A Look At Plains GP Holdings (PAGP) Valuation After Higher Distributions And 2026 Tax Guidance

Plains GP Holdings (PAGP) has increased its quarterly Class A share distribution to $0.4175, or $1.67 on an annualized basis, and signaled that part of 2026 payouts may be taxable dividends.

See our latest analysis for Plains GP Holdings.

Against this backdrop, Plains GP Holdings’ share price sits at US$19.51, with a 90 day share price return of 10.85% and a 1 year total shareholder return of 12.43%. The 5 year total shareholder return of 166.72% points to momentum that has been building over a longer period rather than fading.

If this income focused move has caught your eye, it could be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership as potential next ideas to research.

With Plains GP Holdings trading at US$19.51 and sitting close to analyst targets, some investors may see an intrinsic value gap. The key question is whether there is still an attractive entry point or if the market is already pricing in future growth.

Most Popular Narrative: 6.2% Undervalued

Compared with the last close of US$19.51, the most followed narrative points to a fair value of about US$20.81, framing Plains GP Holdings as modestly mispriced and heavily driven by its crude focused repositioning.

The planned divestiture of the NGL segment and redeployment of ~$3 billion in proceeds into core crude oil operations and bolt-on acquisitions are expected to streamline operations, reduce commodity price exposure, and enhance financial flexibility supporting growth in core revenue and improved net margins via higher return investments and potential buybacks.

Want to understand why this valuation leans on earnings quality more than revenue expansion, and why the implied future P/E is higher than the sector norm? The narrative leans on improving margins, a reset in earnings power, and a specific discount rate to pull those future cash flows back to today. Curious what combination of profit uplift, modest top line assumptions, and rerating potential has to line up for that fair value to hold?

Result: Fair Value of $20.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on crude focused earnings actually materialising, and any weaker Permian volumes or tougher contract renewals could quickly challenge that underpriced story.

Find out about the key risks to this Plains GP Holdings narrative.

Another View: Earnings Multiple Sends A Different Signal

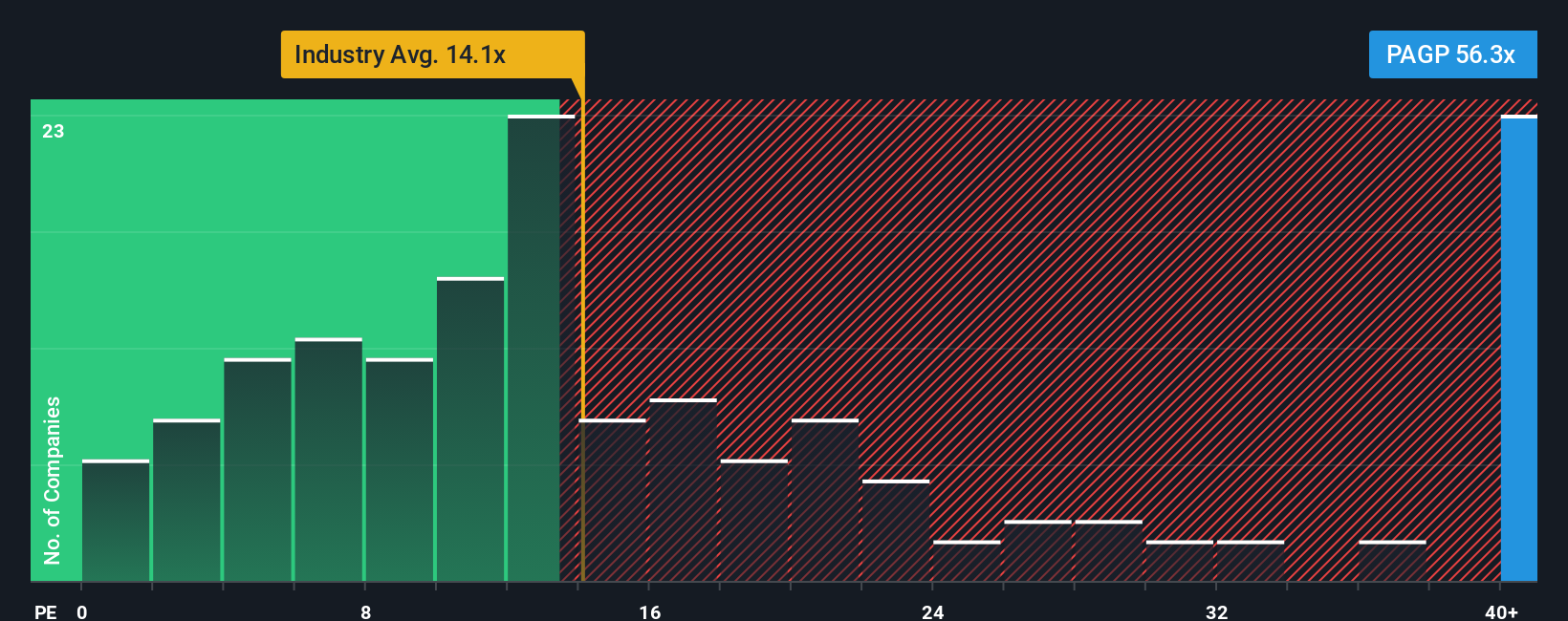

While the narrative fair value of about US$20.81 suggests modest undervaluation, the current P/E of 62.3x tells a tougher story. It is more than double the peer average of 28.2x and well above a fair ratio of 22.6x, which points to clear valuation risk if sentiment cools.

If earnings, cash flows, or sector sentiment reset closer to that fair ratio, today’s price could look stretched rather than cheap. The question for you is simple: do you see current pricing as paying up for quality, or paying too much for a story that still has to be proven?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plains GP Holdings Narrative

If you look at the numbers and reach a different conclusion, or just like building your own view from the ground up, you can shape a fresh thesis in a few minutes with Do it your way.

A great starting point for your Plains GP Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Plains GP Holdings is already on your radar, do not stop there. Broadening your opportunity set now could be what separates you from everyone reacting later.

- Spot potential value gaps early by checking out these 877 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Target growth potential in cutting edge themes by scanning these 25 AI penny stocks that are tied to real business models, not just headlines.

- Strengthen your income focus by reviewing these 14 dividend stocks with yields > 3% that combine yield with the underlying business fundamentals you care about.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报