European Growth Companies With Significant Insider Ownership

As the pan-European STOXX Europe 600 Index hits new highs, buoyed by an improving economic backdrop and closing 2025 with its strongest yearly performance since 2021, investors are increasingly turning their attention to growth companies with significant insider ownership. In such a robust market environment, stocks that combine strong growth potential with high levels of insider ownership can offer unique insights into company confidence and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 35% | 61.2% |

| Guard Therapeutics International (OM:GUARD) | 13.1% | 103.3% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Here's a peek at a few of the choices from the screener.

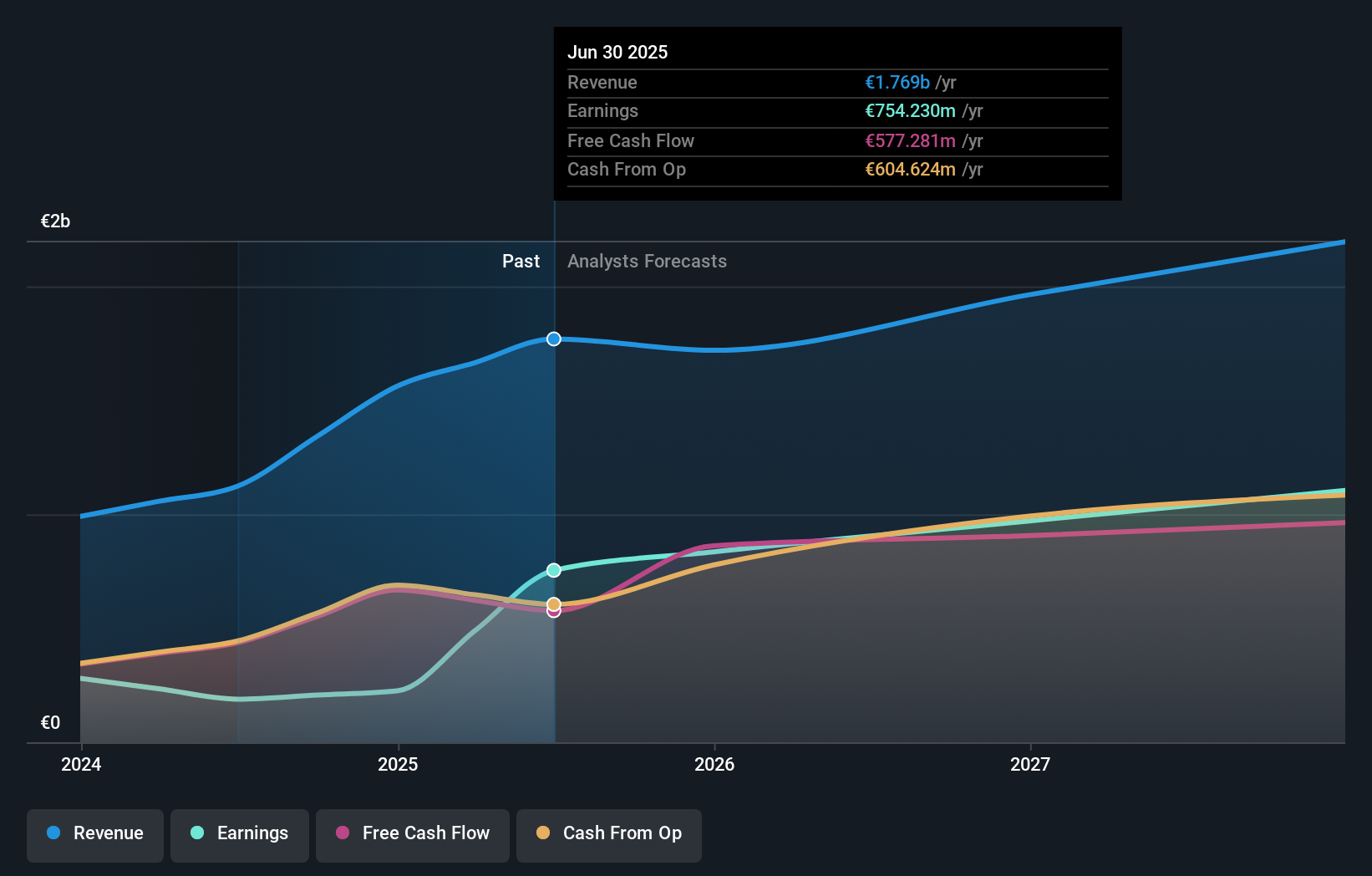

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €15.72 billion.

Operations: CVC Capital Partners generates revenue from several key segments: Credit (€197.65 million), Secondaries (€124.38 million), and Private Equity (€951.11 million).

Insider Ownership: 20.2%

Earnings Growth Forecast: 16.8% p.a.

CVC Capital Partners, with substantial insider ownership, is poised for growth as its earnings are forecast to grow at 16.8% annually, outpacing the Dutch market's 12%. Despite a high level of debt, CVC trades at 29% below its estimated fair value and has a very high projected return on equity of 42.6%. Recent M&A discussions involving ValueLabs highlight CVC's strategic interest in enterprise tech, aligning with growth trends in this sector.

