Assessing Doximity (DOCS) Valuation After Securities Litigation Settlement Agreement

Doximity (DOCS) has reached a proposed settlement to resolve its securities litigation, with a US$31 million payment expected to be fully covered by insurance, subject to court and stockholder approvals.

See our latest analysis for Doximity.

The settlement news lands after a weaker patch for the stock, with a 30 day share price return of 5.75% and a 90 day share price return of 39.35%. The 1 year total shareholder return is 22.10% and the 3 year total shareholder return is 41.24%. This indicates that longer term holders have still seen gains even as recent momentum has faded.

If this legal overhang has you reassessing your watchlist, it could be a good moment to look at other healthcare names using our healthcare stocks.

With the lawsuit likely moving toward closure and the stock trading below the average analyst price target and an internal intrinsic value estimate, you have to ask: Is Doximity on sale here, or is the market already baking in future growth?

Most Popular Narrative Narrative: 39.1% Undervalued

The most followed narrative puts Doximity's fair value at about US$71.11 per share, compared with the last close of US$43.29, and builds that gap using detailed earnings and cash flow assumptions.

The expanded adoption of AI-powered workflow tools (Scribe, Doximity GPT, and Pathway AI) is expected to further entrench Doximity as a core clinician productivity suite, driving frequency of platform use, deeper customer retention, and ultimately higher average revenue per user (ARPU) over time, supporting long-term revenue and margin expansion.

Curious how a productivity toolkit for clinicians can support that kind of valuation gap? The key ingredients are revenue growth, margin expectations, and a rich future earnings multiple.

Result: Fair Value of $71.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that thesis leans heavily on pharma marketing budgets and eventually charging for some AI tools, so tighter industry spending or slower monetization could quickly weaken the undervalued case.

Find out about the key risks to this Doximity narrative.

Another View: What Earnings Ratios Are Saying

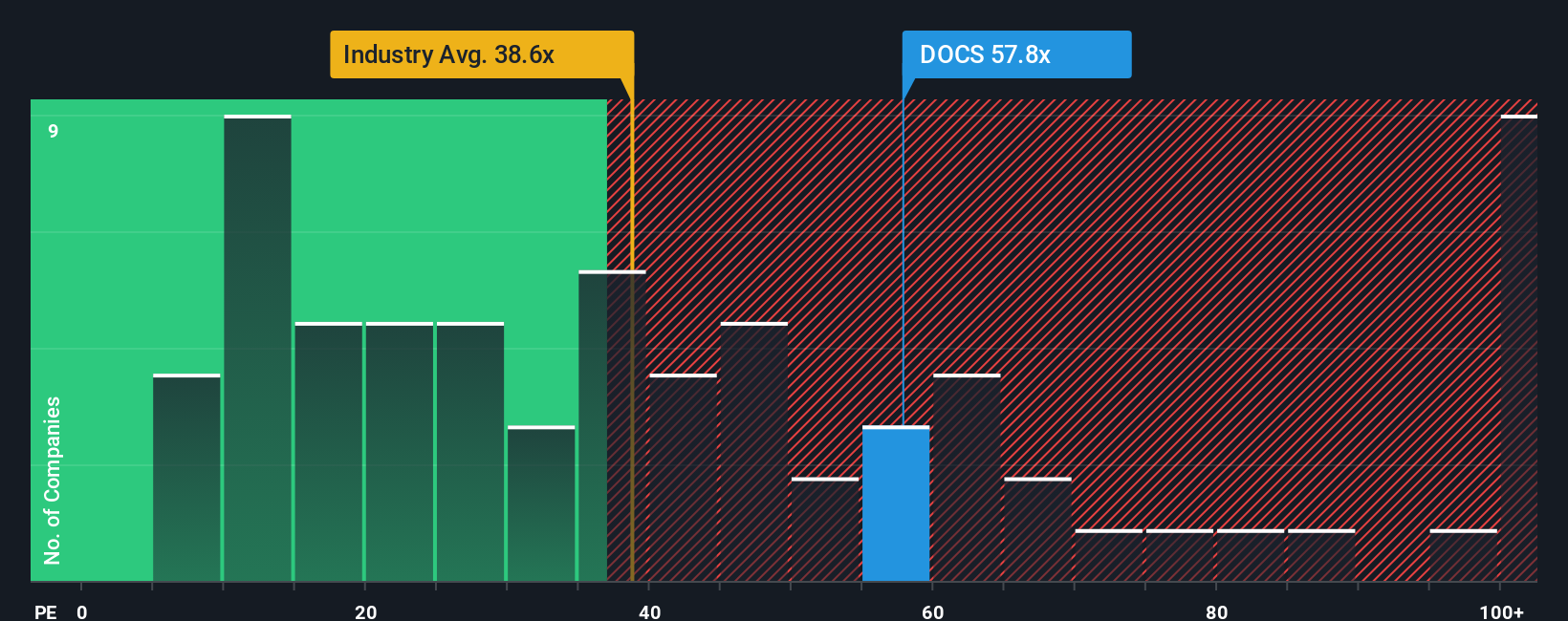

The AI-driven fair value narrative paints Doximity as undervalued, yet the current P/E of 32.2x tells a more mixed story. It sits almost in line with the global Healthcare Services average of 32.4x, but well below peers on 63.3x and above a fair ratio of 21.8x implied by regression analysis.

In practice, that means the market is pricing Doximity roughly in line with the sector overall, cheaper than similar companies, but richer than what the fair ratio suggests the multiple could move toward. Is this a reasonable premium for quality earnings growth or a sign that expectations still carry some valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Doximity Narrative

If you see the numbers differently, or prefer to test your own assumptions against the data, you can build a complete view in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Doximity.

Looking for more investment ideas?

If Doximity has caught your attention, it is worth widening your lens and stress testing your thesis against a broader set of potential opportunities.

- Spot opportunities in companies priced below their estimated cash flow value by checking out these 876 undervalued stocks based on cash flows that could complement or contrast your current watchlist.

- Hunt for growth potential at the smaller end of the market by reviewing these 3564 penny stocks with strong financials before attention and liquidity possibly shift elsewhere.

- Position your portfolio for AI driven trends in healthcare by scanning these 29 healthcare AI stocks while these names are still off many investors' radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报