last close of US$103.05, the most followed narrative points to a higher fair value, built around very specific growth and margin assumptions.

Widespread grid constraints and long interconnection timelines for traditional utility-scale power create a time-to-power advantage for Bloom's solutions, boosting its competitive edge in mission-critical markets and expected to expand the company's addressable market, positively impacting future top-line growth.

Curious what earnings profile supports that higher fair value? This narrative leans on faster top line expansion, rising margins, and a richer future profit multiple. The detailed maths sit behind that headline number.

Result: Fair Value of $112.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the upbeat story could easily be challenged if cleaner zero emissions alternatives undercut gas based fuel cells on cost, or if Bloom’s manufacturing expansion leads to excess capacity and weaker margins.

Find out about the key risks to this Bloom Energy narrative.

Another View: Multiples Signal Rich Pricing

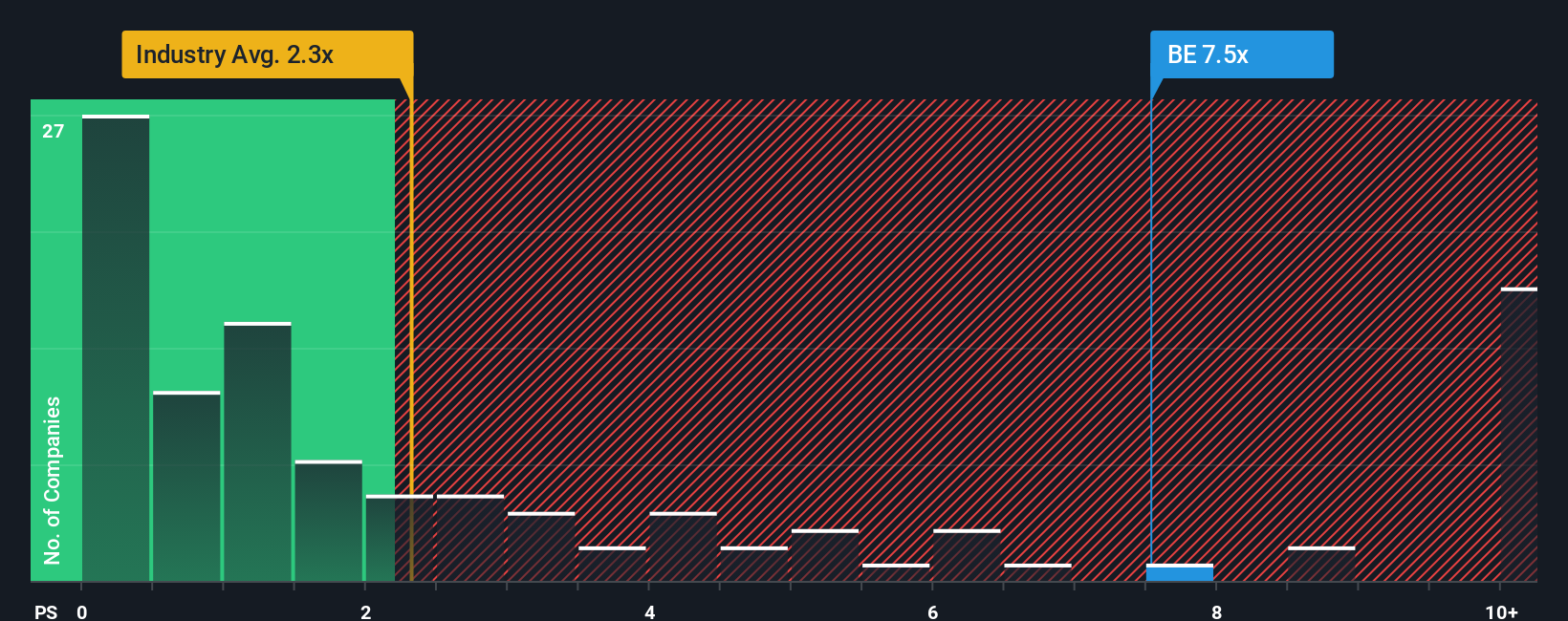

That 8.4% undervalued fair value sits alongside a very different message from simple sales multiples. Bloom trades at a P/S of 13.4x, compared with 4.9x for peers and 2.2x for the wider US Electrical industry, while our fair ratio sits lower at 9.3x. For you, that gap raises a clear question: is the AI power story strong enough to justify paying such a premium to sales today?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bloom Energy Narrative

If this framework does not fully reflect your view, or you prefer to test the assumptions yourself, you can build a custom Bloom Energy story in just a few minutes with Do it your way.

A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Bloom Energy has you thinking differently about where growth could come from next, do not stop here. Widen your watchlist before the next move passes you by.

- Spot potential early stage opportunities by scanning these 3554 penny stocks with strong financials that already pair low share prices with solid financial markers.

- Target the AI theme more broadly by reviewing these 25 AI penny stocks that are tied to chips, data, and software behind the current surge in computing demand.

- Hunt for value by filtering for these 877 undervalued stocks based on cash flows that look cheap based on cash flows and might offer a different risk reward mix to Bloom Energy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报