A Look At Prada’s (SEHK:1913) Valuation After Its Recent Weak Share Price Performance

What Prada’s recent share performance tells you

Prada (SEHK:1913) has drawn attention after a period of weaker share performance, with the stock down over the past month, past 3 months and year. This has prompted investors to reassess expectations around its current valuation.

See our latest analysis for Prada.

At a share price of HK$43.30, Prada’s weaker recent share price returns, including a 90 day share price return decline of 7.32%, sit alongside a 1 year total shareholder return decline of 26.36%. This suggests momentum has been fading as investors reassess the balance between growth prospects and risks.

If Prada’s recent pullback has you rethinking where to focus next, this could be a good moment to widen your watchlist and check out fast growing stocks with high insider ownership.

With Prada trading at HK$43.30, and an intrinsic value estimate suggesting an 18.54% discount, the key question is whether the recent weakness signals undervaluation or if the market is already accounting for future growth.

Most Popular Narrative: 30.1% Undervalued

With Prada closing at HK$43.30 against a narrative fair value of HK$61.94, the current pricing contrasts sharply with the valuation story being argued.

The analysts have a consensus price target of HK$63.712 for Prada based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$88.74, and the most bearish reporting a price target of just HK$45.03.

Want to see what justifies that higher fair value? The narrative leans on steady top line growth, firmer margins, and a richer earnings multiple in a few years. Curious which assumptions carry the most weight in that outlook?

Result: Fair Value of HK$61.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear watchpoints, including Prada’s exposure to affluent tourism and rising marketing and retail investment, which could pressure revenue stability and net margins.

Find out about the key risks to this Prada narrative.

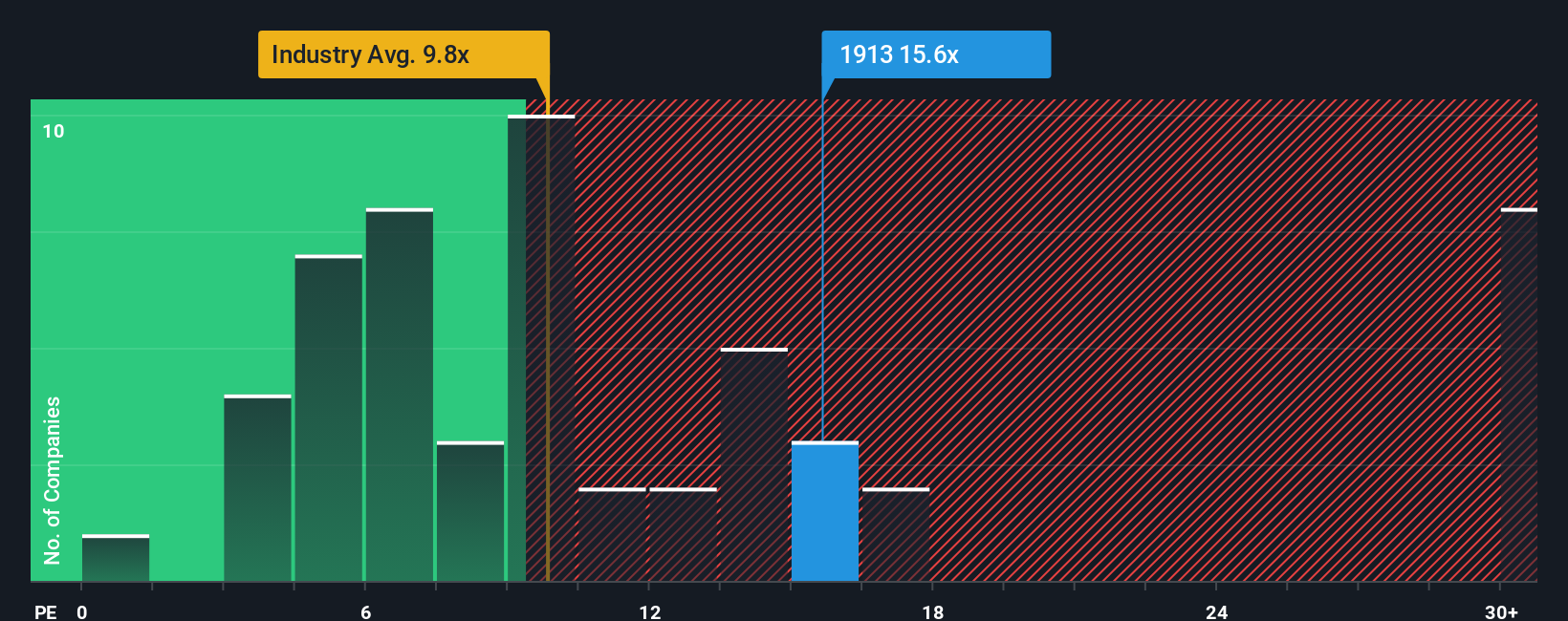

Another View: What P/E Ratios Are Signalling

The fair value narrative presents Prada as 18.5% undervalued, yet the current P/E of 14.5x suggests a more cautious interpretation. It stands above the Hong Kong luxury industry at 9.9x and above its own fair ratio of 12.3x, while remaining below a 16.3x peer average.

In plain terms, the market is already paying a premium to the industry, but not as much as for some peers, and more than what the fair ratio suggests it could move toward over time. Is that gap a signal that expectations are already rich, or an indication that there is room for sentiment to align more closely with the narrative?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prada Narrative

If parts of this story do not fully line up with your view, or you would rather test the assumptions yourself, you can build a personalised Prada thesis in just a few minutes with Do it your way.

A great starting point for your Prada research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Prada is only one piece of your watchlist, now is the time to widen your search and spot other opportunities before they move out of reach.

- Scan for potential value opportunities by checking out these 877 undervalued stocks based on cash flows that line up with your preferred price and quality mix.

- Target income focused ideas by reviewing these 14 dividend stocks with yields > 3% that may suit a yield oriented approach.

- Get ahead of emerging themes by assessing these 79 cryptocurrency and blockchain stocks that tie into digital assets and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报