Is Nintendo (TSE:7974) Overvalued After Recent Share Price Pullback

Nintendo (TSE:7974) shares have been moving without a clear single headline driver, which has some investors revisiting the stock after mixed recent returns across the past month and past three months.

See our latest analysis for Nintendo.

That recent 13.2% decline in the 30 day share price return and 15.5% drop over 90 days sit against a much stronger backdrop, with a 19.8% 1 year total shareholder return and a 112.4% 3 year total shareholder return. This suggests longer term momentum has been stronger than the latest pullback.

If Nintendo has you thinking about where else growth stories might be forming, it could be worth scanning fast growing stocks with high insider ownership as a starting point for other ideas.

So with short term returns under pressure but 1 year and 3 year results still positive, and analysts’ targets sitting above the current ¥10,855 share price, is there a buying opportunity here or is future growth already priced in?

Price-to-Earnings of 34.2x: Is it justified?

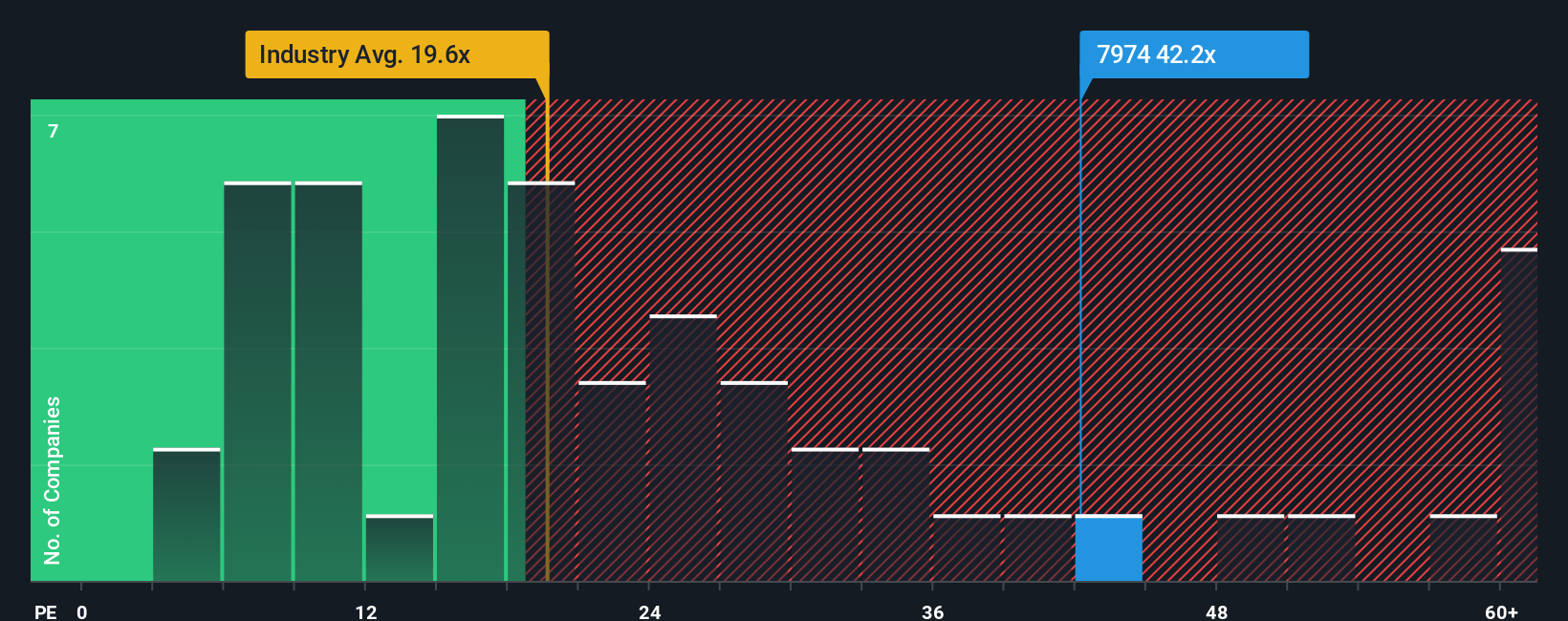

On the numbers given, Nintendo trades on a P/E of 34.2x, which sits above both the Japan Entertainment industry average and the peer group average.

P/E compares the current share price with earnings per share, so a higher P/E usually reflects the market paying more for each unit of current earnings.

For Nintendo, the market is assigning a richer multiple than the Entertainment industry average of 19.4x and slightly above the peer average of 33.6x. Our estimated fair P/E of 37.2x is even higher. This points to a level investors could focus on if sentiment shifts.

Explore the SWS fair ratio for Nintendo

Result: Price-to-Earnings of 34.2x (OVERVALUED)

DCF fair value of ¥9,455.88: what it says about today’s price

Our DCF model gives a fair value estimate of ¥9,455.88 for Nintendo, compared with the last close of ¥10,855. This implies the shares trade above that estimate.

The SWS DCF model works by projecting future cash flows and discounting them back to today, aiming to express those future streams as a single present value figure.

For a mature gaming and entertainment group with existing profitability and forecast earnings and revenue growth, a DCF framework puts the focus on how durable those cash flows may be across hardware, software, and IP over time.

Look into how the SWS DCF model arrives at its fair value.

Result: DCF Fair value of ¥9,455.88 (OVERVALUED)

However, you still have to weigh risks such as hardware and software demand falling short of expectations, or future cash flows not matching the DCF assumptions.

Find out about the key risks to this Nintendo narrative.

Another angle on valuation

The P/E of 34.2x looks rich compared with the Japan Entertainment industry at 19.4x and is even slightly above peers at 33.6x. It still sits below the 37.2x fair ratio suggested by our model as a level the market could move towards. That gap points to both valuation risk and potential upside. Which side of that line do you think will matter more for you?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nintendo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nintendo Narrative

If you see the numbers differently or prefer to piece together your own view, you can build a complete Nintendo story yourself in just a few minutes: Do it your way.

A great starting point for your Nintendo research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Nintendo has sharpened your appetite for opportunities, do not stop here, you could miss other ideas that fit your goals even better.

- Target future growth themes by scanning these 25 AI penny stocks that are tied to long term adoption of artificial intelligence across different parts of the economy.

- Boost potential income by focusing on these 14 dividend stocks with yields > 3% that may offer recurring cash returns alongside share price movements.

- Position yourself early in emerging trends by using these 79 cryptocurrency and blockchain stocks linked to blockchain, digital assets, and related infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报