How Venezuela Turmoil And Capital Returns At Suncor Energy (TSX:SU) Has Changed Its Investment Story

- In recent days, Suncor Energy has come under the spotlight after the U.S. capture of Venezuelan President Nicolás Maduro raised questions about the long‑term outlook for Canadian heavy oil exports and global pricing dynamics.

- At the same time, Suncor’s continued focus on cash generation, dividends, buybacks, and operational reliability has helped underpin investor confidence despite these geopolitical uncertainties.

- We’ll now examine how concerns over Venezuela potentially reshaping heavy oil export markets could influence Suncor’s existing investment narrative.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

Suncor Energy Investment Narrative Recap

To own Suncor, you need to believe in the long term relevance of Canadian heavy oil and Suncor’s ability to keep turning that into solid cash returns. The U.S. capture of Venezuela’s president and potential reshaping of heavy oil exports is a risk to pricing and demand, but current analyst commentary suggests it does not materially change Suncor’s near term focus on reliability, free cash flow and disciplined capital returns, which remain the key short term catalysts and risks.

The recent reaffirmation of dividends and ongoing share buybacks, supported by steady cash generation and operational discipline, is particularly relevant against this backdrop of geopolitical uncertainty. While market worries focus on whether Venezuelan barrels could pressure Canadian heavy oil, Suncor’s continued capital return program and production guidance updates are central to how investors weigh that risk against the company’s ability to keep generating distributable cash in the current environment.

Yet beneath this seemingly resilient cash return story, investors should still be aware of the potential long term impact of higher carbon costs and shifting energy demand...

Read the full narrative on Suncor Energy (it's free!)

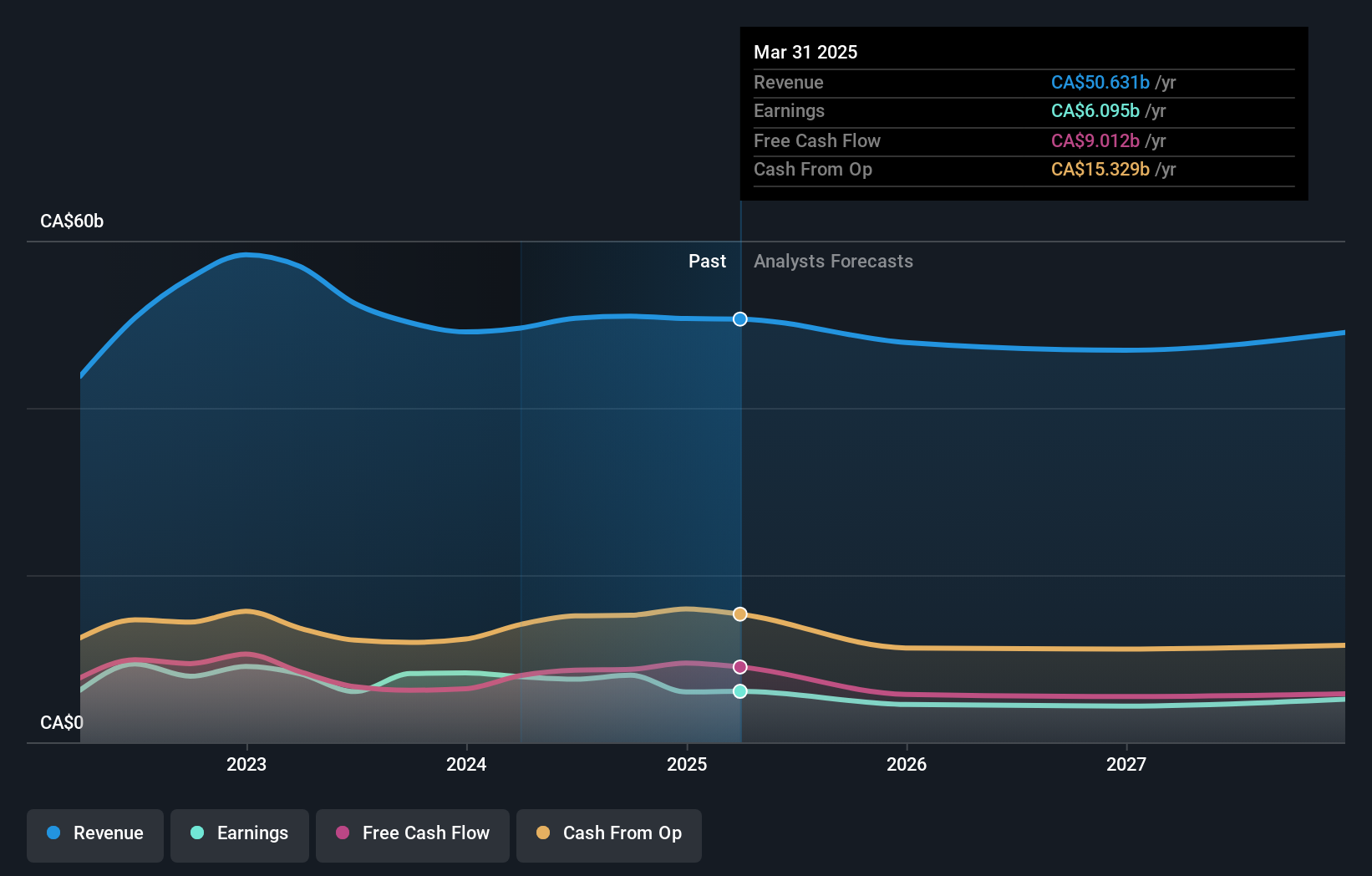

Suncor Energy's narrative projects CA$48.1 billion revenue and CA$5.0 billion earnings by 2028. This implies a 1.1% yearly revenue decline and an earnings decrease of CA$0.7 billion from CA$5.7 billion today.

Uncover how Suncor Energy's forecasts yield a CA$66.70 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Thirteen Suncor fair value estimates from the Simply Wall St Community span about C$52.72 to C$187.51, reflecting a wide spread in expectations. You are seeing these views against a backdrop where heavy oil exposure, possible Venezuelan supply shifts and long term emissions and demand risks could all influence how Suncor’s performance ultimately compares with those community forecasts.

Explore 13 other fair value estimates on Suncor Energy - why the stock might be worth 16% less than the current price!

Build Your Own Suncor Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suncor Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Suncor Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suncor Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报