Assessing Zscaler (ZS) Valuation After Mizuho Upgrade And New AI Security Leadership Moves

Mizuho’s recent upgrade of Zscaler (ZS) to Outperform, together with the appointment of new Chief Marketing Officer Sunil Frida and fresh CEO commentary on AI driven cyber threats, has put the stock back in focus.

See our latest analysis for Zscaler.

At a share price of $222.76, Zscaler has seen a year to date share price return of 0.99%, with a 30 day share price return of an 8.21% decline and a 90 day share price return of a 29.03% decline, even as recent news around the Mizuho upgrade, insider selling and the new CMO appointment has refocused attention on how its Zero Trust and AI security positioning is being valued. Over a longer horizon, the 1 year total shareholder return of 21.13% and 3 year total shareholder return of 112.21% suggest the bigger picture has been more positive, although recent share price momentum has been fading.

If the AI security story has your attention, it could be a good moment to widen the lens and look at high growth tech and AI stocks as potential next ideas.

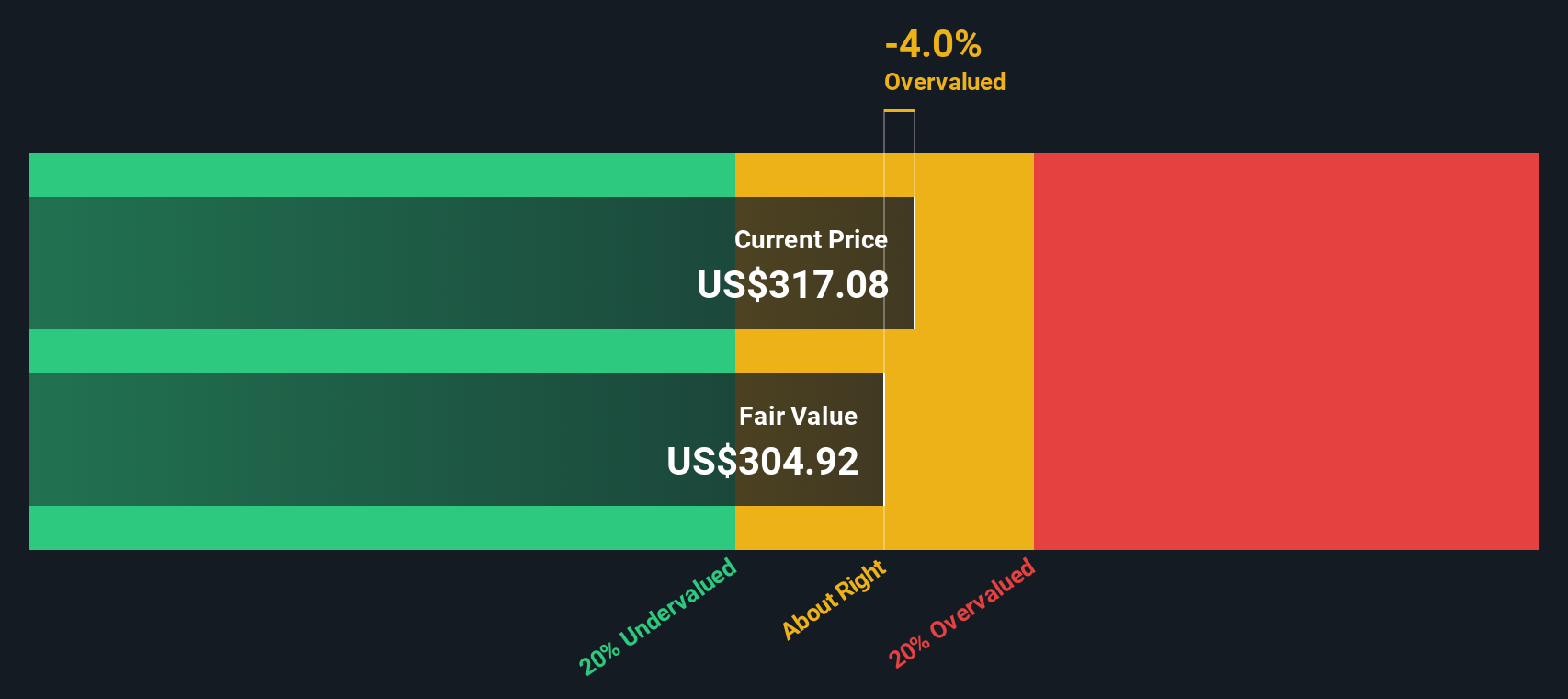

With Zscaler trading at US$222.76 and sitting at a 23.07% intrinsic discount with a value score of 3, the key question is whether recent weakness is creating an entry point or whether the market is already pricing in future growth.

Most Popular Narrative: 32.1% Undervalued

The most followed narrative currently sees Zscaler’s fair value at US$328.22 versus the last close of US$222.76, framing the stock as materially mispriced.

Explosive growth in AI/ML traffic and emerging threats is creating new security challenges that Zscaler is rapidly addressing with differentiated AI security and agentic operations products, positioning the company to capture a rising share of incremental cyber budgets and expand recurring ARR over the long term.

It is worth asking what revenue trajectory, profit turnaround and future earnings multiple are implied by that fair value estimate, since the underlying assumptions appear far from conservative.

Result: Fair Value of $328.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh the risk that cloud providers deepen their own security offerings and that ongoing stock based pay continues to push operating costs and dilution higher.

Find out about the key risks to this Zscaler narrative.

Another Angle On Valuation

Our SWS DCF model also points to Zscaler trading below its estimated worth, with a fair value of US$289.54 versus the current US$222.76. That gap suggests the market could be assigning a discount to the long term cash flow story, so the key question is why.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Zscaler Narrative

If the assumptions behind these fair value views do not quite fit how you see Zscaler, you can stress test the numbers yourself and shape a custom thesis in just a few minutes, then Do it your way

A great starting point for your Zscaler research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Zscaler has sharpened your thinking, do not stop here. Your next strong idea could be waiting in one of these focused stock sets today.

- Target higher income potential by reviewing these 14 dividend stocks with yields > 3% that could complement a growth focused portfolio.

- Tap into the AI theme with these 25 AI penny stocks that concentrate on companies tied to artificial intelligence trends.

- Hunt for price gaps using these 880 undervalued stocks based on cash flows that may trade below what their cash flows imply.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报