A Look At Customers Bancorp (CUBI) Valuation As Leadership Formally Transitions To Sam Sidhu

Leadership transition and what it could mean for investors

Customers Bancorp (CUBI) has now completed its planned leadership transition, with Sam Sidhu taking the CEO role and joining the Board, while founder Jay Sidhu moves to Executive Chairman.

This handoff, supported by new long-term incentive agreements for both executives, reflects an emphasis on continuity of leadership and a clear, performance-linked framework that investors can monitor over time.

See our latest analysis for Customers Bancorp.

Investors have seen positive momentum recently, with a 1 day share price return of 1.30% and a 90 day share price return of 19.59%. The 1 year total shareholder return of 62.12% and 5 year total shareholder return of 248.40% point to strong long term rewards as leadership responsibilities shift to Sam Sidhu.

If this leadership change has you thinking about where else capital could work hard, it might be a good moment to broaden your search with fast growing stocks with high insider ownership.

With the stock at $77.17, a 1 year total return of 62.12% and an indicated 12.7% discount to the $87.00 analyst target plus an intrinsic discount of 54.12%, you have to ask: is there still a buying opportunity here or is the market already pricing in future growth?

Most Popular Narrative: 9.6% Undervalued

With Customers Bancorp last closing at $77.17 against a narrative fair value of about $85.33, the current setup leans toward undervaluation on that framework.

The rapid digitization of commercial banking and payments is driving institutional clients to seek tech-focused, 24/7 banking solutions, a shift that Customers Bancorp capitalizes on through its proprietary cubiX platform. With payments volume of $1.5 trillion in 2024 and accelerating growth, ongoing regulatory clarity around digital assets and stablecoins positions Customers as the leading provider, supporting significant potential for deposit and fee income growth.

Curious how this payments engine translates into that higher fair value? Revenue growth, earnings expansion and a compressed future earnings multiple all sit at the core.

Result: Fair Value of $85.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on cubiX and digital asset activities avoiding regulatory setbacks, and on loan growth not tipping credit quality or funding into less comfortable territory for you.

Find out about the key risks to this Customers Bancorp narrative.

Another view on valuation

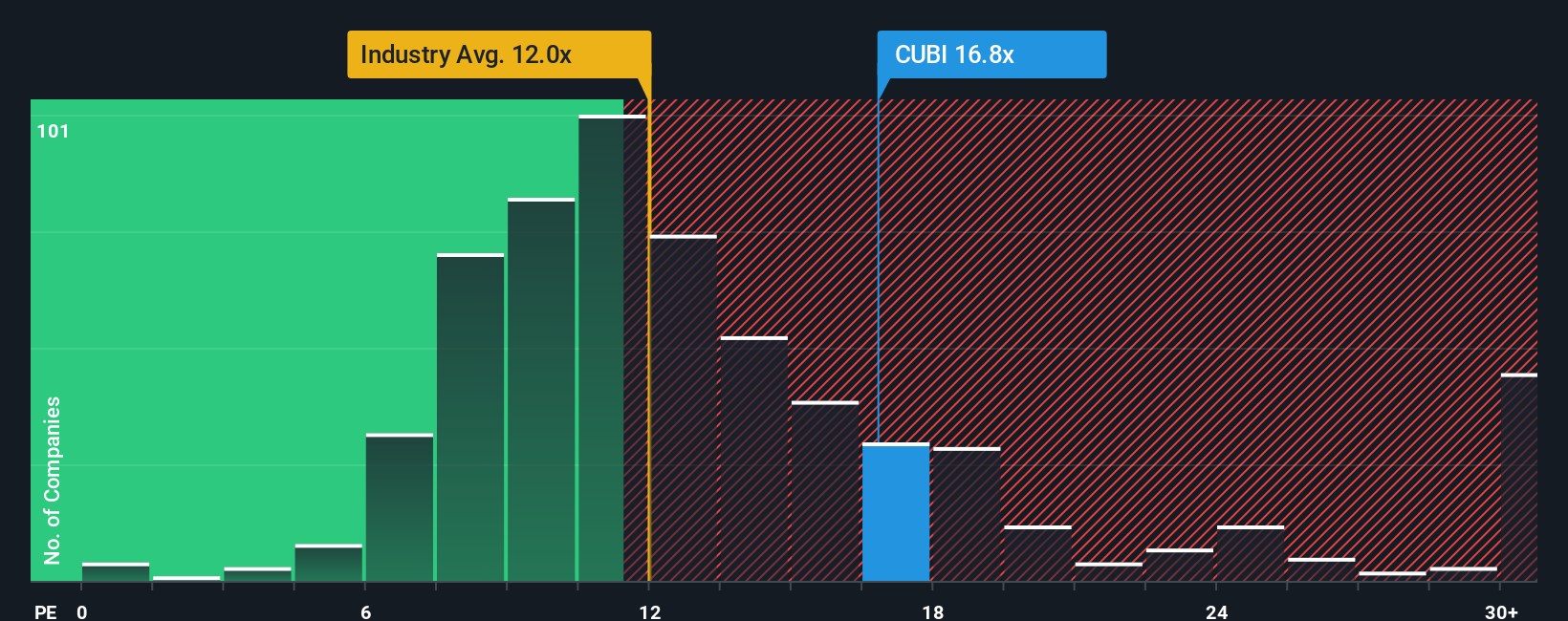

That 9.6% discount to the narrative fair value sits alongside a different message from the market. On a P/E of 16x, Customers Bancorp trades above both US banks at 11.8x and its peer group at 13.6x, while our fair ratio sits slightly higher at 17.1x.

This combination of a higher trading multiple and a fair ratio that suggests some remaining headroom raises a simple question for you: is the market sensibly cautious here, or still underestimating what the business can deliver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Customers Bancorp Narrative

If you look at these numbers and reach a different conclusion, or prefer to test your own assumptions, you can build a custom narrative in minutes with Do it your way.

A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Customers Bancorp has sharpened your thinking, do not stop here. Use the Simply Wall Street Screener to pressure test fresh ideas before committing capital.

- Spot potential mispricing opportunities by scanning these 883 undervalued stocks based on cash flows that might line up better with the risk and return profile you are targeting.

- Tap into growth themes by reviewing these 25 AI penny stocks that could benefit if demand for AI infrastructure and applications keeps building.

- Strengthen your income watchlist by checking out these 14 dividend stocks with yields > 3% that may offer yields above 3% alongside more resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报