OpenAI Acquisition Speculation Drives Pinterest Buzz — Prediction Markets Signal Mixed Odds

Speculation around a potential OpenAI acquisition of Pinterest Inc. (NYSE:PINS) is gaining traction, with traders now putting real money behind the idea.

A Kalshi bet on whether the Sam Altman-led company will announce an acquisition of Pinterest by Jan. 1, 2027, is actively trading, offering a real-time look at how investors and forecasters are pricing the probability of a deal.

The renewed interest follows a recent report from The Information, which included the ChatGPT owner acquiring the digital pinboard platform among its 2026 predictions.

Pinterest shares rose roughly 3% following the report, reflecting heightened investor attention despite the lack of any official confirmation.

Prediction Markets Signal Mixed Odds

On Kalshi, traders are pricing a 54% chance that OpenAI will acquire Pinterest by next year, with $6,660 in trading volume. But at current prices, the market implies a meaningful but far from certain chance that a deal would occur within the next two years.

Other possible buyers for Pinterest also include Meta Platforms Inc. (NASDAQ:META) and Amazon.com Inc. (NASDAQ:AMZN), according to Kalshi traders.

Prediction markets like Kalshi and Polymarket represent capital actively locked into contracts until resolution, meaning traders are financially incentivized to be accurate rather than merely expressive.

Meanwhile, on Polymarket, traders are assigning a lower probability to a near-term deal, pricing roughly a 15% chance that OpenAI acquires Pinterest within the next year. The market has recorded about $9,000 in trading volume, reflecting limited participation compared with longer-dated acquisition bets.

Why Pinterest?

Pinterest operates a visual discovery platform with roughly 600 million monthly active users, about half of whom are Gen Z, according to the company. The platform is widely used for high-intent shopping activity, including the discovery of apparel, home decor, recipes, and lifestyle products, and has consistently reported higher conversion rates than traditional social media platforms.

By contrast, ChatGPT's product discovery remains largely text-based, often requiring multiple steps and external links. While effective for research, it lacks the speed and visual browsing experience that drives inspiration-led commerce — an area where Pinterest could offer OpenAI a strategic advantage.

Pinterest's key assets include a large-scale "taste graph" built from billions of saved images, advanced visual search technology, a verified merchant program with millions of product listings, and an established advertising business generating more than $3 billion in annual revenue.

Price Action: PINS dropped about 10% in 2025, while it has gained 1.3% in the first few trading days this year. At current levels of $26.50, the company is valued at about $17.5 billion.

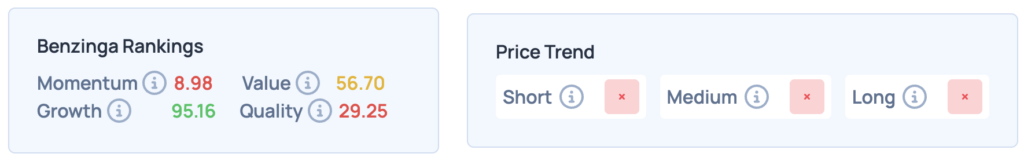

Benzinga’s Edge Rankings show strong growth but weak momentum, quality, and declining price trends across short, medium, and long terms for the stock.

READ NEXT:

Image via Shutterstock

Nasdaq

Nasdaq 华尔街日报

华尔街日报