Energy Fuels (TSX:EFR) Valuation After Uranium Production Beat And New Long Term Contract Wins

Energy Fuels (TSX:EFR) has grabbed investor attention after reporting that its Pinyon Plain and La Sal operations mined over 1.6 million pounds of uranium in 2025, ahead of earlier guidance and backed by fresh long term supply contracts.

See our latest analysis for Energy Fuels.

The fresh production beat and new uranium contracts appear to be feeding into strong momentum, with a 7 day share price return of 30.63% and a 1 year total shareholder return of 223% from the current CA$25.42 level. Longer term total shareholder returns over 3 and 5 years remain very strong in absolute terms.

If this kind of move in uranium has your attention, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With Energy Fuels trading at CA$25.42 and sitting about 32% below the average analyst price target, investors now have to ask whether the market is still underestimating its uranium and rare earths story or already pricing in future growth.

Most Popular Narrative: 24.4% Undervalued

The most followed narrative puts fair value for Energy Fuels at US$33.63, above the CA$25.42 last close, implying a meaningful valuation gap.

The ramp-up of high-grade, low-cost uranium production from the Pinyon Plain mine, combined with imminent processing at historically low cost levels ($23–$30/lb, declining to potentially $30–$40/lb overall by early 2026), is poised to materially improve gross margins and accelerate cash generation as inventory clears and higher volumes are sold at robust contract/spot prices.

Curious what has to happen for that higher value to make sense? The narrative leans on rapid revenue expansion, a sharp swing into profitability, and a rich future earnings multiple.

Result: Fair Value of $33.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on reliable rare earth feedstock and timely project funding. Setbacks on either front could quickly challenge the upbeat valuation story.

Find out about the key risks to this Energy Fuels narrative.

Another Angle on Valuation

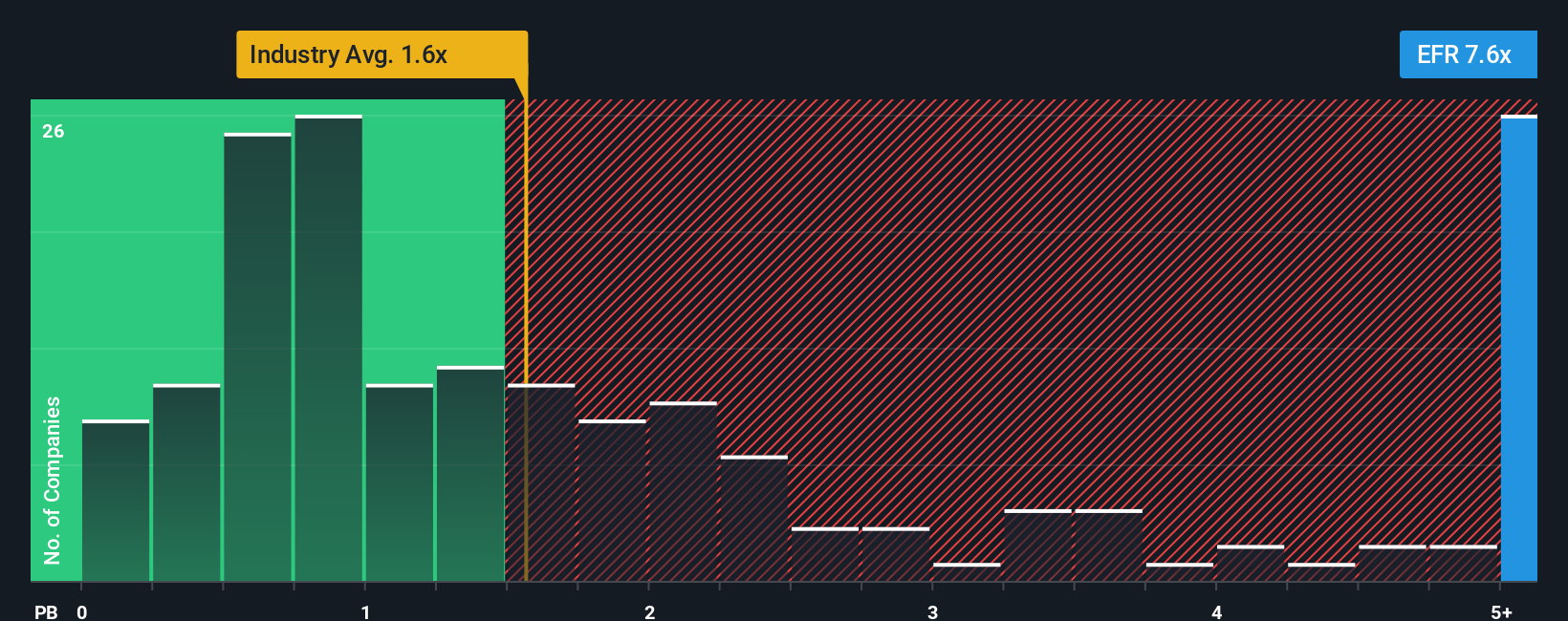

The 24.4% undervaluation story sits awkwardly next to how the market is currently pricing Energy Fuels on a simple P/B basis. The shares trade at 6.2x book value, the same as peers on average, and far above the Canadian Oil and Gas group at 1.7x.

That gap suggests investors are already paying a premium today for future growth and rare earth potential, even though the company is still loss making and carries a 0 out of 6 value score. The question is whether you see that premium as justified upside or a thinner margin of safety than the narrative implies.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Energy Fuels Narrative

If you see the story differently or just want to test your own assumptions against the same data, you can build a custom view in minutes with Do it your way.

A great starting point for your Energy Fuels research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Energy Fuels has sharpened your interest in uranium and resources, do not stop there. Broaden your watchlist with other focused ideas that match your style.

- Target income-focused opportunities by scanning these 14 dividend stocks with yields > 3% that may suit investors who prioritise regular cash returns.

- Catch potential high growth themes early by reviewing these 25 AI penny stocks shaping the future of automation and data driven business models.

- Zero in on value focused candidates by sorting through these 877 undervalued stocks based on cash flows that align with a price conscious approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报