- Click here to discover the nuances of CVC Capital Partners with our detailed analytical future growth report.

- Our valuation report unveils the possibility CVC Capital Partners' shares may be trading at a discount.

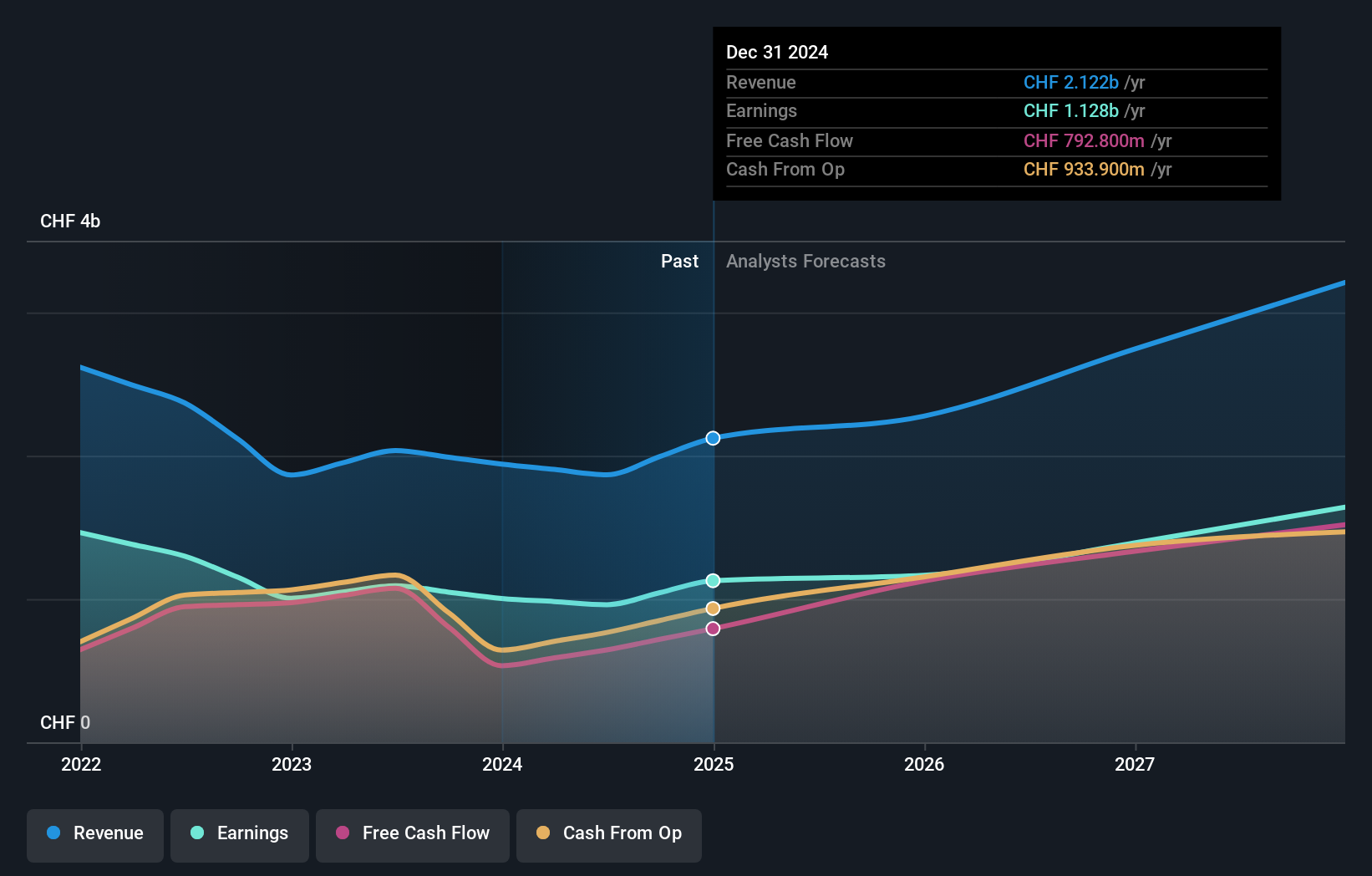

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a private equity firm that specializes in direct, secondary, and primary investments across private equity, real estate, infrastructure, and debt with a market cap of CHF26.72 billion.

Operations: Partners Group Holding AG generates revenue from various segments, including CHF1.43 billion from Private Equity, CHF471.40 million from Infrastructure, CHF215.80 million from Real Estate, and CHF207.40 million from Private Credit.

Insider Ownership: 15.8%

Earnings Growth Forecast: 10.6% p.a.

Partners Group Holding demonstrates growth potential with forecasted revenue growth of 11% annually, outpacing the Swiss market's 4.1%. Despite high debt levels and a dividend not well covered by earnings, it trades at 23.2% below its estimated fair value. Recent strategic expansions include acquiring The Hoxton Poblenou in Barcelona and opening a Montreal office, enhancing its global presence. Partners Group's substantial assets under management and high projected return on equity bolster its growth outlook.

