Asian Dividend Stocks To Consider For Your Portfolio

As global markets navigate a complex landscape of economic shifts, Asia stands out with its dynamic growth prospects and evolving market conditions. In this environment, dividend stocks can offer investors a blend of income and potential stability, making them an attractive consideration for those looking to diversify their portfolios in the region.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.65% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.33% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.25% | ★★★★★★ |

| NCD (TSE:4783) | 3.85% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.13% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.77% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.50% | ★★★★★★ |

Click here to see the full list of 1006 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

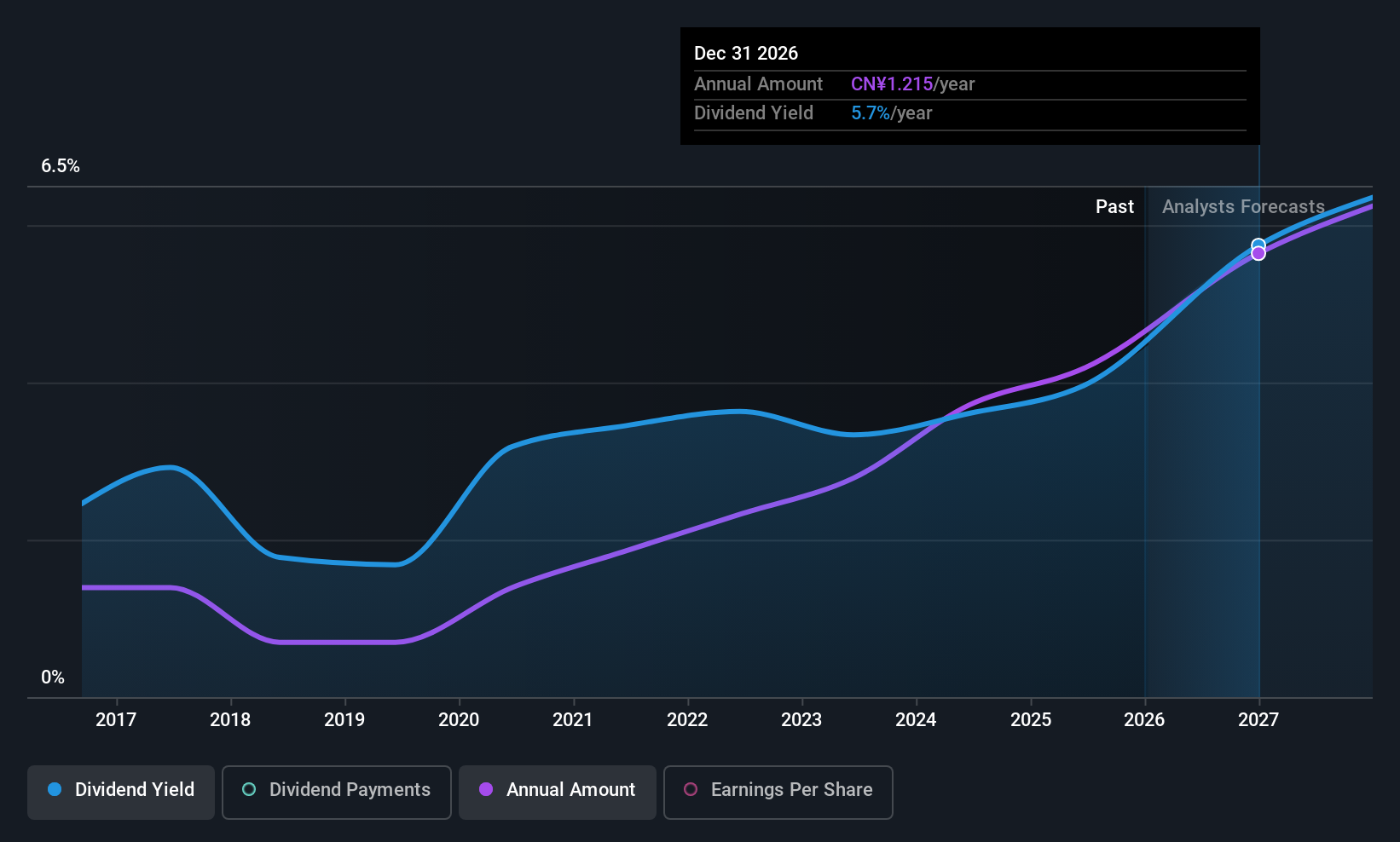

China Communications Services (SEHK:552)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Communications Services Corporation Limited, along with its subsidiaries, offers telecommunications support services globally and has a market cap of HK$33.04 billion.

Operations: China Communications Services Corporation Limited generates revenue from the Provision of Integrated Comprehensive Solutions, amounting to CN¥152.53 billion.

Dividend Yield: 5%

China Communications Services offers a stable dividend, with payments growing consistently over the past decade. Though its 5% yield is below Hong Kong's top tier, it remains reliable and well-covered by earnings given its modest payout ratio of 42%. Currently trading at a significant discount to estimated fair value, this stock presents good relative value compared to peers. Recent participation in major investment conferences highlights ongoing engagement with investors, though no direct impact on dividends was noted.

- Click here and access our complete dividend analysis report to understand the dynamics of China Communications Services.

- Upon reviewing our latest valuation report, China Communications Services' share price might be too pessimistic.

Henan Lingrui Pharmaceutical (SHSE:600285)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Henan Lingrui Pharmaceutical Co., Ltd. is involved in the research, development, production, and sale of drugs in China with a market cap of CN¥12.23 billion.

Operations: Henan Lingrui Pharmaceutical Co., Ltd. generates its revenue through the research, development, production, and sale of pharmaceutical products in China.

Dividend Yield: 4.1%

Henan Lingrui Pharmaceutical's dividend yield of 4.14% ranks in the top 25% of Chinese dividend payers, though its track record is unstable with past volatility. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 63.7% and 56.5%, respectively. The company reported sales of CNY 3.04 billion for the first nine months of 2025, indicating growth from CNY 2.76 billion a year ago, supporting its current valuation below estimated fair value by over a third.

- Get an in-depth perspective on Henan Lingrui Pharmaceutical's performance by reading our dividend report here.

- The analysis detailed in our Henan Lingrui Pharmaceutical valuation report hints at an deflated share price compared to its estimated value.

Ningbo Ligong Environment And Energy TechnologyLtd (SZSE:002322)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ningbo Ligong Environment And Energy Technology Co., Ltd focuses on the R&D, production, sale, and service of online monitoring equipment for the electric power industry in China and has a market cap of CN¥4.45 billion.

Operations: Ningbo Ligong Environment And Energy Technology Co., Ltd generates its revenue primarily from the research, development, production, sale, and service of online monitoring equipment for the electric power sector in China.

Dividend Yield: 4.4%

Ningbo Ligong Environment And Energy Technology offers a dividend yield of 4.45%, placing it in the top 25% of Chinese dividend payers, yet its dividends have been volatile and not well covered by earnings, with a high payout ratio of 103.4%. Recent financials show stable sales at CNY 615.83 million for nine months ending September 2025, though net income declined to CNY 137.64 million from the previous year’s CNY 186.57 million amidst ongoing share buybacks totaling CNY 129.93 million.

- Take a closer look at Ningbo Ligong Environment And Energy TechnologyLtd's potential here in our dividend report.

- The analysis detailed in our Ningbo Ligong Environment And Energy TechnologyLtd valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Reveal the 1006 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报