Reassessing Atmos Energy (ATO) Valuation After Recent Muted Share Price Moves

With no single headline event driving Atmos Energy (ATO) today, the stock’s recent returns and current price level around $169.36 are drawing attention as investors reassess this regulated natural gas utility’s role in portfolios.

See our latest analysis for Atmos Energy.

Recent share price moves have been relatively muted, with a 1-day share price return of 1.03% and a 30-day share price return of 1.13% decline. Longer term, total shareholder returns of 26.86% over 1 year and 119.10% over 5 years point to momentum that has built up over time as investors reassess Atmos Energy’s risk and income profile.

If Atmos Energy has you rethinking defensives, it could be a good moment to widen your scope and check out fast growing stocks with high insider ownership.

With shares around $169.36 and trading at a small 3.76% discount to the average analyst price target of $175.73, Atmos Energy does not appear obviously cheap. This raises the question: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 3.6% Undervalued

With Atmos Energy trading at $169.36 against a narrative fair value of about $175.73, the current setup centers on future earnings power and how regulators treat its spending plans.

Major multiyear capital investment programs focused on modernizing and expanding pipeline infrastructure, combined with favorable regulatory mechanisms and frequent rate filings, underpin ongoing rate base growth, translating to stable and predictable long-term earnings and cash flow.

Want to understand why a regulated gas utility is being priced for steady compounding? The narrative leans on brisk top line expansion, firmer margins and a premium future earnings multiple. Curious how those three ingredients combine to support that fair value gap? The full narrative lays out the exact assumptions behind the call.

Result: Fair Value of $175.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that steady story depends on regulators staying supportive and on high capital spending not putting too much pressure on free cash flow or future earnings.

Find out about the key risks to this Atmos Energy narrative.

Another View: Price Tag Looks Full

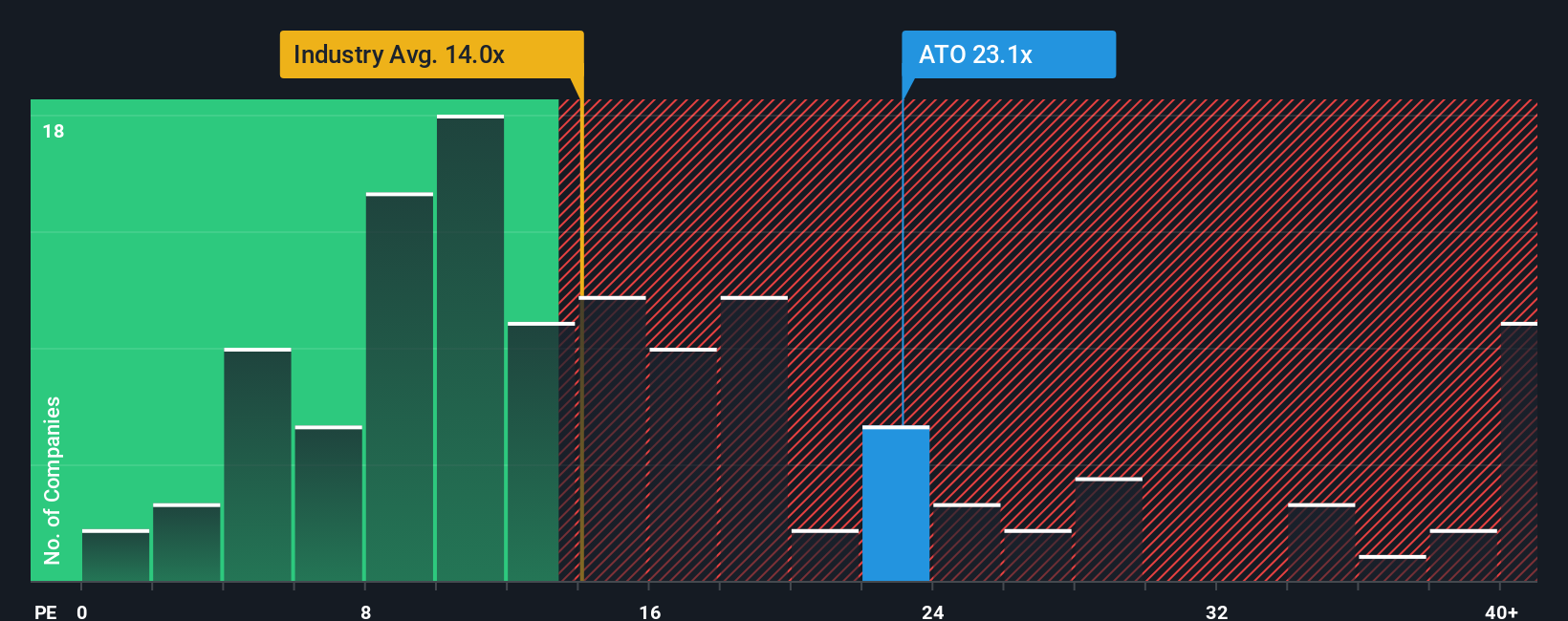

That 3.6% narrative undervaluation sits awkwardly next to how the market is actually pricing Atmos Energy. The shares trade on a P/E of 22.9x, compared with 17.6x for US gas utility peers and 14x for the wider global gas utilities group, and just above a fair ratio of 22.7x.

In practice, that means you are paying a clear premium for Atmos Energy versus both peers and the level our fair ratio suggests the market could move toward over time. The question is whether the earnings and dividend story is strong enough for you to stay comfortable with that premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atmos Energy Narrative

If you see the data differently or want to test your own assumptions, you can build a personalised Atmos Energy view in just a few minutes, starting with Do it your way.

A great starting point for your Atmos Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Atmos Energy has sharpened your thinking, do not stop here. Broaden your watchlist with focused stock ideas built from clear numbers rather than headlines.

- Target potential mispricings by scanning these 876 undervalued stocks based on cash flows that may not yet be fully appreciated by the wider market.

- Spot high-yield opportunities by checking out these 14 dividend stocks with yields > 3% that could support a more income-focused portfolio.

- Get ahead of sector shifts by reviewing these 79 cryptocurrency and blockchain stocks tied to blockchain, digital assets and related infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报