- Take a closer look at Partners Group Holding's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Partners Group Holding's current price could be inflated.

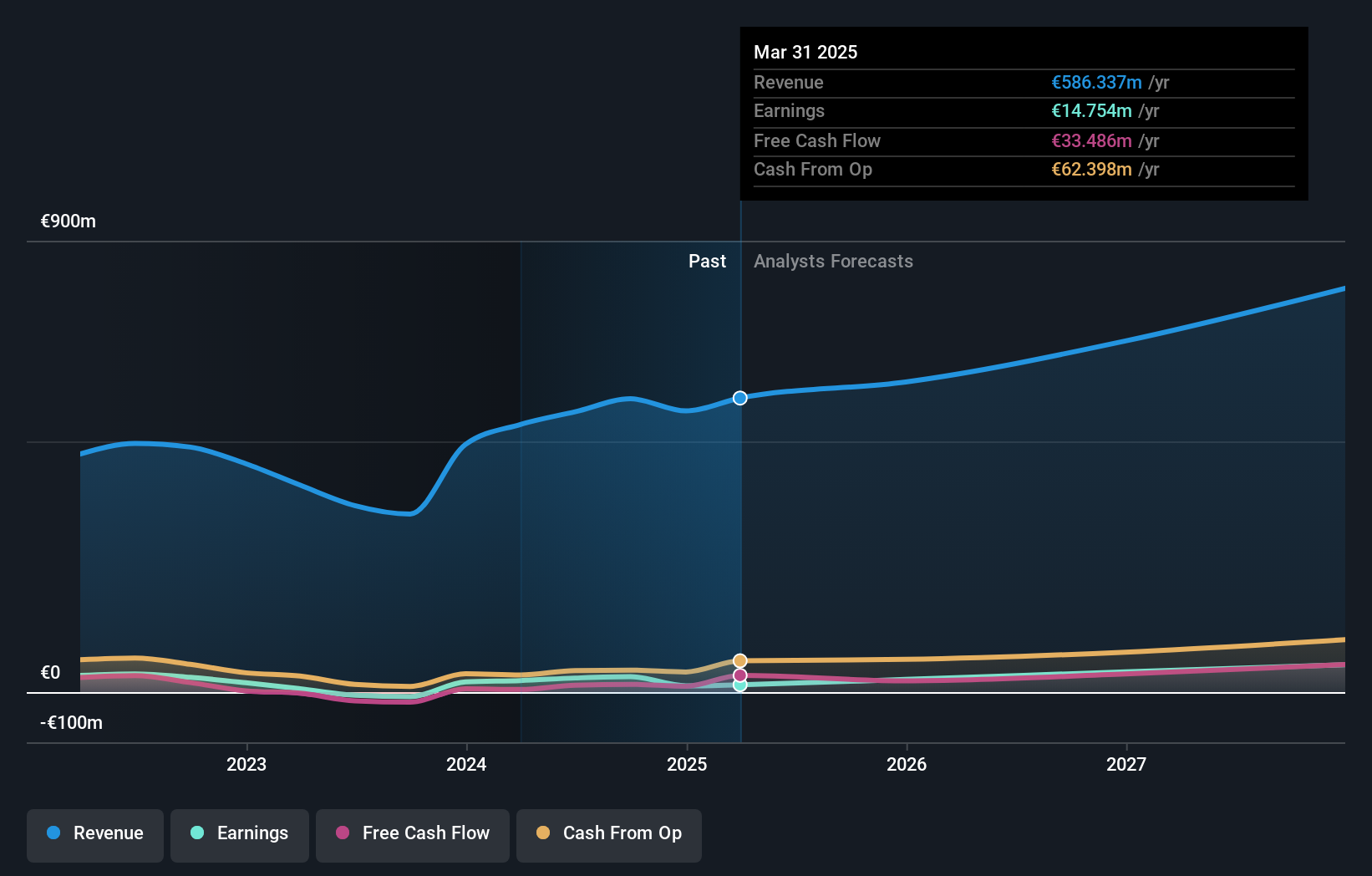

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE develops, operates, and markets technology platforms for the credit, housing, and insurance industries in Germany with a market cap of €869.05 million.

Operations: The company's revenue is generated from its Financing Platforms (€80.32 million), Insurance Platforms (€63.95 million), and Real Estate & Mortgage Platforms (€466.36 million).

Insider Ownership: 33.3%

Earnings Growth Forecast: 35.3% p.a.

Hypoport SE exhibits strong growth potential with earnings forecasted to grow significantly at 35.3% annually, outpacing the German market's 16.3%. Recent financial results show robust performance, with Q3 sales rising to €458.73 million and net income doubling compared to last year. However, profit margins have decreased from 6.9% to 2.7%. Despite a downward revision in revenue guidance for 2025, insider ownership remains high, supporting investor confidence in its growth trajectory.

- Get an in-depth perspective on Hypoport's performance by reading our analyst estimates report here.

- The analysis detailed in our Hypoport valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Click through to start exploring the rest of the 207 Fast Growing European Companies With High Insider Ownership now.

- Ready To Venture Into Other Investment Styles? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报