Morinaga & Co (TSE:2201) Valuation Check As Share Buybacks Continue Under Existing Authorization

Morinaga&Co (TSE:2201) has drawn fresh attention after Morinaga Milk Industry reported ongoing progress in its share buyback program, with 2,463,700 shares acquired under a board approved authorization running through March 31, 2026.

See our latest analysis for Morinaga&Co.

At a share price of ¥2,740.5, Morinaga&Co has recently seen a 1 month share price return of 5.49% and a 3 year total shareholder return of 59.35%, hinting that recent buyback headlines are landing in a market that has already rewarded patient holders.

If Morinaga&Co’s move has you thinking about where capital and ownership strength intersect, it could be a good moment to look at fast growing stocks with high insider ownership.

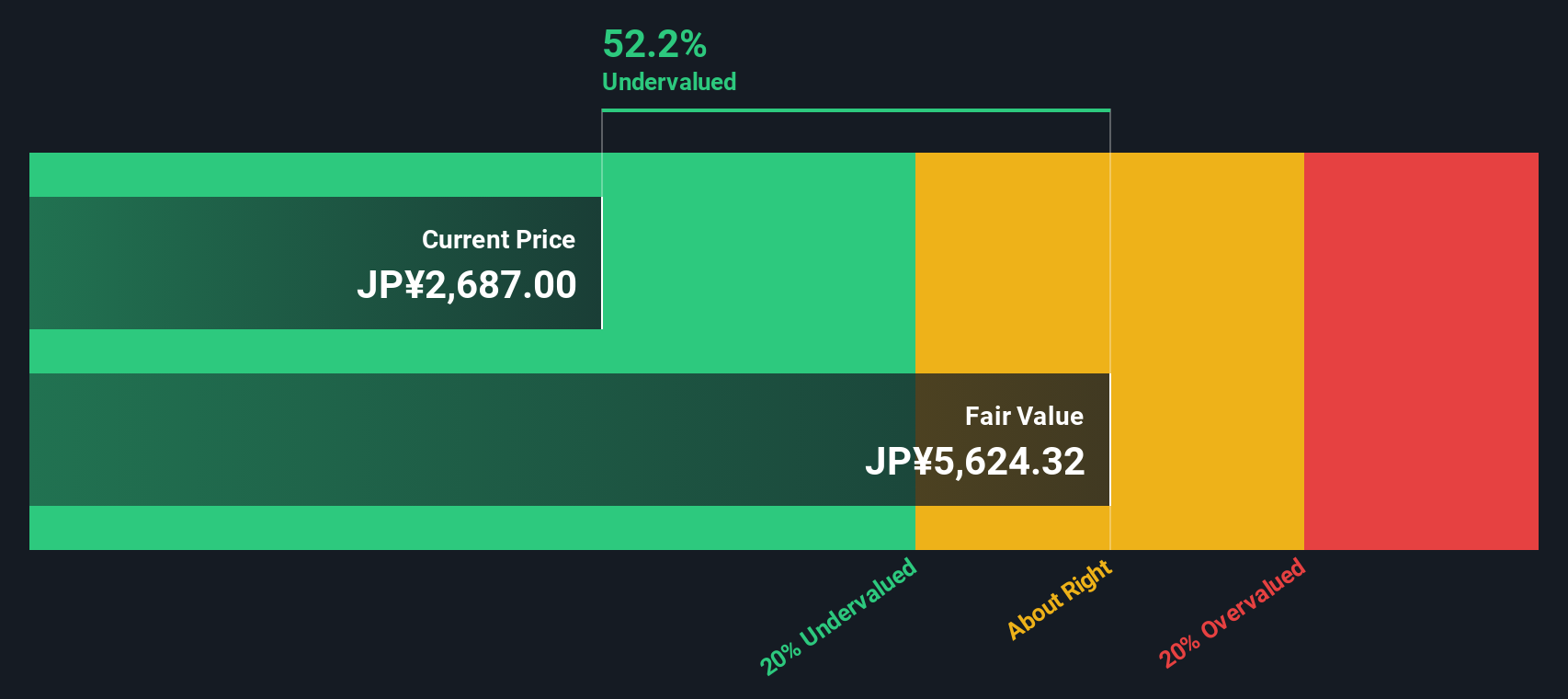

With Morinaga&Co trading at ¥2,740.5, showing solid multi year returns, a value score of 6, and what looks like a large intrinsic discount, the key question is whether this signals a buying opportunity or whether markets are already pricing in future growth.

Price-to-Earnings of 12.7x: Is it justified?

Morinaga&Co is trading on a P/E of 12.7x, which sits below several reference points that investors often watch in the Japanese food sector.

The P/E ratio compares the current share price to the company’s earnings per share, so it effectively tells you how much the market is paying for each unit of profit.

For Morinaga&Co, that 12.7x multiple sits under the JP Food industry average of 16.6x and the peer average of 13.3x. It is also below an estimated fair P/E of 16.1x. Taken together, these figures indicate that the market is valuing the company’s earnings more conservatively than both sector peers and the level suggested by our fair ratio work.

Explore the SWS fair ratio for Morinaga&Co

Result: Price-to-Earnings of 12.7x (UNDERVALUED)

However, steady revenue and net income growth near 3%, along with exposure to consumer discretionary spending on confectionery and ice cream, could challenge any simple undervaluation story.

Find out about the key risks to this Morinaga&Co narrative.

Another View: Our DCF Model Paints A Bigger Gap

While the 12.7x P/E suggests Morinaga&Co is on the cheap side, our DCF model goes further and indicates the shares trade about 54.6% below an estimated fair value of ¥6,042.93. If both earnings and cash flow views flag undervaluation, what might the market be missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Morinaga&Co for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Morinaga&Co Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to weigh the data yourself, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Morinaga&Co research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Morinaga&Co has sparked your interest, do not stop here; broaden your watchlist and pressure test your thinking against other potential opportunities.

- Target income focused opportunities by scanning these 14 dividend stocks with yields > 3%, which might complement a total return approach.

- Spot potential mispricings by filtering for these 882 undervalued stocks based on cash flows that align with your view on quality at a reasonable price.

- Stay ahead of structural shifts in computing by checking out these 29 quantum computing stocks before these themes become crowded trades.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报