Chip Wilson’s Board Shakeup Push Might Change The Case For Investing In lululemon athletica (LULU)

- In late December 2025, lululemon athletica Inc. disclosed that founder Chip Wilson plans to nominate three independent director candidates and has submitted a non-binding proposal to declassify the board for the 2026 annual meeting, while the company reiterated that operations and its current growth strategy remain unchanged.

- The move brings renewed governance pressure at a moment when lululemon is also searching for a new CEO, concentrating attention on how board composition and oversight could shape the brand’s next phase.

- We will now examine how Wilson’s push for new directors and board declassification could influence lululemon’s existing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

lululemon athletica Investment Narrative Recap

To own lululemon today, you need to believe the brand can reinvigorate product demand, especially in the U.S., while cushioning margin pressure from tariffs and weaker traffic. Chip Wilson’s push to add directors and declassify the board does not immediately change these near term fundamentals; the more direct short term catalyst remains whether the upcoming CEO transition and product reset meaningfully improve U.S. trends, while the biggest risk is that category fatigue and promotion intensification persist.

The December 11 announcement of CEO Calvin McDonald’s planned departure and interim co CEO structure is particularly relevant here, as Wilson’s nominations arrive while the company is already reworking leadership and governance. How the board manages both the CEO search and potential refresh of directors could influence execution of key initiatives such as increasing the share of new styles in the assortment by Spring 2026, which many investors are watching as a potential turning point for U.S. performance.

But investors should also be aware that if U.S. casual and lifestyle categories remain weak and require deeper markdowns, then...

Read the full narrative on lululemon athletica (it's free!)

lululemon athletica's narrative projects $12.8 billion revenue and $1.9 billion earnings by 2028. This requires 5.4% yearly revenue growth and about a $0.1 billion earnings increase from $1.8 billion today.

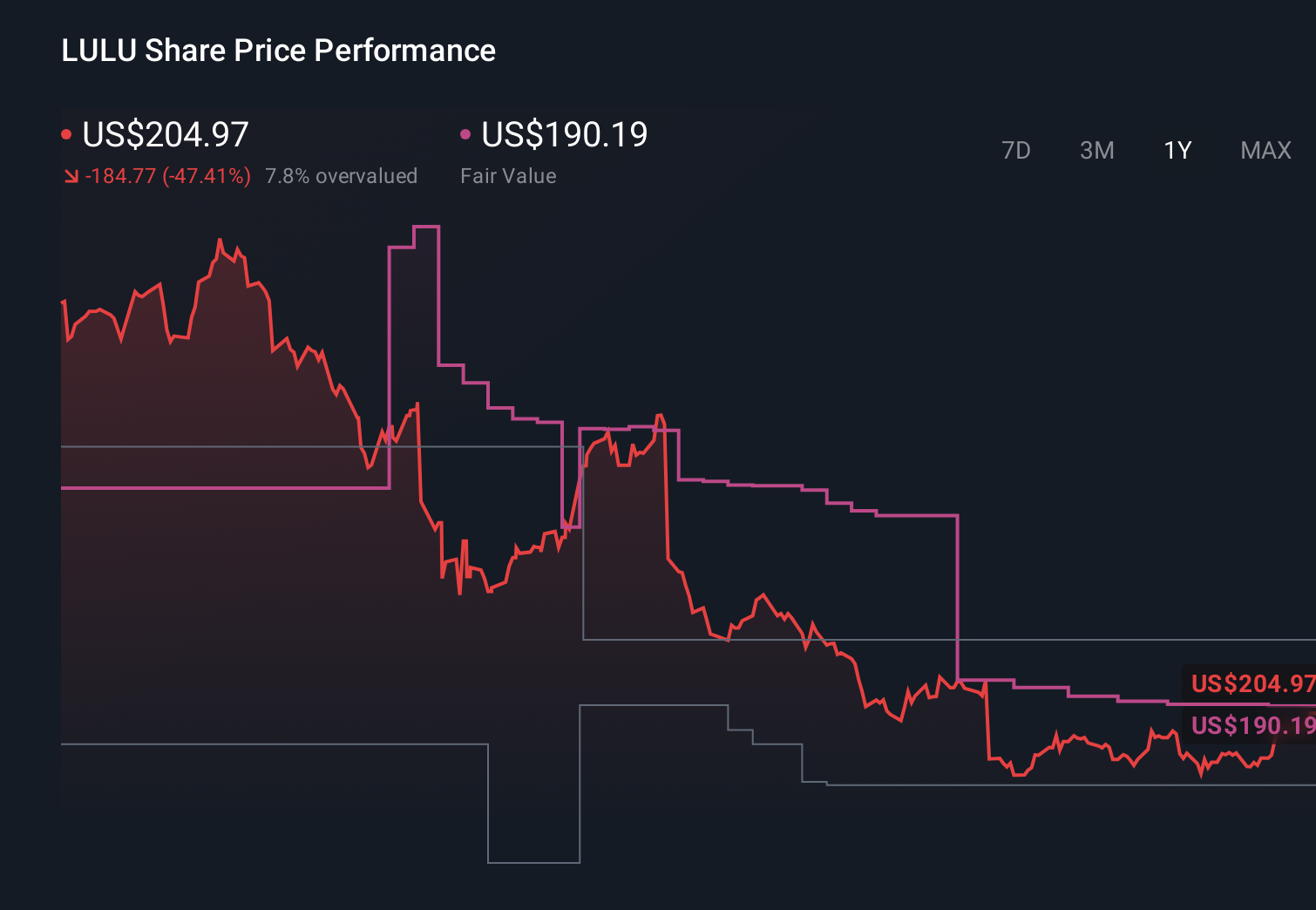

Uncover how lululemon athletica's forecasts yield a $190.19 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Forty five Simply Wall St Community members see lululemon’s fair value anywhere between US$160 and about US$409, with many clustering around the low US$200s. You can weigh those views against the product reset and board level uncertainty that could influence how effectively lululemon addresses U.S. softness and margin headwinds in the years ahead.

Explore 45 other fair value estimates on lululemon athletica - why the stock might be worth 25% less than the current price!

Build Your Own lululemon athletica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free lululemon athletica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate lululemon athletica's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报