Assessing BMW (XTRA:BMW) Valuation After The QNX Software Collaboration For Neue Klasse Vehicles

The fresh collaboration between Bayerische Motoren Werke (XTRA:BMW) and QNX on the software backbone for BMW’s upcoming Neue Klasse vehicles is drawing attention, as investors weigh what more advanced, safety-focused vehicle architectures could mean for the stock.

See our latest analysis for Bayerische Motoren Werke.

Against this backdrop, Bayerische Motoren Werke’s share price is at €93.62, with a 90 day share price return of 7.02%, while the 1 year total shareholder return of 23.79% points to momentum that has built over a longer horizon.

If BMW’s software focused shift has caught your attention, it could be a good moment to see how other auto manufacturers are positioned for the next generation of vehicles.

With BMW trading at €93.62 and an intrinsic value estimate implying a 20% discount, yet sitting slightly above analyst targets, the real question is whether you are seeing a genuine mispricing or a market already banking on future growth?

Most Popular Narrative Narrative: 5.7% Overvalued

With Bayerische Motoren Werke closing at €93.62 against a narrative fair value of €88.59, the current price sits modestly above that modeled estimate, which hinges on a specific set of long term revenue and earnings assumptions.

The analysts have a consensus price target of €88.586 for Bayerische Motoren Werke based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €109.0, and the most bearish reporting a price target of just €68.0.

Curious what justifies paying close to this target today? The core of this narrative is steadier top line progress, thicker margins, and a different earnings multiple a few years out. Want to see exactly how those ingredients are combined and discounted back to that fair value?

Result: Fair Value of $88.59 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on China not worsening and on tariffs staying manageable, because deeper price pressure or higher trade costs could quickly upset those margin assumptions.

Find out about the key risks to this Bayerische Motoren Werke narrative.

Another View: Earnings Multiple Points The Other Way

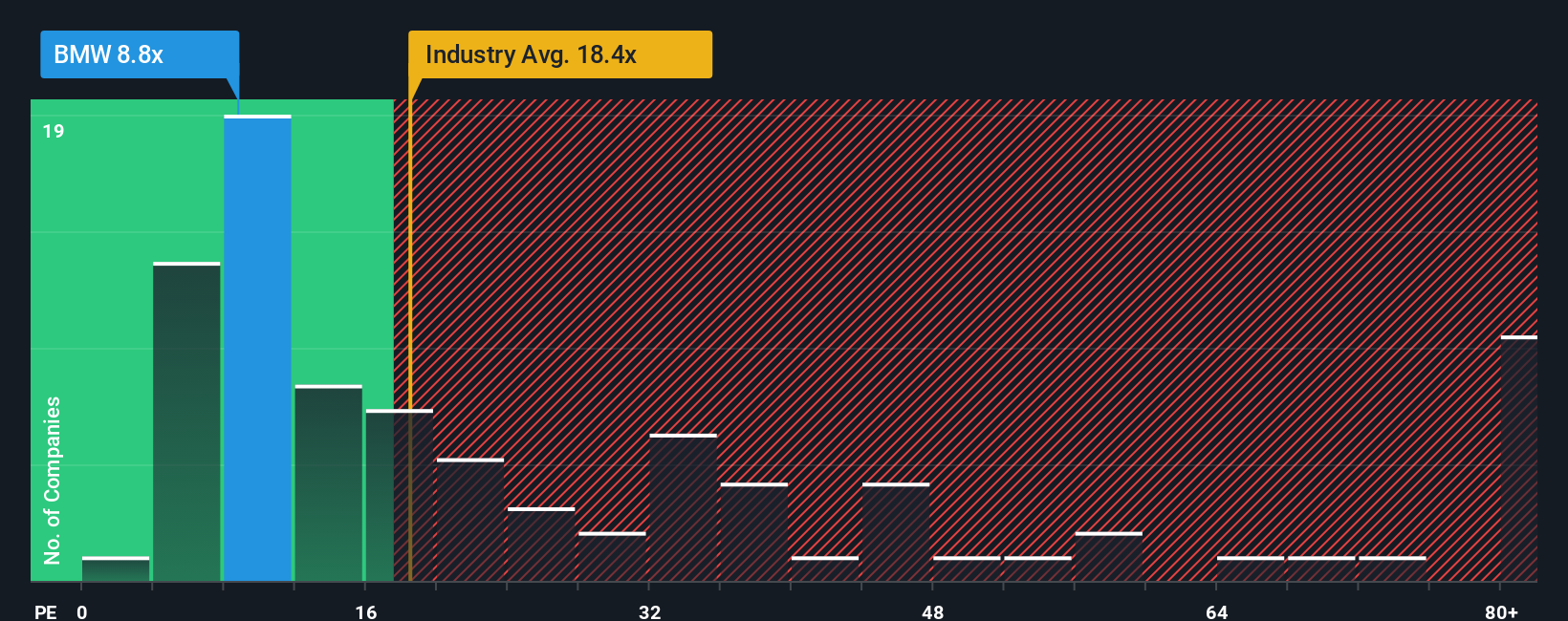

While the narrative fair value of €88.59 frames BMW as 5.7% overvalued, the current P/E of 8.2x tells a different story. It sits well below both the peer average of 19.4x and the global auto industry at 18.2x, and under the 11.9x fair ratio the market could move toward.

That gap suggests the market is either building in meaningful risk, or leaving room for upside if sentiment shifts. Which side of that trade do you think you are on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bayerische Motoren Werke Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom BMW view in minutes using Do it your way.

A great starting point for your Bayerische Motoren Werke research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If BMW is just one piece of your watchlist, now is the time to broaden your search and avoid missing other opportunities that fit your style.

- Spot potential value plays early by screening for these 880 undervalued stocks based on cash flows that may offer more attractive pricing based on their cash flows.

- Tap into the growth story around artificial intelligence through these 25 AI penny stocks and see which companies are tied to this theme.

- Position your portfolio for reliable income by scanning these 14 dividend stocks with yields > 3% that could help you build a steadier return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报