Assessing Domino’s Pizza (DPZ) Valuation After Recent Share Price Weakness And Growth Trends

Domino's Pizza stock snapshot

Domino's Pizza (DPZ) has drawn fresh attention after a period of softer share performance, with the stock showing negative moves over the past week, month and past 3 months despite positive annual revenue and net income growth.

See our latest analysis for Domino's Pizza.

At a share price of US$406.50, Domino's Pizza has had a softer start to the year, with a year-to-date share price return of a 4.42% decline, even though the 1-year total shareholder return is slightly positive at 0.51%. This suggests that shorter-term momentum is fading while longer-term holders have still seen some gain.

If this kind of mixed performance has you thinking about where else opportunities might sit in consumer names and beyond, it could be a good time to broaden your search with fast growing stocks with high insider ownership.

With Domino's Pizza growing revenue and net income, but its share price pulling back to around US$406, the real question is whether today’s valuation looks conservative or if the market is already pricing in future growth?

Most Popular Narrative Narrative: 18.2% Undervalued

Compared with the last close at US$406.50, the most followed narrative pegs Domino's Pizza's fair value near US$496.65, setting up a clear valuation gap to unpack.

The proprietary "fortressing" strategy focused on store densification and operational efficiencies is further optimizing delivery times and reducing costs in high-traffic urban areas, positioning Domino's to improve both revenue and net margins as urbanization trends persist. Ongoing investment in technology-enabled supply chain management and procurement productivity, alongside menu innovation (for example, permanently adding Stuffed Crust), positions Domino's to continually improve operating margins and foster repeat traffic, supporting long-term earnings growth even as input and labor costs fluctuate.

Curious what kind of revenue climb, margin shift, and future earnings multiple need to line up to support that higher value? The full narrative lays out a precise earnings path, a specific profitability step up, and a premium P/E assumption that together have to hold for this valuation to stack up.

Result: Fair Value of $496.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change if global pizza demand stays flat or if international unit growth and store economics continue to fall short of expectations.

Find out about the key risks to this Domino's Pizza narrative.

Another View: What the Earnings Multiple Is Saying

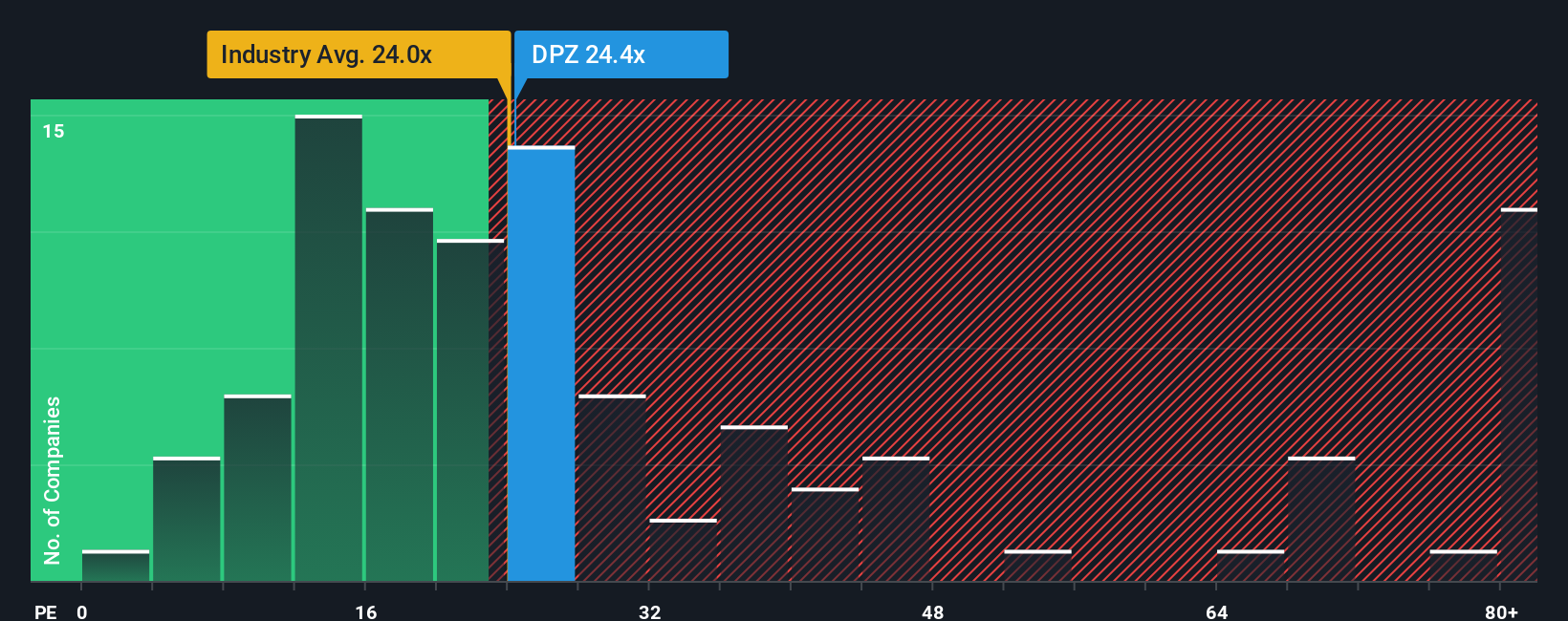

The popular narrative points to Domino's Pizza trading about 18.2% below an implied fair value, but the earnings multiple tells a tighter story. At a P/E of 23.3x, the stock is below the 24.3x peer average yet above its 20.1x fair ratio, so the market is not clearly pricing in a bargain.

That gap suggests limited room for error if earnings or growth assumptions fall short. This raises the question of whether you see this as a cushion or a warning sign in your own thesis.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Domino's Pizza Narrative

If you do not fully buy into this view or simply prefer to weigh the numbers yourself, you can shape a custom story in just a few minutes, starting with Do it your way.

A great starting point for your Domino's Pizza research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready to hunt for your next idea?

If Domino's Pizza has sharpened your thinking, do not stop here. Widen your research now so you do not miss other opportunities shaping the market.

- Target potential high-upside names early by scanning these 3554 penny stocks with strong financials that already show stronger financial footing than many expect from this corner of the market.

- Tap into the fast growing trend in automation and data by checking out these 25 AI penny stocks positioned around artificial intelligence themes.

- Zero in on price tags that look more appealing compared to cash flow estimates by working through these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报