Top UK Dividend Stocks Featuring Macfarlane Group And Two More

In the current UK market landscape, the FTSE 100 has recently experienced a downturn, influenced by weak trade data from China and its ongoing struggle to recover from pandemic-related challenges. As global economic uncertainties persist, dividend stocks can offer investors a measure of stability and income potential amidst fluctuating market conditions. In this article, we will explore three notable UK dividend stocks, including Macfarlane Group, that stand out for their ability to provide consistent returns in such an environment.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Seplat Energy (LSE:SEPL) | 6.79% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.52% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.36% | ★★★★☆☆ |

| MONY Group (LSE:MONY) | 6.75% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.09% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.91% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 3.55% | ★★★★★☆ |

| Eurocell (LSE:ECEL) | 4.70% | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | 3.79% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.48% | ★★★★★☆ |

Click here to see the full list of 50 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

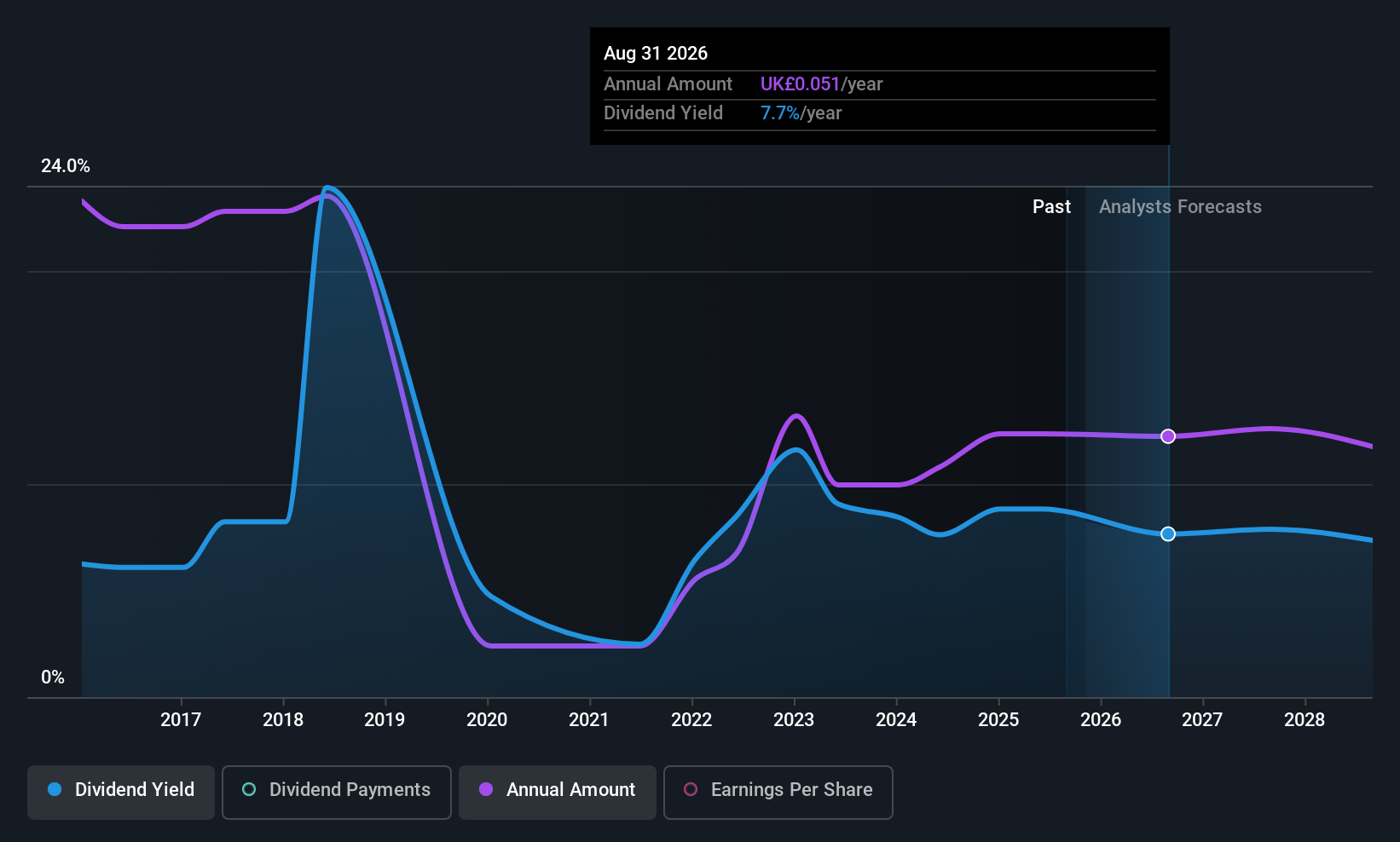

Macfarlane Group (LSE:MACF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macfarlane Group PLC, with a market cap of £113.19 million, designs, manufactures, and distributes protective packaging products to businesses in the United Kingdom and Europe through its subsidiaries.

Operations: Macfarlane Group PLC generates revenue through its Packaging Distribution segment, which accounts for £228.28 million, and its Manufacturing Operations segment, contributing £65.34 million.

Dividend Yield: 5.1%

Macfarlane Group's dividend payments have been volatile over the past decade, though they have shown growth. The dividends are well-covered by both earnings, with a payout ratio of 48.6%, and cash flows at 27.6%, indicating sustainability despite an unstable track record. Trading at a price-to-earnings ratio of 9.4x, below the UK market average, it offers good value relative to peers but has a lower yield than top-tier UK dividend payers.

- Unlock comprehensive insights into our analysis of Macfarlane Group stock in this dividend report.

- The analysis detailed in our Macfarlane Group valuation report hints at an deflated share price compared to its estimated value.

