How Investors Are Reacting To nVent Electric (NVT) Surging AI-Driven Liquid Cooling Demand

- In recent months, nVent Electric has reported robust organic sales growth in its data center and power utility businesses, supported by strong demand for its liquid cooling solutions tied to AI infrastructure investments.

- This performance, combined with disciplined capital allocation across product development, acquisitions, dividends, and buybacks, has drawn broad analyst confidence in nVent’s positioning within high-growth electrical connection and protection markets.

- We’ll examine how this momentum in AI-driven liquid cooling demand may reshape nVent Electric’s existing investment narrative and future expectations.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

nVent Electric Investment Narrative Recap

To be comfortable owning nVent Electric, you need to believe in sustained demand for its electrical connection and protection solutions, especially in AI-driven data centers and power infrastructure. The latest news of strong organic growth and widespread analyst optimism reinforces the current main catalyst: continued AI and hyperscaler CapEx supporting liquid cooling. It does not materially change the biggest near term risk, which remains nVent’s heavy exposure to AI-related data center spending cycles.

Among recent announcements, the most relevant to this backdrop is nVent’s ongoing share repurchase activity under its May 2024 program, which has retired more than 6.3 million shares for about US$352.3 million. This sits alongside increased dividends and continued product investment, tying capital returns to the same AI and data center growth drivers that analysts are focusing on, while also heightening the importance of how resilient those end markets prove to be.

Yet behind the strong AI-linked growth story, investors should be aware of the concentration risk if hyperscaler spending were to...

Read the full narrative on nVent Electric (it's free!)

nVent Electric's narrative projects $4.5 billion revenue and $651.5 million earnings by 2028.

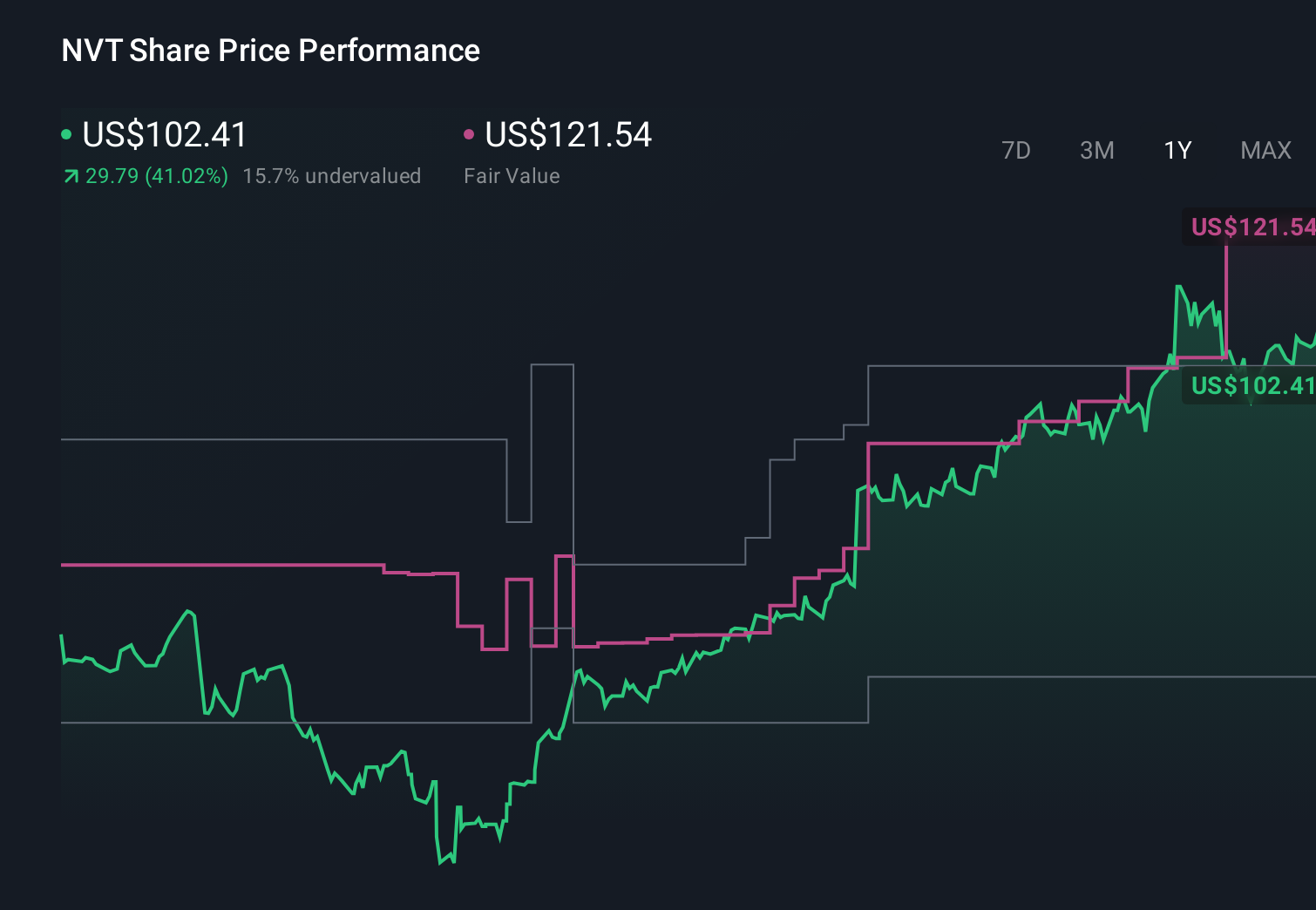

Uncover how nVent Electric's forecasts yield a $121.54 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$81 to US$123 per share, showing how far apart individual views can be. You can set these against nVent’s AI centered growth catalyst and consider how dependence on data center demand might influence the company’s performance over time.

Explore 5 other fair value estimates on nVent Electric - why the stock might be worth as much as 15% more than the current price!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报