Assessing Ionis Pharmaceuticals (IONS) Valuation After Analyst Optimism And FDA Approval Of Tryngolza

Recent optimism from several Wall Street firms toward Ionis Pharmaceuticals (IONS) has been tied to its broad RNA-focused pipeline and the recent FDA approval of Tryngolza, a treatment for familial chylomicronemia syndrome and acute pancreatitis.

See our latest analysis for Ionis Pharmaceuticals.

Despite a mixed recent patch, with the latest 1-day and 30-day share price returns both in negative territory, Ionis shares have a 90-day share price return of 12.25% and a very large 1-year total shareholder return of 124.56%. This points to momentum that has built around its clinical progress and approvals rather than fading.

If this kind of biotech story has your attention, it could be a good moment to widen your watchlist with other healthcare stocks that are also trying to turn medical breakthroughs into long term returns.

So with Ionis shares up strongly over the past year, trading around US$78.53 and sitting below the average analyst price target, should you see current levels as a fresh entry point, or assume the market is already pricing in future growth?

Most Popular Narrative: 8.6% Undervalued

With Ionis shares at US$78.53 and the most followed narrative pointing to fair value around US$85.95, the story leans toward underpricing on long term potential.

The fair value estimate has risen slightly to approximately $85.95 per share from about $85.47 per share, reflecting modestly higher long term assumptions.

Revenue growth has remained effectively unchanged at around 20.44% annually, signaling stable medium to long term topline expectations.

Curious what sits behind that higher fair value, yet steady growth outlook? Revenue projections, margin assumptions and a rich earnings multiple all have specific roles. Want the full picture?

Result: Fair Value of $85.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh the chance that pricing pressure in larger indications or setbacks for key late stage drugs could quickly challenge this underpricing story.

Find out about the key risks to this Ionis Pharmaceuticals narrative.

Another View: Rich Sales Multiple Raises Questions

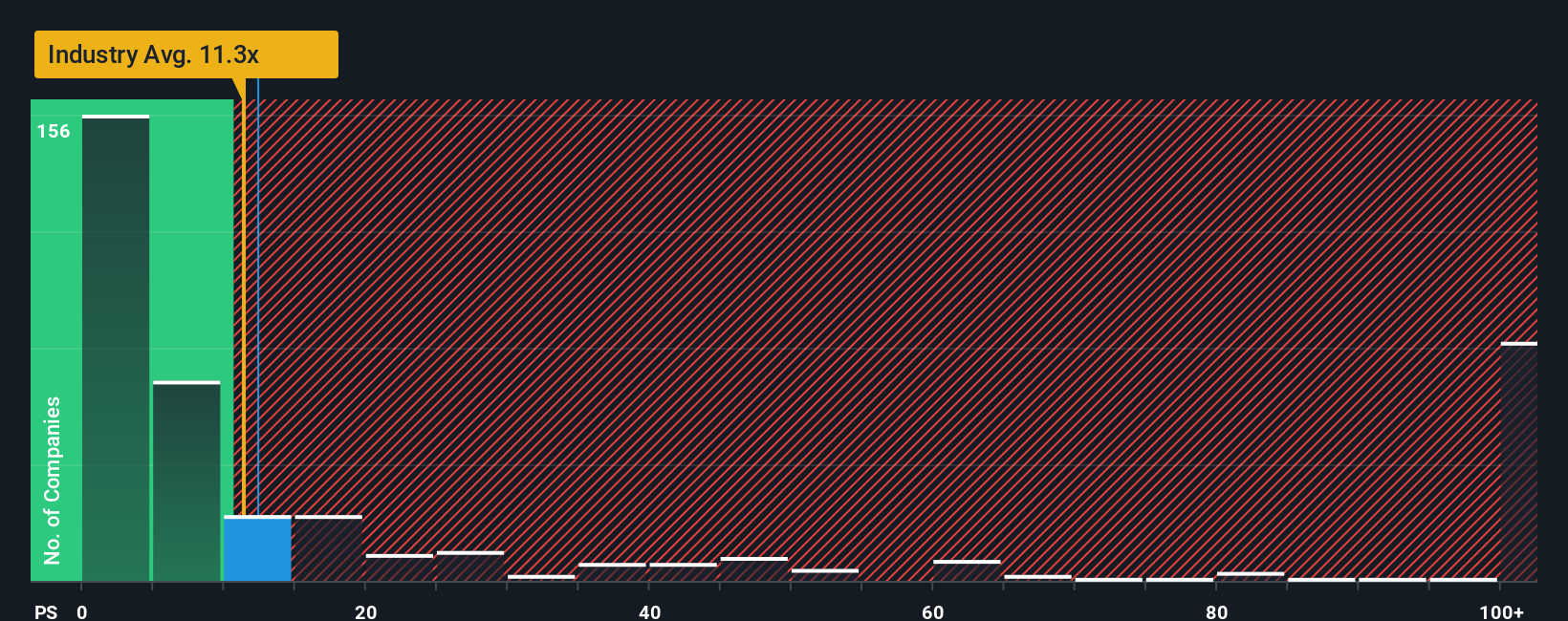

The fair value story around US$85.95 suggests Ionis shares are undervalued, yet the P/S ratio tells a different tale. At about 13.2x sales versus 4.5x for peers, and a fair ratio of 5x, the stock carries a much richer sales tag than both peers and the level our fair ratio points to. That gap implies less room for error if revenue or margins fall short of expectations. Investors may want to consider how comfortable they are paying this kind of premium for the company’s growth path.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ionis Pharmaceuticals Narrative

If you look at the numbers and come to a different conclusion, you can still test your own assumptions and shape a personal thesis in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ionis Pharmaceuticals.

Ready to Hunt for More Investment Ideas?

If Ionis has you thinking more broadly about opportunities, this is the point where you widen your view and actively search for ideas that truly fit your style.

- Target income-focused opportunities by scanning these 14 dividend stocks with yields > 3% that could help anchor your portfolio with regular cash payouts.

- Spot potential growth stories early by reviewing these 3557 penny stocks with strong financials that combine smaller size with stronger financial profiles.

- Zero in on price-focused ideas by checking these 877 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报