Assessing Zai Lab (ZLAB) Valuation After Recent Share Price Volatility

Zai Lab (ZLAB) has drawn fresh attention after its recent trading performance, with the stock up 4.4% over the past day but showing a 46.3% decline over the past 3 months.

See our latest analysis for Zai Lab.

That 1 day share price gain sits against a weaker backdrop, with a 30 day share price return of 7.23% and a 90 day share price return of 46.30% indicating fading momentum despite the current US$18.09 level. At the same time, the 1 year total shareholder return of 29.91% highlights how challenging the longer term has been.

If Zai Lab’s recent moves have you reassessing the sector, this could be a useful moment to see how other healthcare names stack up through healthcare stocks.

With Zai Lab trading at US$18.09, facing long-term total return pressure but with analyst targets and intrinsic estimates far above the current level, investors may need to ask whether this is a mispriced opportunity or whether the market is already pricing in future growth.

Most Popular Narrative: 63.4% Undervalued

With Zai Lab last closing at US$18.09 and the most followed narrative pointing to fair value near US$49.49, the valuation gap is hard to ignore.

Analysts have moderately lowered their price target on Zai Lab to approximately $49.49, reflecting more conservative assumptions for revenue growth and profit margins, along with the stock’s recent removal from a key regional conviction list.

Curious what kind of revenue ramp and margin shift could still justify that valuation gap, even after those cuts? The underlying assumptions may surprise you.

Result: Fair Value of $49.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story collides with real pressure points, including heavy reliance on in licensed assets and intense competition in core oncology markets that could cap future margins and market share.

Find out about the key risks to this Zai Lab narrative.

Another View: Market Ratios Send Mixed Signals

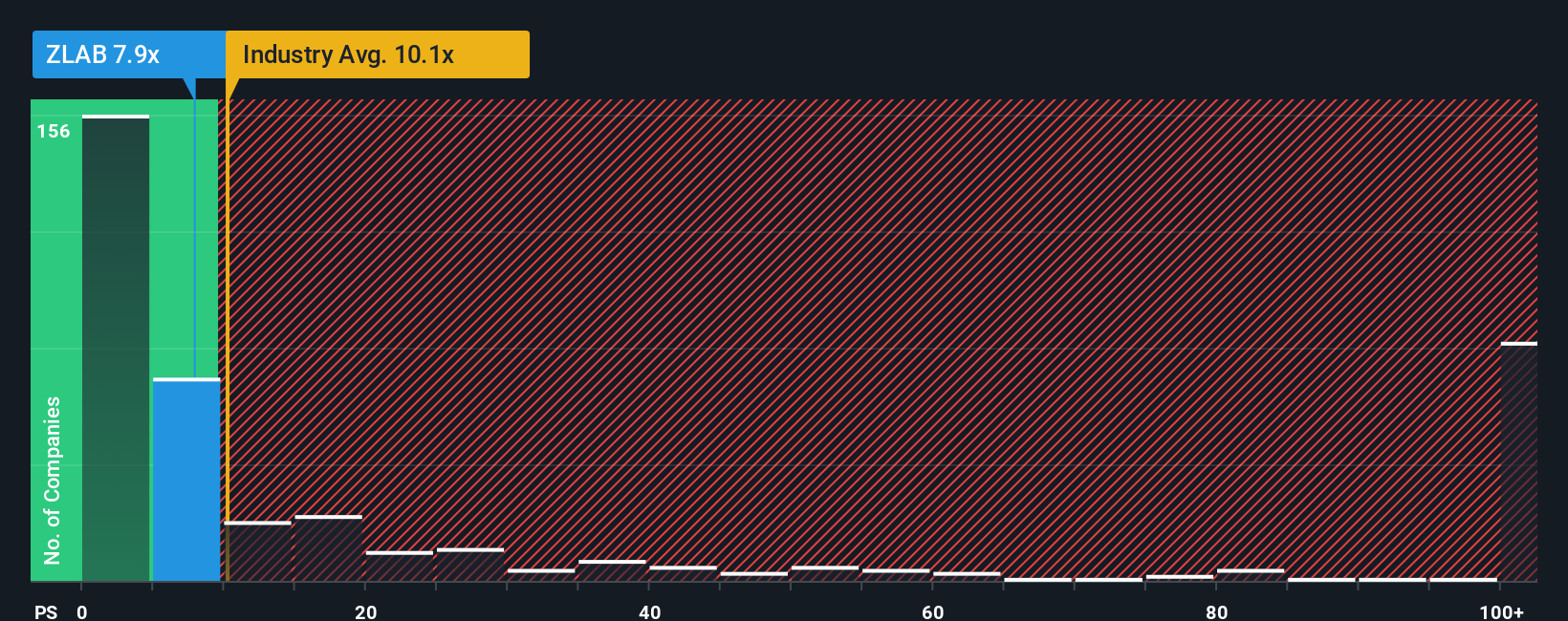

Our SWS fair ratio points to a P/S of 3.9x for Zai Lab, yet the stock currently trades on a P/S of 4.6x. That is cheaper than the US Biotechs industry at 11.7x and peers at 5x, but still above the fair ratio, which raises questions about how much mispricing is really on the table.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zai Lab Narrative

If you see the data differently or prefer to test your own assumptions, you can build a personalised view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zai Lab.

Looking for more investment ideas?

If Zai Lab has sharpened your focus, do not stop here. Broaden your watchlist with a few targeted ideas that could sharpen how you think about opportunities.

- Spot companies that pair value with income potential by checking out these 14 dividend stocks with yields > 3% and see which names currently stand out.

- Hunt for growth themes tied to artificial intelligence across sectors by filtering through these 25 AI penny stocks before the crowd catches on.

- Zero in on companies where price and cash flows line up attractively using these 877 undervalued stocks based on cash flows so you do not miss potential mispricings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报