Smiths News (LSE:SNWS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Smiths News plc, with a market cap of £187.79 million, operates in the distribution of newspapers and magazines both within the United Kingdom and internationally.

Operations: Smiths News plc generates revenue of £1.06 billion from its operations in distributing newspapers and magazines.

Dividend Yield: 11%

Smiths News offers a high dividend yield, ranking in the top 25% of UK payers. Despite a volatile and unreliable dividend history over the past decade, current payouts are well-covered by earnings and cash flows with payout ratios below 50%. Recent earnings growth of 11% supports this coverage. However, upcoming executive changes could impact future stability. The stock trades at a significant discount to its estimated fair value, presenting potential value relative to peers.

- Navigate through the intricacies of Smiths News with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Smiths News is trading behind its estimated value.

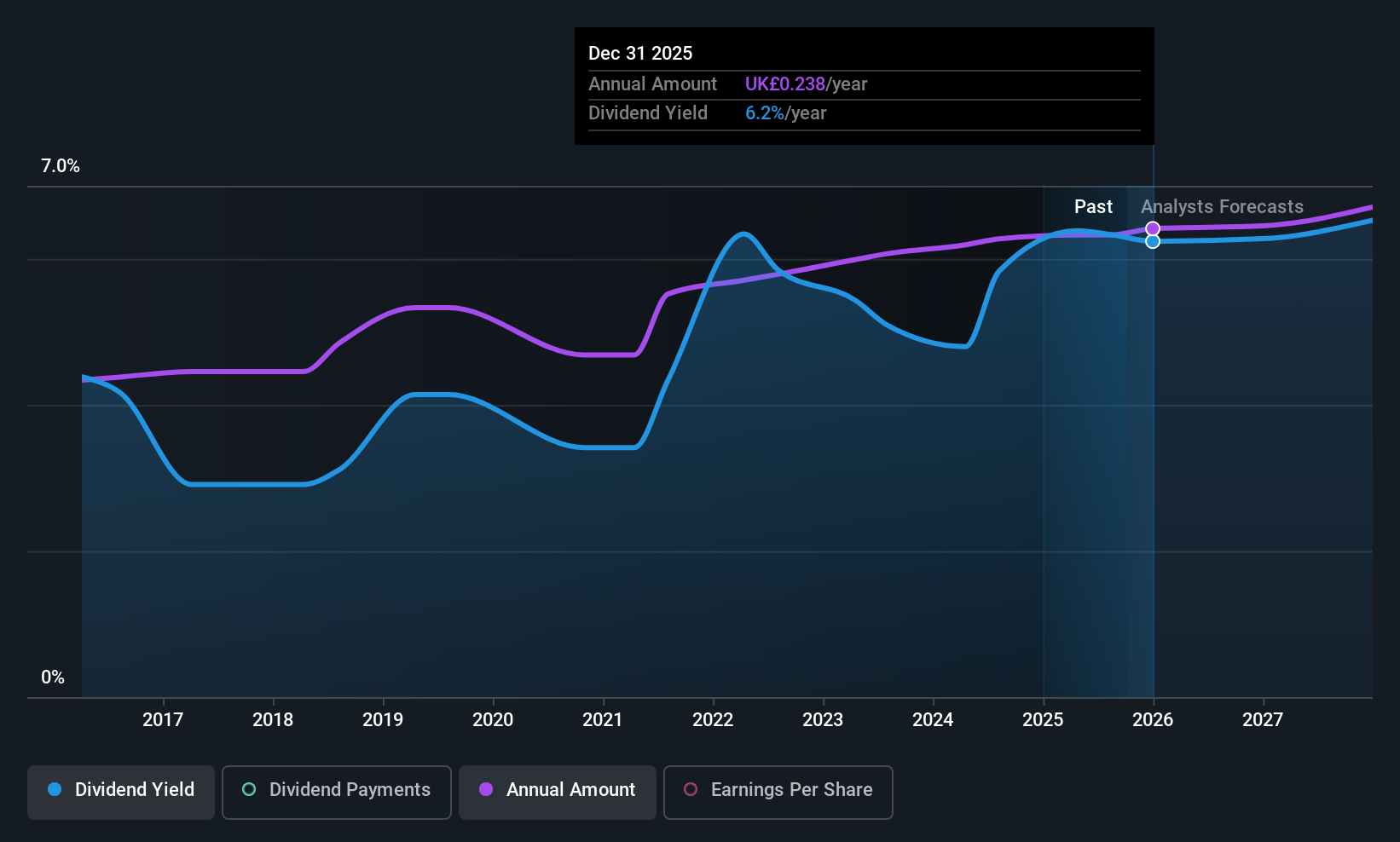

Vesuvius (LSE:VSVS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vesuvius plc offers molten metal flow engineering and technology services to the steel and foundry casting industries globally, with a market cap of approximately £978.74 million.

Operations: Vesuvius plc generates revenue through its segments in Foundry (£463 million), Steel - Flow Control (£753.40 million), Steel - Sensors & Probes (£36.30 million), and Steel - Advanced Refractories (£538.30 million).

Dividend Yield: 5.9%

Vesuvius offers a dividend yield in the top 25% of UK payers, though its history is marked by volatility and unreliability. Current dividends are covered by earnings but not by cash flows, with a high cash payout ratio of 235.3%. The company trades at nearly half its estimated fair value, suggesting potential undervaluation. Recent guidance anticipates revenue between £1.77 billion and £1.82 billion for fiscal year 2025, with trading profit around £178 million to £188 million.

- Click here to discover the nuances of Vesuvius with our detailed analytical dividend report.

- According our valuation report, there's an indication that Vesuvius' share price might be on the cheaper side.

Make It Happen

- Discover the full array of 50 Top UK Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报