Tariff Freeze On Furniture Imports Could Be A Game Changer For Wayfair (W)

- In early January 2026, the Trump administration delayed previously planned tariff increases on imported upholstered furniture, kitchen cabinets, and vanities until 2027, keeping existing duties at 25%, which eases immediate cost pressures for import-dependent retailers such as Wayfair.

- This extension gives Wayfair more room to manage its sourcing, pricing, and logistics decisions under a stable tariff regime while larger trade and legal questions, including a pending Supreme Court review, remain unresolved.

- With tariffs on key furniture categories now frozen at prior levels, we’ll examine how this policy pause reshapes Wayfair’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Wayfair Investment Narrative Recap

To own Wayfair, you need to believe its online-focused home furnishings model can translate improved operations into durable profitability despite a still-uncertain housing and macro backdrop. The tariff freeze mainly reduces short term margin pressure but does not change the key near term catalyst, which remains upcoming earnings updates, or the biggest risk, which is weaker big ticket demand if housing and consumer spending stay soft.

The most relevant recent development here is the White House decision to keep tariffs on upholstered furniture, kitchen cabinets, and vanities at 25% until 2027, a move that has supported sentiment around Wayfair’s margin outlook. This sits alongside existing efforts like CastleGate and cost discipline, giving investors a clearer near term read on how much of any earnings improvement is coming from internal execution versus temporary external relief.

Yet, while tariffs are on hold, investors still need to be aware that...

Read the full narrative on Wayfair (it's free!)

Wayfair's narrative projects $13.9 billion revenue and $124.7 million earnings by 2028. This requires 4.9% yearly revenue growth and a $424.7 million earnings increase from -$300.0 million today.

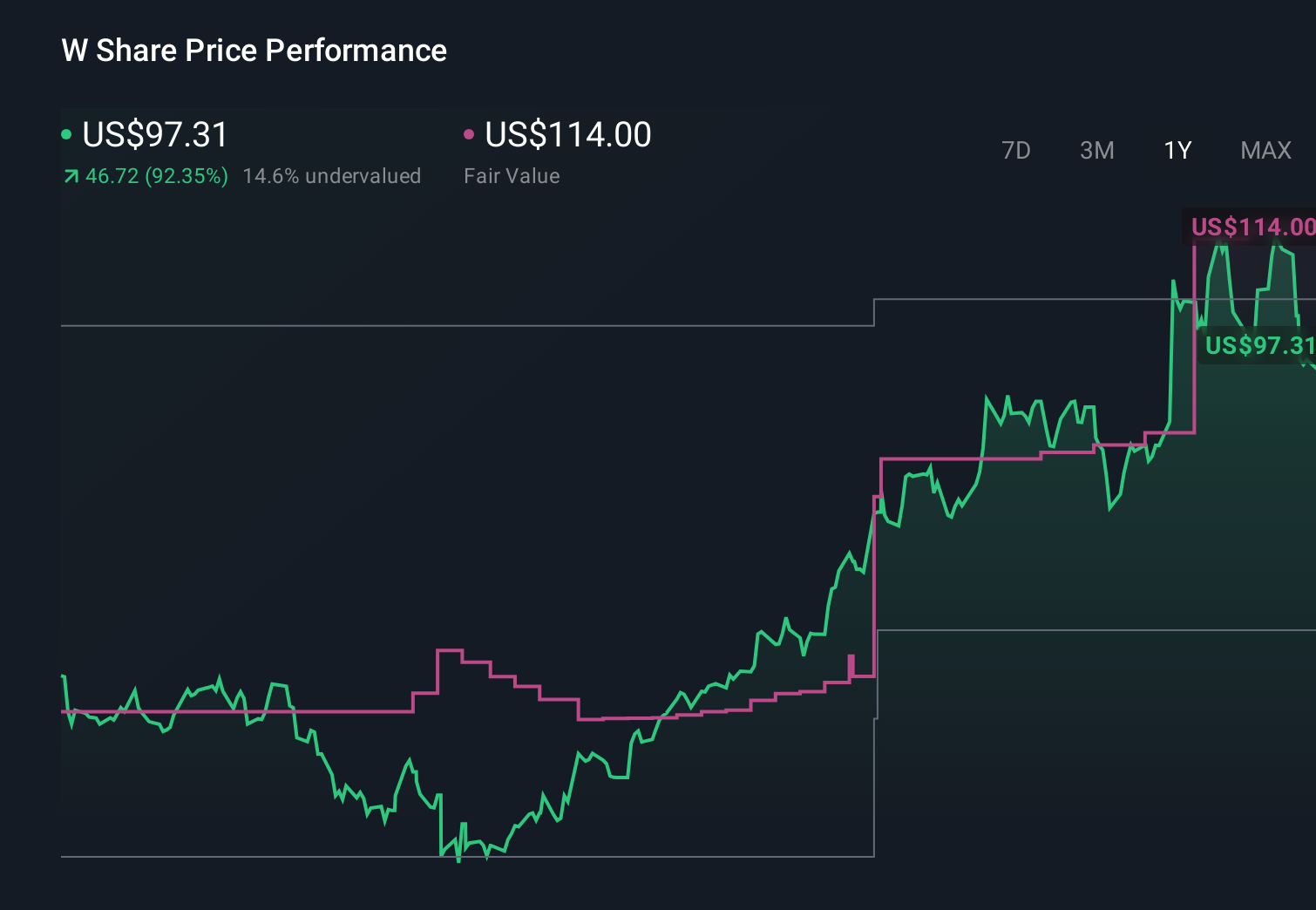

Uncover how Wayfair's forecasts yield a $114.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community fair value estimates for Wayfair span roughly US$40 to US$216 per share, underscoring how far apart individual views can be. As you weigh those against the tariff pause and housing related demand risk, it is worth exploring several of these alternative viewpoints before forming your own stance.

Explore 6 other fair value estimates on Wayfair - why the stock might be worth over 2x more than the current price!

Build Your Own Wayfair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wayfair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wayfair's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报