Assessing Mowi (OB:MOWI) Valuation After Environmental And Regulatory Setbacks

Why recent environmental setbacks matter for Mowi (OB:MOWI)

Chile’s Supreme Court decision to uphold a fine over a 2018 salmon escape, together with reported salmon mortality in Canada, has pushed environmental and regulatory risk firmly into focus for Mowi (OB:MOWI) shareholders.

See our latest analysis for Mowi.

At a share price of NOK 240.0, Mowi’s recent setbacks in Chile and Canada have coincided with a 1-day share price return decline of 1.72%. Over the past 90 days, the share price return of 12.25% contrasts with a 1-year total shareholder return of 26.39%, suggesting that longer term momentum has been stronger than the latest moves.

If these environmental headlines have you reassessing your watchlist, this could be a useful moment to widen your search with fast growing stocks with high insider ownership.

With Mowi trading at NOK 240.0, sitting at a discount to one analyst price target and with a value score of 4, you have to ask: is this an entry point, or is the market already pricing in future growth?

Most Popular Narrative: 6.7% Undervalued

With Mowi last closing at NOK 240.0 and the most followed narrative pointing to a fair value around NOK 257, the gap between price and narrative value is relatively modest but still meaningful to some investors.

Mowi's expansion in harvest volumes, both organically and through the Nova Sea acquisition (guiding 545,000 tonnes in 2025 and at least 600,000 tonnes in 2026), is presented as positioning the company for volume-driven revenue and EBITDA growth relative to peers.

Curious what justifies paying up for this kind of growth story in a mature food producer? The narrative leans heavily on higher volumes, richer margins and a future earnings multiple that is described as closer to fast growing consumer brands than traditional commodity protein. Want to see the full chain of assumptions that turns those ingredients into that fair value estimate?

Result: Fair Value of NOK 257 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on achieving cost savings and maintaining stable biological conditions. Setbacks such as higher feed prices or new environmental incidents could quickly pressure margins and sentiment.

Find out about the key risks to this Mowi narrative.

Another Angle On Valuation

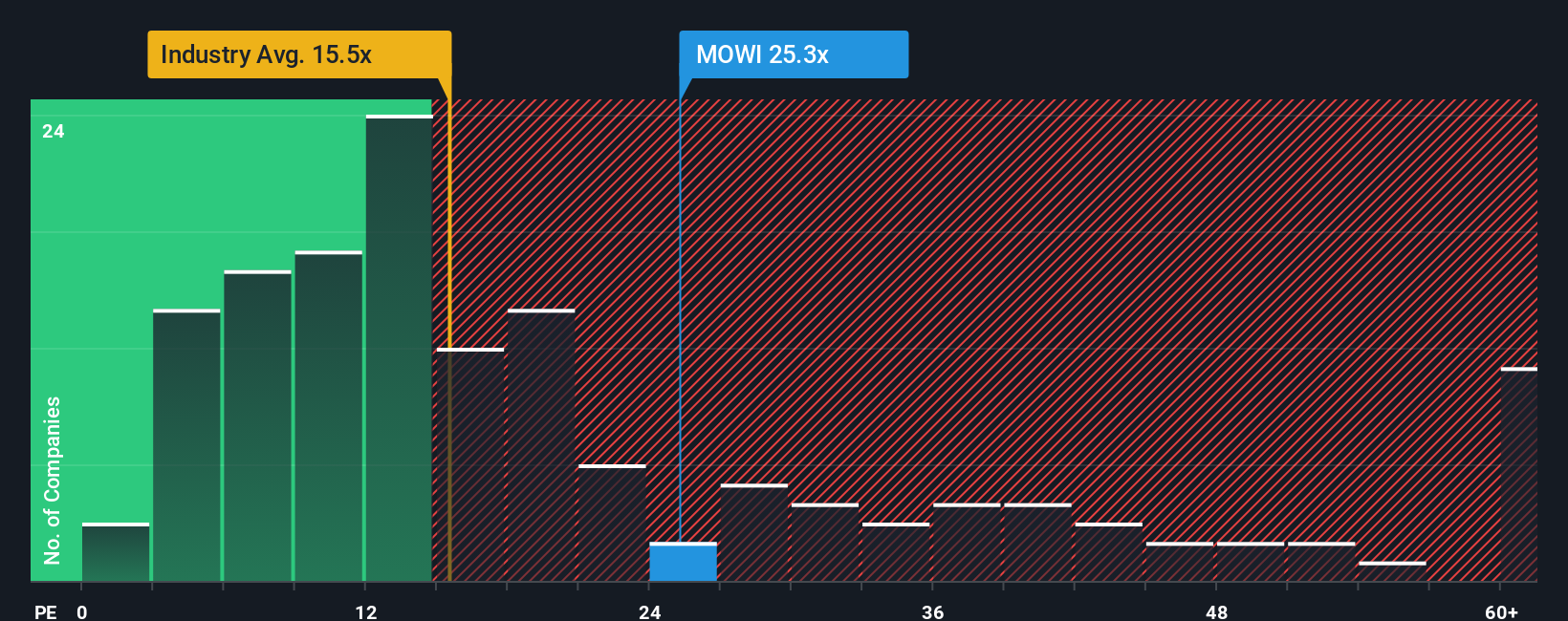

So far the story leans on future cash flows and fair value around NOK 257 per share. If you switch to a simple P/E lens instead, the picture feels more cautious. Mowi trades on 27.2x earnings versus 16.2x for the European Food industry and 37.5x for peers.

Our fair ratio for Mowi’s P/E is 29.4x, slightly above today’s 27.2x. That suggests the market is already paying up for quality, with only a small gap to where the ratio could drift. Is that premium enough for you given the environmental, regulatory and debt questions now on the table?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mowi Narrative

If you look at these numbers and reach a different conclusion, or prefer to rely on your own work, you can quickly build a custom view with Do it your way.

A great starting point for your Mowi research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Mowi has sharpened your focus, do not stop here. Use the Simply Wall St Screener to spot fresh opportunities that fit your style and risk tolerance.

- Zero in on potential mispricings by hunting through these 877 undervalued stocks based on cash flows that might offer more attractive entry points than widely followed names.

- Ride major technology shifts by scanning these 25 AI penny stocks where companies are building real businesses around artificial intelligence rather than just talking about it.

- Target income potential by sorting through these 14 dividend stocks with yields > 3% that could complement growth names with regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报