TROPHY GAMES Development A/S' (CPH:TGAMES) Share Price Matching Investor Opinion

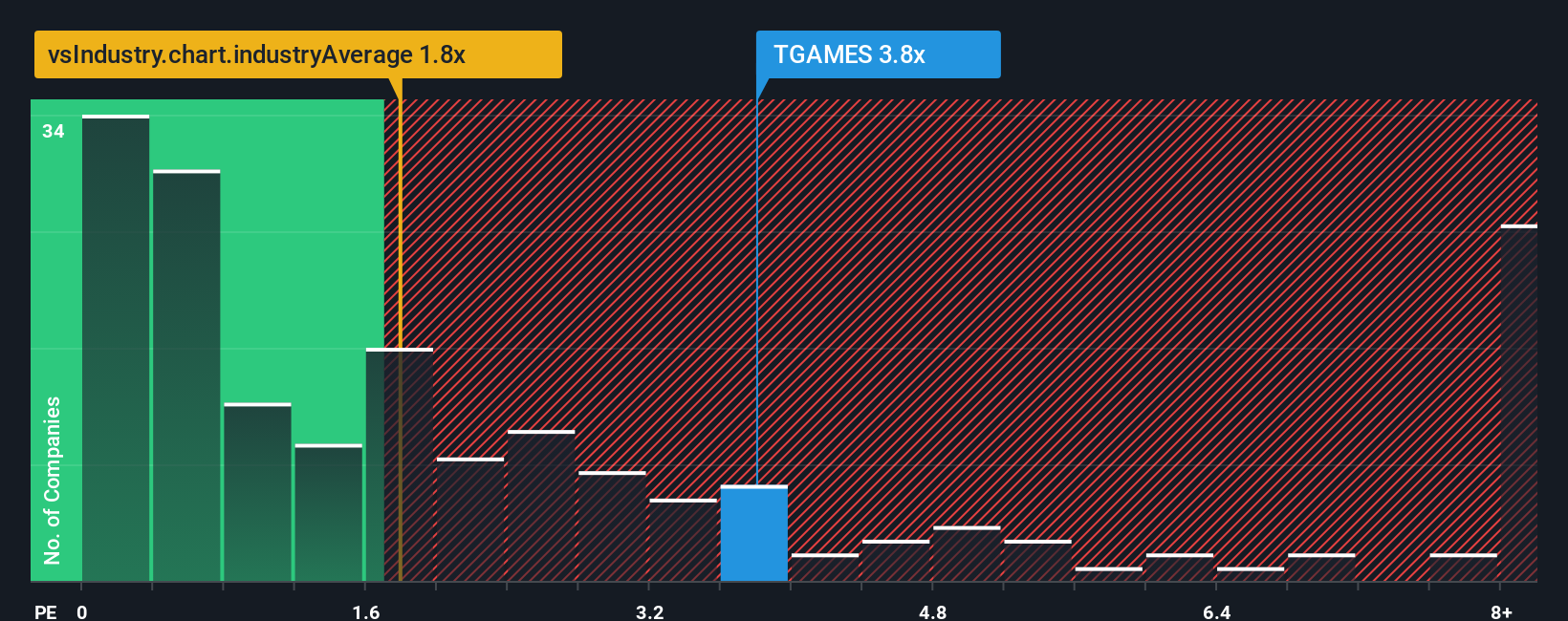

When you see that almost half of the companies in the Entertainment industry in Denmark have price-to-sales ratios (or "P/S") below 1.8x, TROPHY GAMES Development A/S (CPH:TGAMES) looks to be giving off strong sell signals with its 3.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for TROPHY GAMES Development

How Has TROPHY GAMES Development Performed Recently?

TROPHY GAMES Development has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on TROPHY GAMES Development will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For TROPHY GAMES Development?

The only time you'd be truly comfortable seeing a P/S as steep as TROPHY GAMES Development's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 26%. The latest three year period has also seen an excellent 120% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 5.3%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why TROPHY GAMES Development is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From TROPHY GAMES Development's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that TROPHY GAMES Development can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

You always need to take note of risks, for example - TROPHY GAMES Development has 3 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报