Assessing Cencora (COR) Valuation After Strong Multi Year Total Returns

Cencora’s recent performance in focus

Cencora (COR) has drawn investor attention after a stretch of strong multi year total returns and fresh gains over the past 3 months, prompting closer scrutiny of how its current share price lines up with fundamentals.

See our latest analysis for Cencora.

At a share price of $340.92, Cencora’s recent 9.8% 90 day share price return sits alongside a much stronger backdrop, with 1 year and 5 year total shareholder returns of 46.7% and 238.3% respectively, which may reflect shifting growth and risk expectations.

If Cencora has you thinking about healthcare exposure, this could be a useful moment to broaden your watchlist with healthcare stocks as potential long term candidates to research next.

With Cencora trading at $340.92, an indicated 51% discount to one intrinsic value estimate and a 13.4% gap to the current analyst price target, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 11.8% Undervalued

The most followed valuation narrative places Cencora’s fair value at US$386.60 per share versus the recent close of US$340.92, setting up a clear gap for investors to assess.

Cencora's ongoing investment in digital infrastructure and advanced analytics positions the company to capitalize on the accelerating digitization of healthcare and regulatory requirements like the Drug Supply Chain Security Act. This is improving supply chain efficiency and transparency, which should drive higher net margins and operating income over time. The expanding demand for specialty drugs, driven by innovation in treatments for chronic diseases and new approvals in complex categories such as retina, supports robust volume growth in Cencora's high-margin specialty distribution and value-added services, directly benefiting future revenue and operating income.

Curious what kind of revenue path, margin lift and future P/E multiple are baked into that US$386.60 figure, all discounted at 6.956%? The full narrative lays out how earnings, specialty volumes and profitability are expected to evolve together, and how that ties back to today’s price.

Result: Fair Value of $386.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh risks such as thinner margins from biosimilars and generics, as well as ongoing pressure on international specialty logistics and consulting earnings.

Find out about the key risks to this Cencora narrative.

Another view on Cencora’s valuation

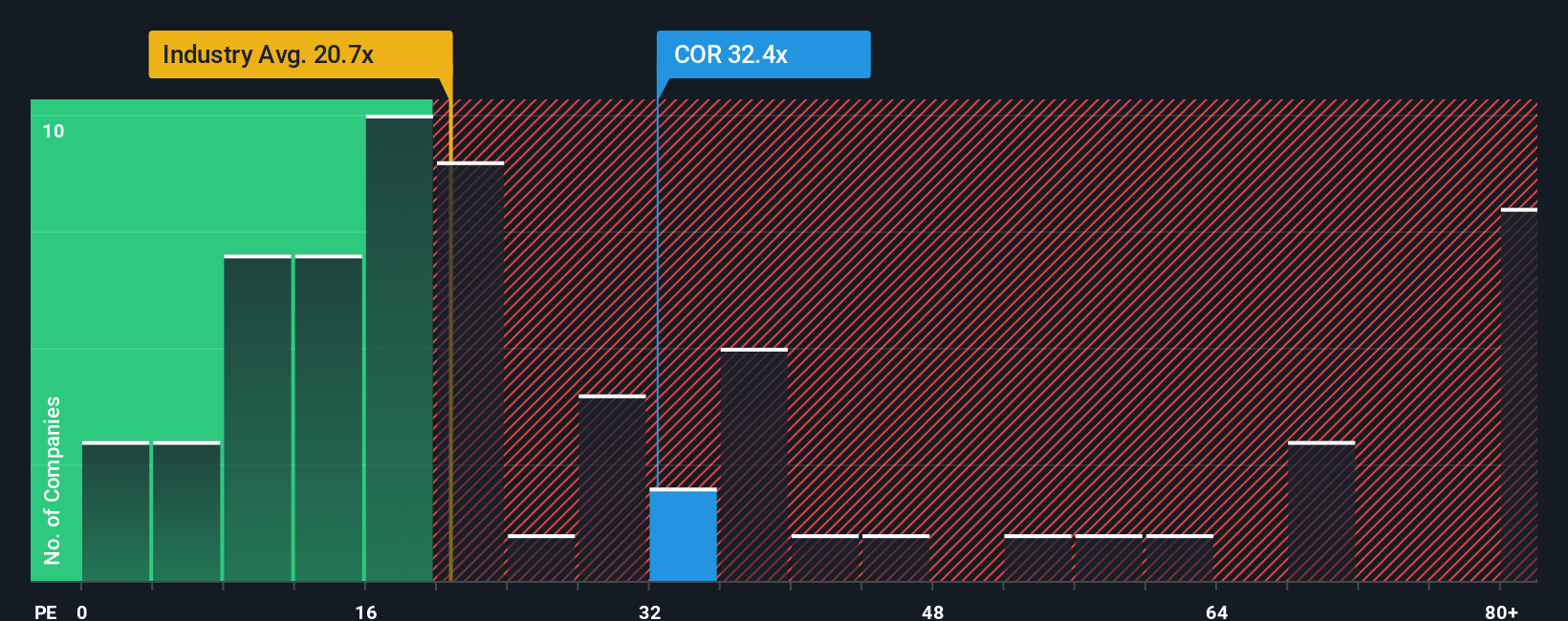

That 11.8% discount to fair value from the narrative sits alongside a very different signal from earnings based pricing. Cencora trades on a P/E of 42.6x, well above both the US Healthcare industry at 22.2x and peers at 23x, and also above a 36.8x fair ratio estimate.

Paying that kind of premium can work if profit growth and execution stay on track, but it also leaves less room for disappointment if anything slips. Is this pricing a reasonable charge for quality, or more valuation risk than you are comfortable with?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cencora Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions against the data, you can build a personalised thesis in just a few minutes using Do it your way.

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Cencora has sharpened your focus, do not stop here. Use the Simply Wall St Screener to uncover fresh, data driven ideas before others move first.

- Target potential mispricings by scanning these 878 undervalued stocks based on cash flows that currently trade at a discount based on their cash flow profiles and fundamentals.

- Explore developments in technology by checking out these 25 AI penny stocks positioned at the intersection of artificial intelligence and long term earnings potential.

- Consider potential income opportunities by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% with room for careful further research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报