A Look At Principal Financial Group’s Valuation As JP Morgan Cuts PFG To Neutral

Analyst downgrade puts Principal Financial Group in focus

JP Morgan’s decision to shift Principal Financial Group (PFG) to a Neutral rating has put the stock back in the spotlight, as investors weigh sector rotation against the company’s asset management outlook.

See our latest analysis for Principal Financial Group.

The downgrade comes after a strong run, with a 90 day share price return of 10.69% and a 1 year total shareholder return of 20.08%. This suggests momentum has been building as investors reassess growth prospects and risk around asset management flows and upcoming results.

If this kind of insurer focused story has your attention, it could be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

With PFG trading near JP Morgan’s new price target and screening with a high intrinsic discount score, the key question for you is simple: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 2% Overvalued

With Principal Financial Group last closing at US$90.51 against a narrative fair value of about US$89.08, the current setup rests on relatively tight valuation assumptions.

Principal Financial Group is positioning itself to capitalize on growth opportunities in the retirement ecosystem, focusing on SMBs and Global Asset Management. This strategy could drive future revenue growth as these markets expand.

Want to see what is baked into that near match between fair value and share price? The narrative leans heavily on steady revenue gains, firmer margins and a lower future earnings multiple, all run through a 6.96% discount rate. Are you curious which of those levers carries the most weight in the model, and how much earnings power it assumes PFG can deliver by the late 2020s?

Result: Fair Value of $89.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the picture could quickly change if fee businesses see sustained outflows, or if claims costs unsettle current margin expectations and reset what investors are willing to pay.

Find out about the key risks to this Principal Financial Group narrative.

Another Angle On Value

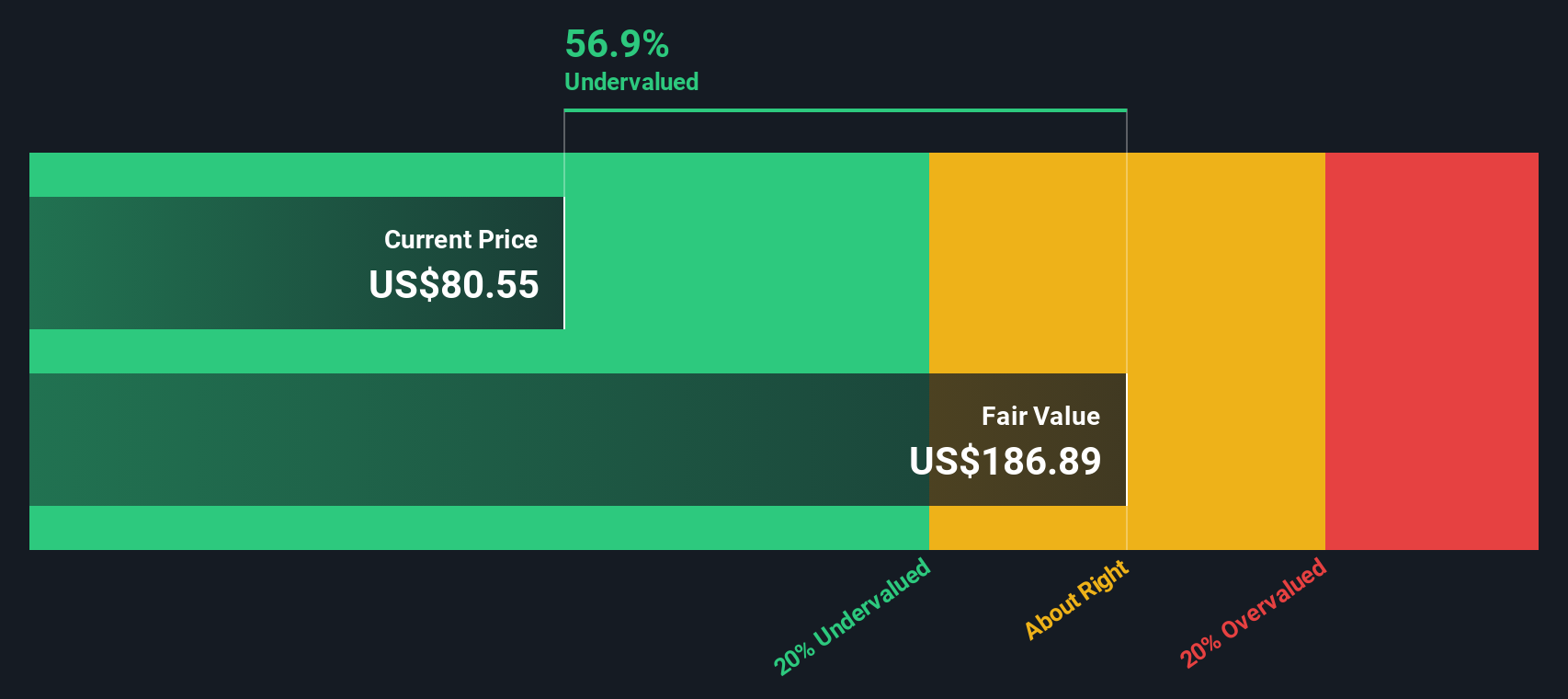

So far, the narrative model has PFG about 2% overvalued, with fair value near US$89.08 against the US$90.51 share price. Our DCF model arrives somewhere very different, with an estimate of fair value around US$210.45, which suggests the shares are trading at a steep discount instead.

That gap reflects different assumptions about how durable PFG's cash flows are and what return you might require for holding the stock. The question for you is simple: which set of assumptions feels closer to how you see this business and its risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Principal Financial Group Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to base decisions on your own work, you can build a fully custom view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Principal Financial Group.

Looking for more investment ideas?

If Principal Financial Group has sparked your interest, do not stop there. Broaden your hunt with focused screeners that surface other opportunities aligned with your investing style.

- Target potential mispricings by checking out these 883 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Ride powerful tech themes by scanning these 25 AI penny stocks tied to artificial intelligence trends that could reshape entire industries.

- Tap into income focused opportunities by reviewing these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报